The U.S. auto industry is a trillion-dollar industry – an economic engine that is not a single business, but a collection of businesses touching nearly every household and community in the U.S. It’s also an industry deeply influenced by a massive web of economic, policy, social, and technological factors.

Calendar year 2025 was a perfect example of that reality. Despite countless complications, or perhaps because of the complications, the market delivered better-than-expected results in many metrics. Retail sales beat expectations, fleet demand remained healthy, and wholesale values stayed relatively stable despite tariff-induced volatility.

The factors influencing the automotive market also became more fragmented in the past year, simultaneously pulling the industry in different directions, creating opportunities for some players while posing risks for others. That fragmentation will likely be even more central to the industry’s narrative in 2026.

As the Cox Automotive Economic and Industry Insights team looks to the year ahead, five major themes are shaping the automotive forecast. Each reflects conflicting dynamics that will ultimately play out in overall market performance.

The Bifurcated Consumer: The divide between high-income and low-income households is widening. Wealthier consumers will benefit from wealth effects, lower taxes, and rate cuts, while lower-income households will continue to feel the strain of years of inflation, yet also see higher tax refunds. This divergence accelerates trade-down behavior, making value perception critical across the market. Cox Automotive is expecting an increase in demand for affordable vehicles, lower monthly payments, and used-vehicle options that provide solutions for consumers seeking to stretch their budgets.

Fragmented Labor: A growing labor market is the foundation for a healthy automotive market, and right now we are in a jobless expansion – GDP is growing through investment and productivity, but employment has stagnated. We are in a no-hire, no-fire environment, where low unemployment numbers mask the reality: Job seekers face challenges, while those in stable roles fare better. Slow job growth dampens household formation critical for vehicle demand and saps the confidence needed for big-ticket purchases like vehicles. This dynamic will weigh on first-time buyers and could limit growth in entry-level segments in the year ahead.

Inflation and Fed Risk: Inflation appears to be peaking, and rate cuts this fall and into 2026 will help affordability. Yet uncertainty looms with Federal Reserve Chair Jerome Powell’s succession and questions about Fed independence. Lower rates will provide some relief, but long-term rates remain sticky, delaying housing recovery and limiting auto sales. Uncertainty has been a key theme lately, and in 2026, our team is expecting more uncertainty when it comes to inflation and Fed’s decision path. As the Fed works to balance its dual mandate, there is no simple way forward.

Policy and the EV Shock: As clearly demonstrated in the past year, the White House remains actively engaged in economic and industry policy. For the most part, our team has come to expect the unexpected. The auto industry now has higher material costs, more freedom to produce what consumers want, and the benefit of lower taxes. This doesn’t sound impossible to navigate, but it creates an uneven playing field. Next up: USMCA renegotiation, which could disrupt the outlook even further. And be ready for the next chapter in the electric vehicle story, where new-EV sales are no longer supported by government incentives and off-lease EVs begin to surge into the used-vehicle market. Everyone involved in the automotive business will need to be ready to navigate a shifting policy landscape in the year ahead, while balancing consumer demand and profitability.

AI’s Inflection Point: AI investments in infrastructure are driving GDP growth and stock market gains, and the associated wealth effect is supporting retail demand. We are also witnessing AI-driven productivity gains, but competitive fragmentation will intensify. For auto dealers, AI promises efficiency and transparency, which is good news for consumers and retailers alike. Cox Automotive expects AI to improve the retail landscape – and as a company, we are actively engaged in that endeavor – with even more pricing transparency, better customer engagement, and enhanced consumer service experiences. Questions remain about long-term ROI, but the path is set. AI will be central to the industry’s story in the year ahead.

2026 Forecast Highlights

Collectively, these five factors are steering the Cox Automotive forecast for 2026. Highlights include:

- New Vehicle Sales: Our new vehicle SAAR estimate of 15.8 million is down 2.4% from 2025 levels. A high-15 million level may be the new norm given global factors and demographic trends. Slower economic growth and job creation – and the expiration of EV tax incentives – will weigh on demand.

- Retail and Fleet: New retail sales are expected to decline about 1.5% year over year, while fleet sales will see sharper drops as slower growth limits commercial demand.

- Leasing: With the expiration of the tax incentive on EVs and plug-in hybrids, and the “leasing loophole” that drove the numbers higher, total leasing will decline in 2026, dropping lease penetration toward 21%, the lowest level in three years.

- Used Market: We expect slightly lower used-vehicle sales versus last year, with total used and used retail down roughly 1% year over year. Used retail inventory will remain relatively tight in 2026, but demand should be steady due to affordability concerns pushing consumers toward lower-priced vehicles.

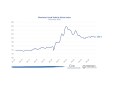

- Wholesale Values: The Manheim Used Vehicle Value Index is projected to rise 2% by year-end 2026, signaling relatively normal depreciation rates. EVs will represent a growing share of wholesale values, adding complexity to pricing trends.

A full look at our forecast for the year ahead can be found here.