Key Metrics

- The Manheim Used Vehicle Value Index (MUVVI) decreased to 210.0, reflecting a 0.2% decrease in wholesale used-vehicle prices (adjusted for mix, mileage, and seasonality) in the first 15 days of February compared to January, and a 2.9% increase compared to February 2025. Seasonally adjusted wholesale values typically decrease by about 0.2% on average over the full month.

- Non-adjusted wholesale vehicle prices increased 1.9% in the first half of February from January and are up 3.1% year over year. The long-term average monthly move in non-adjusted values is typically an increase of 0.9% for the full month of February.

Expert Perspective — Jonathan Gregory, Senior Manager of Economic and Industry Insights, Cox Automotive

“The wholesale market carried its January momentum into February, with year-over-year price growth accelerating to 2.9% even as the seasonally adjusted index edged lower – a pattern consistent with the spring selling season getting an early start. Tax refund season is now in full swing, and the early data is encouraging: the average refund is up roughly 11% from this time last year, and the share of returns receiving a refund is up 2 percentage points. In the lanes, we’re already seeing that demand translate: Sales conversion climbed to 62.5% in the first half of February, up nearly 3 points year over year and 2.4 points from January, while MMR retention held above 100%. Dealers came into the month stocking up ahead of what many expect to be a strong spring, and the luxury segment continues to lead. We’re also seeing EV values firm up after some post-incentive softness earlier in the year. Wholesale supply has ticked up slightly to 28 days, but with conversion rates running this strong, that inventory is being absorbed. With lower auto loan rates giving more consumers the confidence to act and a potentially prolonged tax refund tailwind, wholesale values should find sustained support through the spring season.”

MMR Prices, Retention & Sales Conversion

- MMR prices for the Three-Year-Old Index increased 1.3% in the first half of February, a stronger move than we observed last year and against the long-term average.

- MMR retention averaged 100.3%, higher by 0.3 points year over year and up 0.3 points from January.

- Sales conversion averaged 62.5%, higher by 2.7 points year over year and up 2.4 points from January.

Takeaway: MMR depreciation rates were considerably lower than long-term rates early in February. MMR retention and sales conversion are both above their longer-term run rates, indicating that demand remains strong at Manheim.

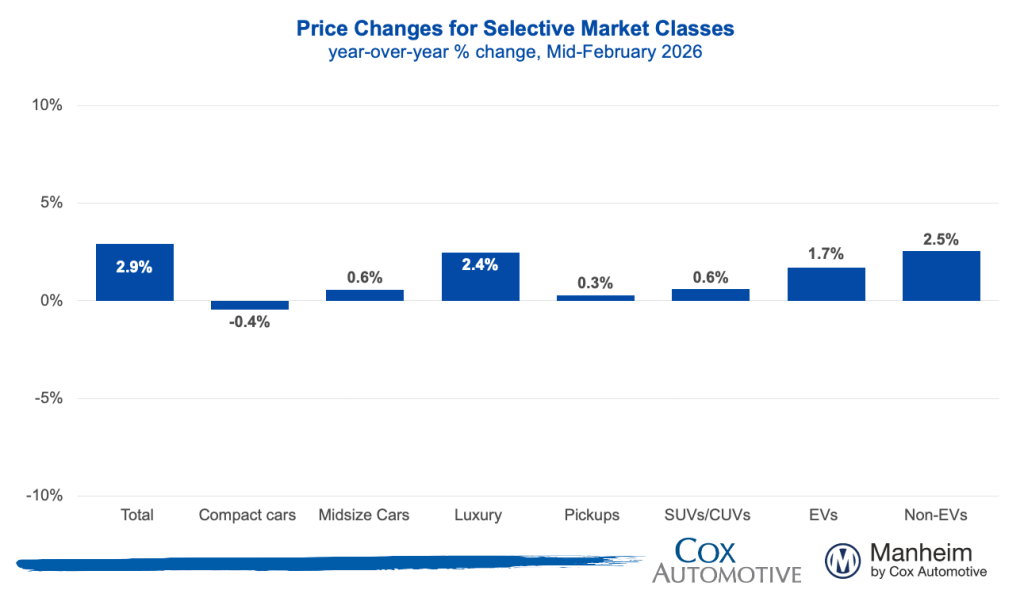

Segment Performance: Year-Over-Year Price Changes

Prices in the overall market rose 2.9% year over year, supported primarily by continued price growth in the luxury vehicle segment.

Takeaway: The luxury vehicle segment continues to see strong performance, while cars saw the largest declines.

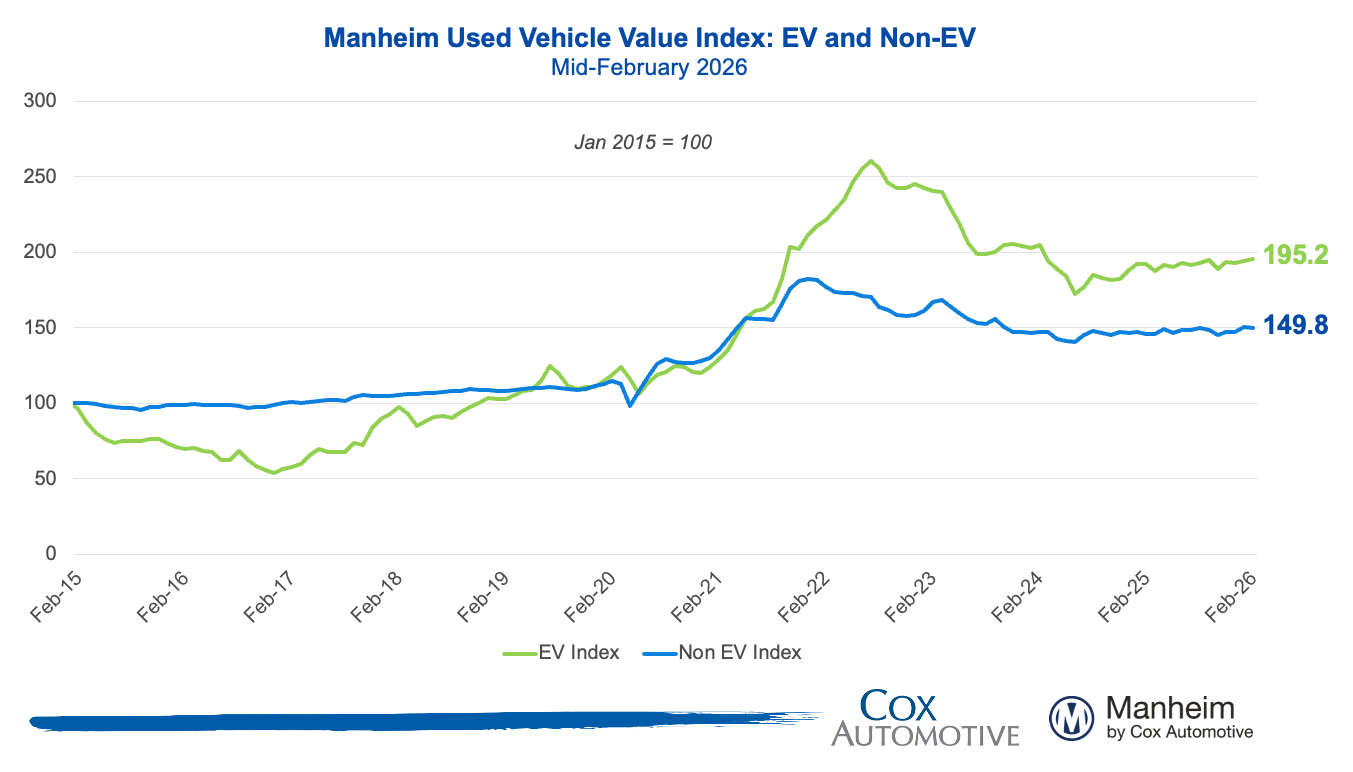

EV versus Non-EV Index

- EVs: The Electric Vehicle (EV) Index was up 1.7% year over year and up 0.7% from January.

- Non-EVs: The Non-EV Index was up 2.5% year over year, and it is down 0.2% from January.

Takeaway: EV values have firmed up since the start of the year, while non-EV values remain high, despite cooling slightly from January levels.

Wholesale Supply

- At the end of January, wholesale vehicle supply reached 27 days, flat against January 2025 and decreasing from 32 days at the end of December. As of Feb. 15, days’ supply climbed to 28 days.

Takeaway: Wholesale used-vehicle supply slightly outpaced sales through the first half of February, following a steady tightening in January.

View historical MUVVI reports here.

For more information on Manheim, visit Manheim.com.

The Manheim Used Vehicle Value Index (MUVVI) is a trusted benchmark for tracking wholesale used-vehicle prices in the U.S., which helps dealers and analysts gauge market shifts and anticipate retail trends. The official measure is reported on the fifth business day of each month. The mid-month MUVVI number is a checkpoint number, is not an official reading and should not be compared to the official index reading. The mid-month is not a flash estimate, and it is not meant to provide any directional estimate of the full-month number. The next complete suite of monthly MUVVI data will be released on Friday, March 6, 2026.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

Note: The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Learn more about the decision to rebase the index.