As widely forecast, sales of new electric vehicles (EVs) in the U.S. fell sharply in the fourth quarter, following record-breaking results in Q3. With government-backed sales incentives revoked at the start of October, total EV sales in Q4 plunged to 234,000 units, down 46% compared to Q3 and 36% lower year over year. Sales in the final quarter of 2025 were at the lowest point since Q4 2022.

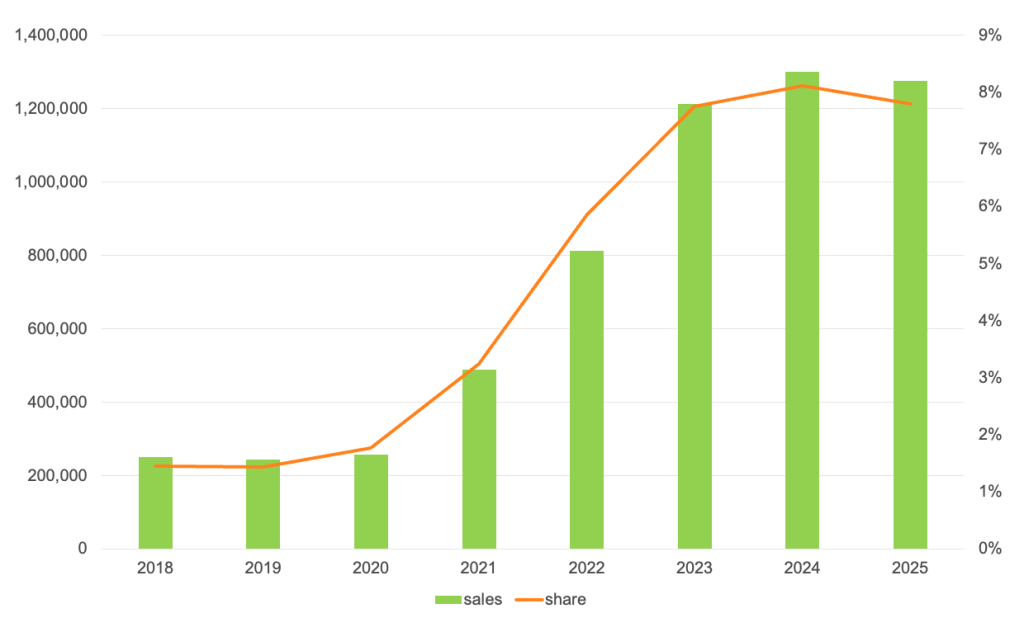

While the Q4 collapse will command headlines, total EV sales in calendar year 2025 tell a different story: Thanks in part to record volume in Q3, total EV sales last year came in just shy of 2024’s 1.30 million. In fact, 2025 was the second-best year on record for EV sales in the U.S., and the EV share of total market sales was a strong 7.8%, down from 8.1% a year earlier, according to Kelley Blue Book estimates.

New US Electric Vehicle Sales and Share

“2025 unfolded largely as anticipated, with changes to federal EV incentives reshaping the demand patterns that drove record Q3 sales,” said Stephanie Valdez Streaty, director of Industry Insights at Cox Automotive. “Rather than signaling a retreat from electrification, this shift marks a structural transition toward a market increasingly driven by consumer choice. While 2026 will bring challenges, momentum remains grounded in market maturation: expanding model availability across price points, improving charging reliability, and continued advances in battery performance and cost.”

Tesla remains the EV market leader, by far, even with sales declining for the second year after peaking in 2023. Nearly half of all EVs sold in the U.S. come from Tesla, mostly the popular Model 3 and Model Y. Tesla sales fell to 589,000 in 2025, down 7% from 2024, or 44,000 units.

While Tesla’s sales declined, General Motors’ sales accelerated thanks to strong new models. GM sold more than 150,000 EVs in 2025, up 48% year over year and now accounting for 13% of total EV sales in the U.S. Chevrolet and Cadillac lead GM’s EV push with strong-performing models. While volume remains modest compared to Tesla, GM has clearly established its position as the market’s EV leader not named Tesla (AKA No. 2).

The Next Chapter Begins

Electric-vehicle share of total U.S. new-vehicle sales peaked at 10.5% in Q3 2025, then fell to 5.8% in Q4, roughly equal to the share in the first half of 2022. Cox Automotive expects EV share in the year ahead to be near 8%, as new product enters the market, infrastructure improves and consumer confidence in EV technology continues to grow. New vehicles, including the affordable 2026 Chevrolet Bolt, the Rivian R2, and a new generation of BMW EVs – as personified in the soon-to-launch BMW iX3 SUV – will help write the next chapter of EV sales in the U.S.

Government policy remains a wildcard in this equation. Recent moves by the current administration suggest less regulatory pressure to improve fuel economy and reduce emissions, leaving growth largely in the hands of automakers and consumers. Still, Cox Automotive believes EV sales will increase in the long run, and the U.S. market will become more electrified in the coming decade, with product innovation and infrastructure improvements supporting gradual sales growth. The automotive market in the U.S. is more than 100 years old. Change takes time.