ATLANTA, Sept. 3, 2025 – Despite persistent economic uncertainty and waning consumer confidence, U.S. auto dealers maintained a steady outlook in Q3 2025, according to the latest Cox Automotive Dealer Sentiment Index (CADSI). While profitability dipped and customer traffic slowed from the spring surge, the overall sentiment remained stable, with dealers signaling cautious optimism as they navigate a complex market landscape.

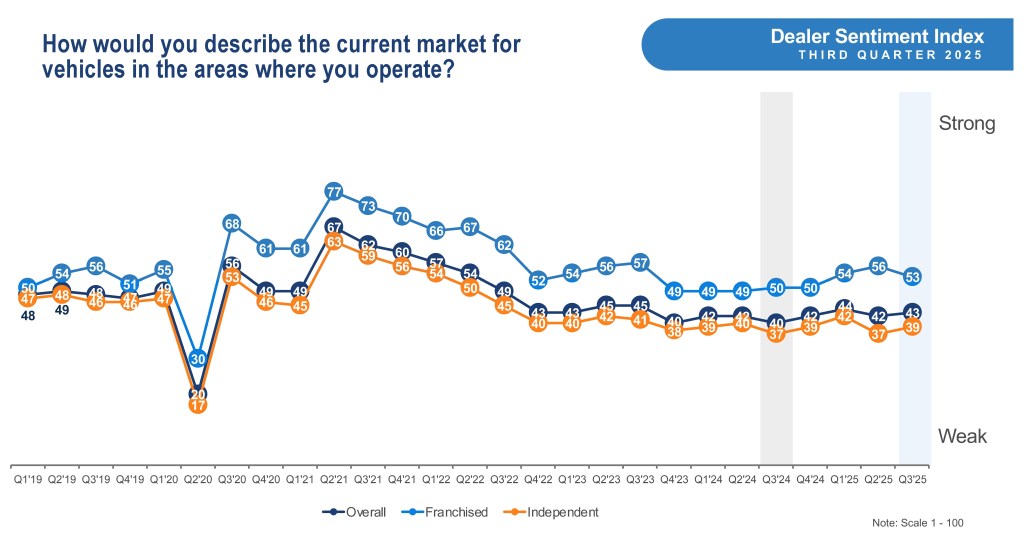

The Q3 2025 CADSI, based on a national survey of 891 franchised and independent dealers conducted from July 22 to Aug. 4, shows the current market index at 43, up one point from Q2. Although still below the 50 threshold – indicating more dealers view the market as weak rather than strong – the score reflects consistent sentiment over the past two years. In Q3, franchised dealer sentiment fell by 3 points to 53, while independent dealers increased from 37 to 39.

“With sales momentum mostly holding, dealers are not throwing in the towel on sentiment,” noted Jonathan Smoke, Chief Economist at Cox Automotive. “New-vehicle sales have come down from the surge in the spring but have remained relatively strong and better than the past few years. While the labor market has softened, unemployment remains historically low, and, for the most part, tariffs have only been a glancing blow to consumer wallets so far. While 2025 has been a roller coaster for many, the market is still generally on track.”

Key Findings from Q3 2025 CADSI

- Market Outlook Holds Steady: The market outlook index for the coming three months rose slightly to 46, significantly higher than year-ago levels but down from the Q1 peak of 58, a two-year high. Franchised dealers posted a score of 55, while independent dealers remained flat.

- Customer Traffic Slows Sharply: After a surge in Q2, customer traffic declined significantly in Q3. The index dropped from 37 to 33, with franchised dealers falling from 50 to 43, a statistically significant decrease. For independent dealers, the overall traffic score remains weak, shifting directionally from 32 to 30 this quarter.

- Profitability Weakens as Costs Remain Elevated: Dealer profitability declined slightly in Q3, with the overall profit index falling from 39 to 38. Independent dealers continued to report weaker profitability (34) compared to franchised dealers (49). Meanwhile, the cost index held at 70 – still the highest score in the survey – indicating widespread concern over rising operating expenses.

- Inventory Rebounds Amid Slower Sales: New-vehicle inventory rose sharply from 50 to 57, reversing declines seen in Q1 and Q2. This increase coincided with a dip in the new-vehicle sales environment index, which fell from 62 to 58.

- Price Pressure Intensifies: Dealers reported increased pressure to lower prices, with the price pressure index climbing from 57 to 61. This marks the first increase in a year and reflects growing inventory and slower sales. Independent dealers reported more pressure (61) than franchised dealers (58).

- Electric Vehicle (EV) Market Outlook Hits Record Low: Despite strong EV sales in July, dealer expectations for future EV sales dropped to 30, the lowest score on record. This decline reflects concerns over the expiration of government-backed tax credits at the end of September.

- Economic and Interest Rate Concerns Ease Slightly: The economy remains the top factor holding back business, cited by 44% of dealers, but a significant decrease from Q2. Interest rates followed closely at 43%, nearly even with the previous quarter. Market conditions ranked third, cited by 36%. Political climate and tariff concerns declined significantly in Q3, with mentions dropping to 28% and 16%, respectively.

Cox Automotive Dealer Sentiment Index Methodology

The Cox Automotive Dealer Sentiment Index (CADSI) is derived from a quarterly survey issued to a representative sample of franchised and independent auto dealers across the United States. The Q3 2025 CADSI is based on responses from 891 dealers, including 477 franchised and 414 independent dealers.

The survey, conducted from July 22 to Aug. 4, 2025, measures dealer perceptions of current retail auto sales and sales expectations for the next three months as “strong,” “average,” or “weak.” Responses are weighted by dealership type and sales volume to represent the national dealer population. Indices are calculated by assigning values to responses: 100 for strong/increasing, 50 for average/stable, and 0 for weak/decreasing. Respondents who select “don’t know” are excluded from the index calculation. The reported metrics have a margin of error of +/- 3.28%.

About Cox Automotive

Cox Automotive is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $23 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com