Updated, Sept. 4, 2025 – The new-vehicle sales pace in August was above 16 million for the second straight month and better than year-ago results, suggesting that consumers are shaking off economic uncertainty and staying in market. Initial August results show the seasonally adjusted annual rate (SAAR) of sales likely finished at 16.1 million, just ahead of the Cox Automotive forecast of 16.0 million. (Below)

New-vehicle sales volume was very close to the Cox Automotive forecast of 1.46 million, and data indicate that strong commercial sales partially supported the volume of 1.45 million in August. Overall new-vehicle sales were higher by 3% year over year. According to Bobit, traditional fleet sales in August increased by nearly 25% compared to the same month last year. Retail sales showed only a modest gain of 2.5% compared to August 2024, and the retail share of sales in August was lower year over year.

The August data also indicate that EV sales were very strong for the second month in a row as consumers and dealers alike work to close EV deals before the $7,500 tax credit and “leasing loophole” are shut down by the Trump administration at the end of September. Chief Economist Jonathan Smoke said it best: “Dealers have calendars too.” The urgency is real.

Even before the month ended, General Motors was reporting record EV sales, as the General’s collection of EVs is now flowing freely and providing consumers with a wide variety of excellent electric vehicles. Cox Automotive is expecting Q3 to be a record quarter for EV sales – with two months in the books, the record of 356,000 EVs sold in Q4 last year is well within reach.

According to findings in the latest Cox Automotive Dealer Sentiment Index (released earlier this week), dealers are not optimistic about EV sales in Q4. Still, overall sentiment held steady in Q3 as dealers see the market as relatively stable despite a number of headwinds. Inventory levels are healthy, sales incentives are flowing in the new-vehicle market and while profitability is lower, the market remains resilient. “Dealers are not throwing in the towel on sentiment,” said Smoke.

The Cox Automotive Economics and Industry Insights team will be reviewing Q3 market performance on Thursday, Sept. 25, at 11 a.m. EDT. RSVP here to join the call.

ATLANTA, Aug. 27, 2025 – August new-vehicle sales, when announced next week, are expected to remain healthy, as tariff-driven price increases remain muted and sales incentives increase. August’s monthly sales pace, or seasonally adjusted annual rate (SAAR), is forecast by Cox Automotive to reach 16.0 million in August, a slight decline from July’s robust 16.4 million level, but a large gain over last year’s 15.1 million pace.

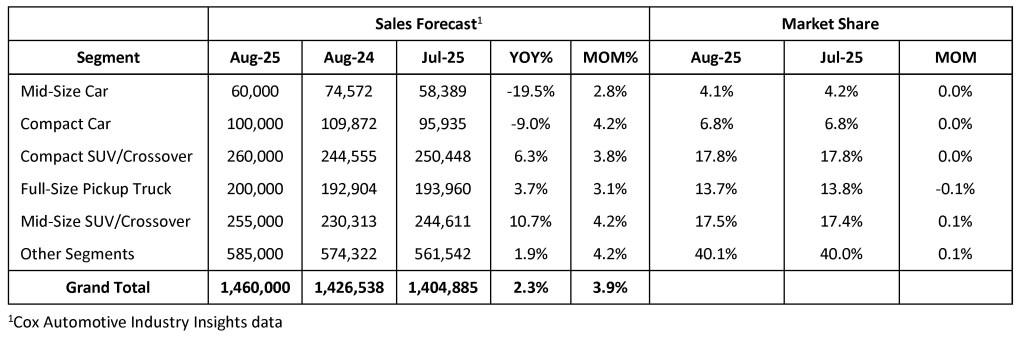

August new-vehicle sales volume is projected to reach 1.46 million, up 3.9% from July and 2.3% from last year. The increase is partly due to one additional sales day compared to July.

According to Charlie Chesbrough, senior economist at Cox Automotive: “The new-vehicle sales pace has been surprisingly strong this summer as uncertainty around tariff policy has decreased. So far at least, vehicle price inflation has been relatively tame, and unemployment rates are low. Couple that good news with a strong stock market, and there are a lot of consumers who have stayed in a buying mood.”

August 2025 New-Vehicle Sales Forecast

EV Market Pushes August New-Vehicle Sales Higher

The EV market experienced significant growth in July, a trend that likely continued into August as consumers sought to benefit from expiring federal tax credits. July new EV sales climbed to an estimated 130,082 units, up 26.4% month over month and 19.7% year over year. In July, 11 brands posted their best EV sales of the year. Sales incentives on EVs were at record highs in July.

“One of the key contributors to sales gains this summer has been an increase in electric vehicles,” Chesbrough said. “Sales of EVs have risen over the summer in the wake of the Big Beautiful Bill’s passage as buyers rush to market before the $7,500 tax credits expire at the end of September. July recorded the second-highest EV sales in history, and August is expected to also see large gains.”

What’s Ahead for the New-Vehicle Market

With the expected surge in EV sales wrapping up in September, the new-vehicle market is likely to slow in the fourth quarter as higher prices and tighter inventory weigh on demand. “Sales pace in the light vehicle market is expected to wane in the coming months,” said Chesbrough. “Sales of EVs will likely fall dramatically when tax credits expire, and market conditions for other vehicles will become more challenging in future months. More tariffed products are replacing existing inventory, and prices are expected to be pushed slowly higher, leading to softer sales in the coming months.”

Federal Reserve Chair Jerome Powell recently signaled that the Fed may be nearing a rate cut, possibly as early as September. However, Cox Automotive Chief Economist Jonathan Smoke noted recently, “Even if the Fed starts cutting in September, what they control is short-term rates and the cost of lending from the Fed and between banks. Mortgage and auto loan rates follow longer-term Treasury yields like the 10-year, which isn’t expected to move much in the near term. Auto loan rates are projected to decline gradually as loan performance improves and economic conditions stabilize, with more meaningful relief likely in 2026 or later, rather than in the near term.”

The Cox Automotive 2025 full-year forecast will be revisited in the September forecast release. The current forecast for new-vehicle SAAR is in the range of 15.6 million to 16.3 million, with a baseline of 15.7 million.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $23 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com