New-vehicle affordability in September hit its lowest level since December 2024, according to the latest Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

“Higher incentives and income growth weren’t enough to offset September’s new-vehicle price increase,” said Cox Automotive Chief Economist Jonathan Smoke. “Even though incentive spending was at its highest level this year, the average transaction price for a new vehicle reached a record $50,080.”

The estimated average auto loan rate remained stable, decreasing by 1 basis point to 9.63%, which was 89 basis points lower year over year. The average new-vehicle price increased 2.1% for the month to a new record high, according to Kelley Blue Book’s September average transaction price report. Income growth remained strong at 3.4% year over year.

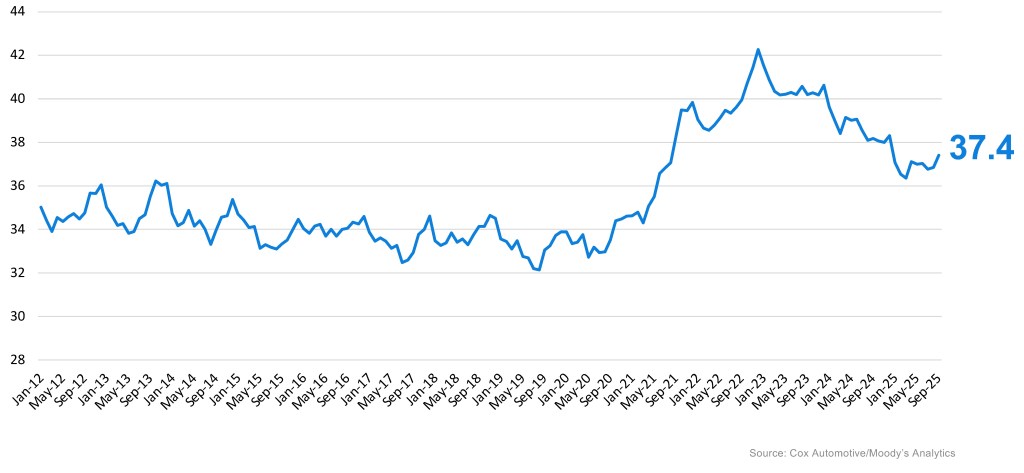

The typical payment for a new vehicle increased 1.9% to $766, marking the highest monthly payment in 15 months, and was up 1.2% year over year. The number of median weeks of income needed to purchase the average new vehicle increased to 37.4 weeks from 36.8 weeks. The average monthly payment peaked at $795 in December 2022.

Cox Automotive/Moody’s Analytics Vehicle Affordability Index

September 2025

Weeks of Income Needed to Purchase a New Light Vehicle

New-vehicle affordability in September improved by 2% compared to a year ago, when it took 38.2 weeks of median income to purchase the average new vehicle. A year ago, prices were 3.7% lower, but interest rates were higher. Incomes and incentives were also lower in September 2024.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on Nov. 17, 2025.

1 The index input of the average interest rate paid by consumers is calculated to reflect a 72-month, fixed-rate loan. For the latest Dealertrack estimated volume-weighted average new loan rate, visit the Auto Market Snapshot.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive brand. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.