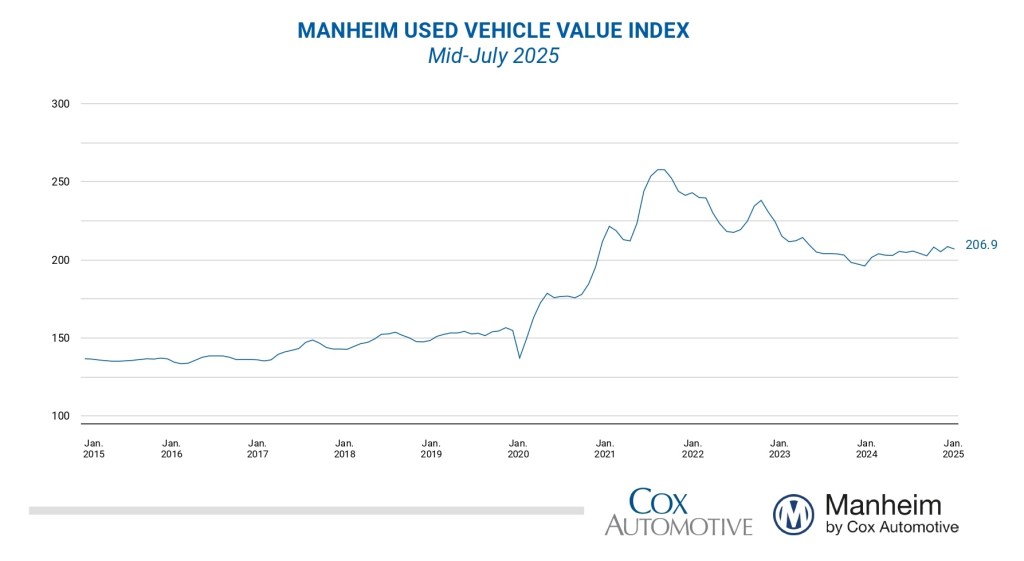

Wholesale used-vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) decreased 0.7% from June in the first 15 days of July. The mid-month Manheim Used Vehicle Value Index was 206.9, showing a rise of 2.6% from the full month of July 2024. The seasonal adjustment reduced the results for the index in the month, which was lower than normal.

The non-adjusted price change in the first half of July fell 1.6% compared to June, and the unadjusted price is higher by 2.8% year over year. The average move for the full month of July is a decline of 0.7 percentage points for non-adjusted values, indicating the depreciation observed so far in July is stronger than normally seen for the full month. Market values increased significantly more than usual in July 2024, making the comparison more challenging on a year-over-year basis.

“Price appreciation trends against last year are starting to moderate as we enter Q3, a time that showed stronger pricing than normal for wholesale markets last year,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “In the first two weeks of July, depreciation trends are slightly elevated for the MUVVI index, though used retail sales and supply are holding steady. Last year saw stronger appreciation rates than normal throughout most of Q3, so the index gains over 2024 levels should start to moderate, as we expected. However, wholesale supply is quite a bit tighter than last year, so supply and demand are well balanced currently.”

Over the last two weeks, the Manheim Market Report (MMR) prices for the Three-Year-Old Index decreased by an aggregate of 0.3%, a little less than normal. The long-term average decline for 3-year-old values in the first two weeks of July is a decline of 0.5%. Over the first 15 days of July, MMR retention, the average difference in price relative to current MMR, averaged 98.7%, impacted by the holiday period early in the month. This is a decline of half a point from late June, indicating that market prices moved lower than valuation models early in July. MMR retention is eight-tenths of a point lower compared to the first half of July 2024. The average daily sales conversion rate in the first half of the month was 54.9%, down from 57.8% in June and lower by two points from last year’s level of 57.0%, indicating a modest softening in demand.

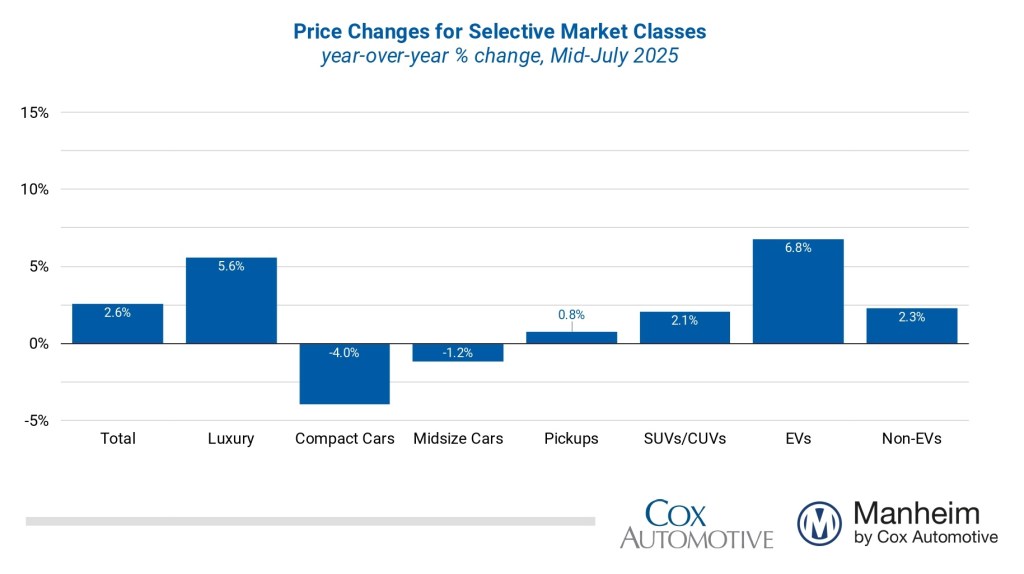

Most major market segments experienced positive year-over-year results for seasonally adjusted prices in the first half of July. Compared to the industry’s year-over-year increase of 2.6%, the luxury segment performed the best, rising by 5.6% and outperforming the market. Rising less than the industry, SUVs were higher by 2.1%, and trucks showed gains of 0.8%. Mid-size cars declined by 1.2%, and the compact car segment fell the most, lower by 4.0% compared to last year. Most segments were lower compared to the results from the end of June. The overall industry declined by 0.7% compared to the prior month. Trucks were higher month over month, rising by 0.5% so far in July, while mid-size cars declined only 0.2%, and the compact car segment fell 0.7%, in line with industry results. Showing lower gains than the industry, SUVs declined 1.1% against June, while the luxury segment fell the most, down by 1.4% over the period.

Electric vehicles (EVs) are showing the strongest year-over-year gains currently, as last year’s levels were weaker at this time, helping the comparison. EVs showed an increase of 6.8% in early July, while the non-EV segment increased by 2.3% over the period. Against June values, EVs showed larger declines than the industry, falling by 2.1% in the first half of July, while non-EVs were unchanged against June in the first half of the month.

Wholesale Supply Down in Mid-July

Leveraging Manheim sales and inventory data, wholesale supply ended June at an estimated 25 days, flat against the end of May and down one day compared to June 2024 (at 26 days). Wholesale supply remains tighter at this time of year, running roughly two days lower than the longer-term levels for this week. As of July 15, wholesale supply remained unchanged from the end of June, at 25 days, and was 10%, or three days, lower than last year.

Consumer Sentiment Up Slightly in First Half of July

The daily index of consumer sentiment from Morning Consult shows a slight positive trend with data through July 15. After jumping 7.1% in May and then declining 3.6% in June, the index is up 0.5% so far in July. Views of current conditions have improved, but future expectations are unchanged in the first half of July. According to AAA, the average price of unleaded gasoline has decreased 0.6% as of July 15 and is down 10% year over year.

The next complete suite of monthly MUVVI data will be released on Aug. 7, 2025, the fifth business day of the month, as regularly scheduled.

For questions or to request data, please email manheim.data@coxautoinc.com. If you want updates about the Manheim Used Vehicle Value Index, as well as direct invitations to the quarterly call sent to you, please sign up for our Cox Automotive newsletter and select Manheim Used Vehicle Value Index quarterly calls.

Note: The Manheim Used Vehicle Value Index was adjusted to improve accuracy and consistency across the data set as of the January 2023 data release. The starting point for the MUVVI was adjusted from January 1995 to January 1997. The index was then recalculated with January 1997 = 100, whereas prior reports had 1995 as the baseline of 100. All monthly and yearly percent changes since January 2015 are identical. Learn more about the decision to rebase the index.