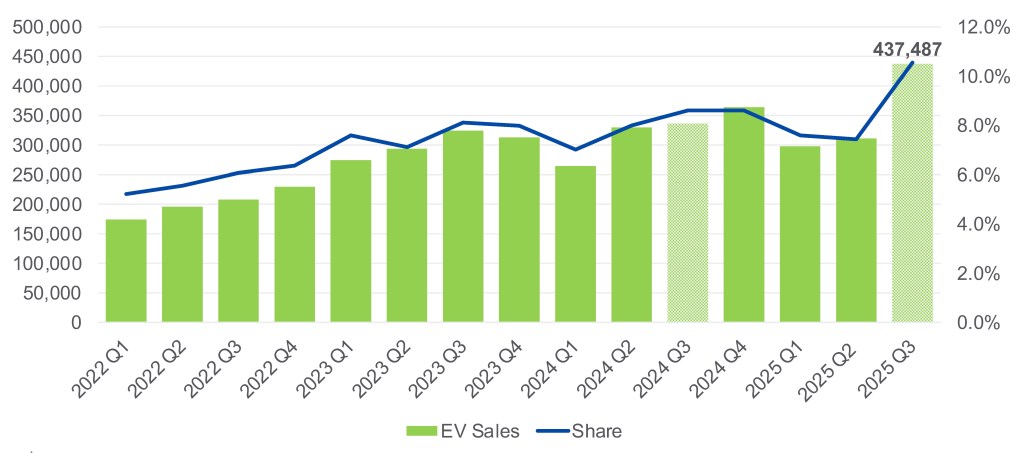

As expected, electric vehicle (EV) sales volume in the U.S. hit an all-time high in Q3 2025: 438,487 units sold, according to Kelley Blue Book estimates. EV sales volume in Q3 was up 40.7% from the previous quarter and higher by 29.6% year over year. The Q3 record beat the prior peak set in Q4 2024 by nearly 20%. During the third quarter, electric vehicles accounted for 10.5% of total vehicle sales, also a new record and a significant increase from the 8.6% share in the same period last year.

Q3 New EV Sales — Record Sales and Share

Sales surge 29.6% year over year, pushing market share to a record 10.5%

However, not all automakers joined the sales party. Mercedes-Benz EV sales in Q3 were mostly flat year over year, while Toyota and Nissan both sold fewer EVs last quarter compared to Q3 2024. Meanwhile, Volkswagen, General Motors, Honda and Hyundai saw sizeable gains — VW and GM posted EV sales more than double year-ago levels — and even Tesla managed to eke out an 8% year-over-year gain in the quarter, the company’s first increase in 2025 after seeing sales tumble in the first half. Clearly, the urgency of an incentive-ending deadline got people and dealers moving.

Tesla’s share of total EV sales fell to 41% from 49% in Q3 2024, according to Kelley Blue Book estimates. The EV pioneer can’t maintain its share in a segment where every automaker is working to expand its own electric vehicle portfolio. Recently announced price cuts may help Mr. Musk’s company maintain volume. But the challenges are only getting tougher for Tesla, which essentially has a two-vehicle lineup supported by three niche vehicles.

In Q3, roughly 90 EV models registered sales, and yet only nine posted sales above 10,000 units. The Tesla Model Y and Model 3 continue to stand out, with sales of 114,000+ and 53,000+, respectively, in Q3. The new Chevy Equinox was the third best-selling EV last quarter with sales of nearly 25,000. That may seem like a reasonable volume, but the top 3 are outliers, as the vast majority of EVs sell at a rate of far less than 2,000 a month, or 6,000 units a quarter. In the volume-driven business of automotive manufacturing, low volume is the enemy; EV profitability remains a distant dream for nearly every automaker.

With government-backed EV sales incentives now eliminated, making and selling EVs for the U.S. market becomes even more challenging. The all-time sales and share records in Q3 were all but certain. What is far less certain is what happens next. “The training wheels are coming off,” notes Cox Automotive’s Director of Industry Insights Stephanie Valdez Streaty. “The federal tax credit was a key catalyst for EV adoption, and its expiration marks a pivotal moment. This shift will test whether the electric vehicle market is mature enough to thrive on its own fundamentals or still needs support to expand further.”

Cox Automotive is forecasting EV sales to drop notably in Q4 and through the early months of 2026. Even though many automakers have already pulled back on plans for new product launches, Cox Automotive continues to believe that over the long term — the next 10 years or more — sales of vehicles powered solely by internal combustion engines (ICE) will continue to decline. Electrified vehicles — hybrids, plug-in hybrids and pure EVs — are the future. Says Valdez Streaty, “Growth moving forward will be slower than many advocates hoped, though continued innovation in battery technology, improved transparency in battery health and expanding infrastructure give reason for optimism. The road ahead will be challenging, but progress will continue.” (Read more from Valdez Streaty in “After the Credits: How EV Adoption Advances When Incentives Fade.”)