Updated, Jan. 7, 2026 – New-vehicle sales finished December as forecast, down from year-ago levels but higher than November. Initial estimates suggest the Cox Automotive volume forecast of 1.46 million (see below) was spot on, pushing total 2025 sales to 16.3 million units, according to our Kelley Blue Book counts.

The December SAAR, or seasonally adjusted annual rate of sales, came in at 16.0 million, near the Cox Automotive forecast of 15.9 million and higher due to seasonal adjustments. Importantly, the market lost momentum in Q4, as the sales pace dropped to 15.6 million in the period, down from 16.4 million in Q3. In fact, Q4 was the weakest quarter of the year, as the market ended 2025 on a down note.

Retail sales in December were particularly weak, according to industry sources, down nearly 5% year over year. Fleet sales helped the overall market in the final month of the year, with fleet share increasing to 17.2%, up from 15% in December 2024.

As forecast by Cox Automotive, 2025 will go into the books as the best year for new-vehicle sales since 2019, but the strong sales were spurred in part by White House policy — Tariffs Coming!; EV Incentives Going Away! — not by strong fundamentals. High prices and high interest rates continue to shock many consumers and hold total new-vehicle sales well below the high-water mark of 17.5 million seen 10 years ago, in 2016.

The Cox Automotive team is forecasting new-vehicle sales in 2026 to come in near 15.8 million, as ongoing affordability issues keep many consumers away from new-vehicle showrooms. 2025 was a year of ups and downs and policy shifts, and yet new-vehicle sales finished surprisingly strong. Cox Automotive is hopeful that 2026 will be a year when the auto industry begins to rediscover some stability and establish a new normal.

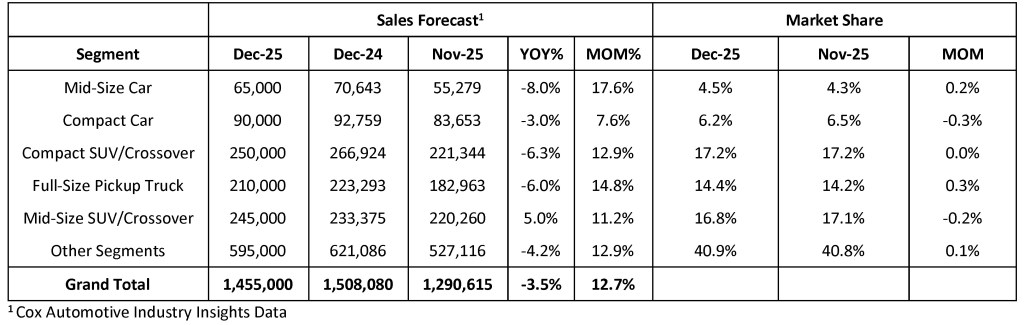

ATLANTA, Dec. 17, 2025 – December new-vehicle sales are expected to finish down from last year, but the pace should pick up slightly from previous months and help push total new-vehicle sales in 2025 above year-ago levels. According to the Cox Automotive forecast released today, the December seasonally adjusted annual rate of sales (SAAR) is expected to finish near 15.9 million, down from last year’s 16.8 million pace but up from November’s 15.6 million level. Sales volume in December is expected to fall 3.5% from last December but rise by 12.7% from November.

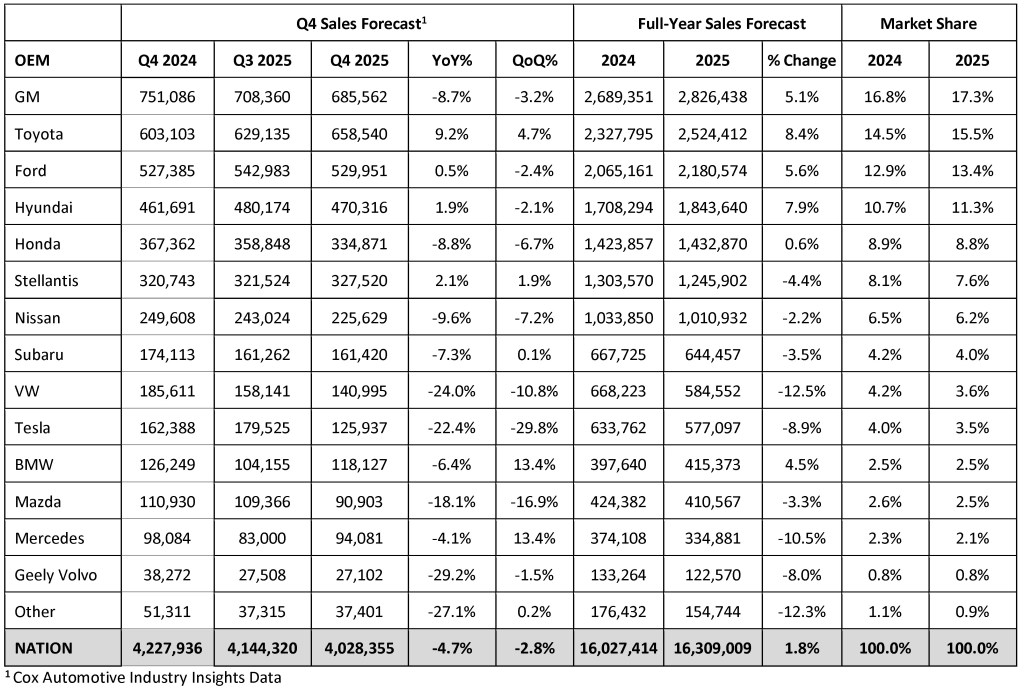

Despite a relatively weak fourth quarter, new-vehicle sales will finish 2025 up 1.8% year over year, according to Kelley Blue Book estimates. New-vehicle sales of 16.3 million will make 2025 the best sales year since 2019. General Motors is expected to end the year as the top-selling automaker in the U.S. for the fourth consecutive year, with a total market share of 17.3%, up from 16.8% in 2024.

“Despite challenges, 2025 has been a good year for new-vehicle sales,” said Charlie Chesbrough, senior economist at Cox Automotive. “The fourth quarter is showing the expected slowdown, as headwinds from tariffs, inflation and reduced EV incentives weigh on the market after nine surprisingly strong months. Still, consumer demand has kept the new-vehicle market healthy throughout 2025.”

December 2025 New-Vehicles Sales Forecast

Despite Economic Challenges and Higher Prices, New-Vehicle Sales Beat Forecast in 2025

2025 was marked by volatility as Trump administration policies fueled uncertainty in the automotive market, causing sales to fluctuate sharply.

In many ways, shifting policies from the White House have been a positive story for new-vehicle sales volume, with sales running well ahead of last year’s pace for most of the year. The wealth effect supported by a strong stock market boosted vehicle demand, and uncertainty about future higher prices led many potential vehicle buyers to purchase sooner rather than later.

New-vehicle sales saw a measurable surge in the spring as buyers rushed to market to beat expected higher prices in the wake of announced tariffs. Sales of electric vehicles and plug-in hybrid electric vehicles then accelerated in early July after the passage of the Trump administration’s One Big Beautiful Bill Act, as buyers rushed to market before the $7,500 tax credits expired at the end of September. The third quarter was the best-ever for EV sales, and a strong quarter for the overall market. Then came the expected EV sales collapse as tax credits expired. The fourth quarter, in general, saw a noticeable market slowdown, with prices climbing as more tariffed inventory arrived.

Q4 and Full-Year New-Vehicle Sales Forecast

GM Poised to Lead 2025 Despite Q4 Slowdown; Toyota Gains Share as Top Automakers Widen Gap

The market winner in 2025 is expected to be General Motors. The market leader is forecast to end the fourth quarter with over 685,000 vehicles sold, and finish the year above 2.8 million, a year-over-year increase of more than 5%. GM’s sales in Q4, however, are forecast to be down from last year and last quarter, suggesting a loss of momentum going into 2026.

Toyota will finish a strong second in 2025, with gains from both the Toyota and Lexus brands. The company’s sales are expected to increase 8.4% from last year, with market share rising from 14.5% to 15.5%. Toyota’s solid share gain is part of a broader trend in 2025, in which the largest automakers grew larger. Market share for the top four sellers – General Motors, Toyota Motor Corporation, Ford Motor Company, and Hyundai Motor Company – increased 2.6 points in 2025, while nearly all other automakers saw declines in both sales and share.

Forecast: 2026

Looking ahead to 2026, Cox Automotive’s Economic and Industry Insights team forecasts that the new-vehicle sales pace in 2026 will decline by 2.4% to 15.8 million. Factors such as slower economic growth, less job creation, and the lack of EV tax incentives are expected to affect vehicle sales in the year ahead. While most vehicle sales figures in 2025 exceeded expectations, the outlook for 2026 suggests a slowdown across many important metrics. Earlier today, the team released its 2026 forecasts for the U.S. automotive market, highlighting five forces set to shape the auto industry in the coming year. (Note: The Cox Automotive 2026 forecast is based on the annual sales pace, which in 2025 is now forecast at 16.2 million. The Kelley Blue Book sales volume numbers, as shown in the chart above, include additional heavy trucks sold at retail. The sales volume counted by Kelley Blue Book is slightly higher than the volumes used in the SAAR calculations.)

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $23 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com