Press Releases

Cox Automotive Forecast: February New-Vehicle Sales Expected to Increase Year Over Year, Thanks to Improving Inventory, Fleet Sales Gains

Wednesday February 22, 2023

Article Highlights

- Annual new-vehicle sales pace in February is expected to finish near 14.4 million, up 0.7 million from last February’s 13.7 million pace but down from January’s 15.7 million level.

- Improved inventory is expected to contribute to a true volume gain compared to February 2022’s supply-constrained market.

- February sales volume is expected to rise 4.0% from one year ago and reach 1.105 million units. This is also a 3.9% increase from January, which also had 24 selling days.

Updated, March 2, 2023 – The Cox Automotive Industry Insights team was expecting the auto market to deliver both year over year and month over month sales increases in February, and initial results indicate the sales gains were there. In fact, results likely beat the Cox Automotive forecast, with the sales pace likely reaching 14.9 million, above our 14.4 million forecast. Volume was near 1.13 million. As expected, strong fleet sales – initial estimates will be reported next week – likely helped the overall picture.

Some automakers have already reported solid February sales results, notably Ford, Hyundai and Kia. As our senior director of new-vehicle sales strategies noted earlier this week, the Korean brands have been gobbling up share in recent months, with excellent products and an equally excellent reputation for quality. Inventory is still a challenge but has improved for the Hyundai Motor Group brands, and its U.S. dealers have been turning sales quickly, with minimal incentives. If sales races are of interest to you, Hyundai Motor Group is knocking on Stellantis’ door. Other brands, notably Honda, Toyota, and Subaru, continue to be supply constrained. But new-vehicle inventory is vastly better than year-ago levels and helping lift overall, industry-wide volume.

With two months in the books, Q1 new-vehicle sales in the U.S. are on pace to beat Q1 2022, but that is a low bar, as inventory was scarce a year ago and the first three months of 2022 were slow indeed. The new-vehicle market right now is healthy in comparison, but the market has also clearly shifted due to elevated prices, higher auto loan rates, and a focus on high-end buyers. Sales volume in February was up from 2022 and near 1.13 million units. Still, last month delivered among the lowest February totals in a decade. The days of 17 million SAAR remain well in the rearview mirror.

ATLANTA, Feb. 22, 2023 – New-vehicle sales in February are forecast to show a modest gain when announced next week, an improvement over last February’s supply-constrained market. Sales are expected to increase nearly 4% from last year and last month – a true volume gain by comparison since there are 24 selling days in each month. However, the February 2023 auto sales pace, or seasonally adjusted annual rate (SAAR), is expected to reach 14.4 million, a decline from January’s surprisingly strong 15.7 million level. With elevated auto loan rates and persistent inflation, a sales pace decline from January was expected.

Affordability is a growing headwind for vehicle buyers but is impacting new and used sales differently as the spring season approaches. According to Charlie Chesbrough, senior economist at Cox Automotive: “We have diverging markets today. New-vehicle prices remain high while used retail prices are now in decline. New inventory is slowly stabilizing while used supply is falling. However, I wouldn’t be surprised to see this situation change later in the spring. With many affordability-seeking vehicle buyers leaving the new market for the used, dealers may find they have too little used inventory, and price declines may reverse. And, OEMs may find they have too much new-vehicle inventory and be forced to be more aggressive with incentives to boost sales.”

February 2023 Sales Forecast Highlights

- Light vehicle sales are expected to finish near 1.105 million, a 3.9% rise from last month and a 4.0% increase from February 2022.

- The SAAR in February 2023 is estimated to be 14.4 million, above last February’s 13.7 million level but down from January’s 15.7 million pace.

- Fleet sales are expected to show strong year-over-year gains over February 2022’s inventory-limited market.

- February 2023 has 24 selling days, equal to both February 2022 and January 2023.

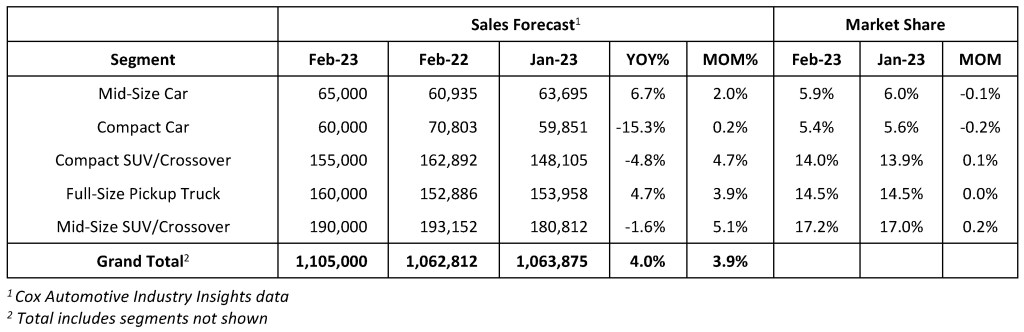

February 2023 Sales Forecast

All percentages are based on raw volume, not daily selling rate.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders and fleet owners. The company has 25,000+ employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™ and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with $21 billion in revenue. Visit coxautoinc.com or connect via @CoxAutomotive on Twitter, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com