Press Releases

Cox Automotive Forecast: New-Vehicle Sales Stall in September

Monday September 27, 2021

Article Highlights

- Automobile sales in September are forecast to slow for the fifth straight month, as tight inventory, high prices take a toll on the industry.

- September sales volume is expected to fall nearly 26% from one year ago and finish near 1.0 million units, among the lowest volume in the past decade.

- Third-quarter vehicle sales are forecast to be down 14% versus Q3 2020 and down 22% compared to the same period in 2019.

UPDATED, Oct. 4, 2021 – The Cox Automotive Industry Insights team was expecting U.S. auto sales to cool in the third quarter, following a strong second quarter that greatly reduced inventory. That outlook proved correct, with vehicle inventory falling even further than initially expected and new-vehicle sales in September finishing very near our forecasted volume of 1 million units, among the lowest for a month in the past decade. The sales pace in September was measured at 12.18 million, slightly above our forecast of 12.1. Sales in Q3 finished down nearly 14% versus 2020 and more than 20% lower than the same period in 2019. While sales are up year-to-date, inventory is expected to remain tight through the fourth quarter, forcing our team to lower our full-year, new-vehicle forecast to 15.5 million, down from our 16.5 million forecast at the end of the second quarter.

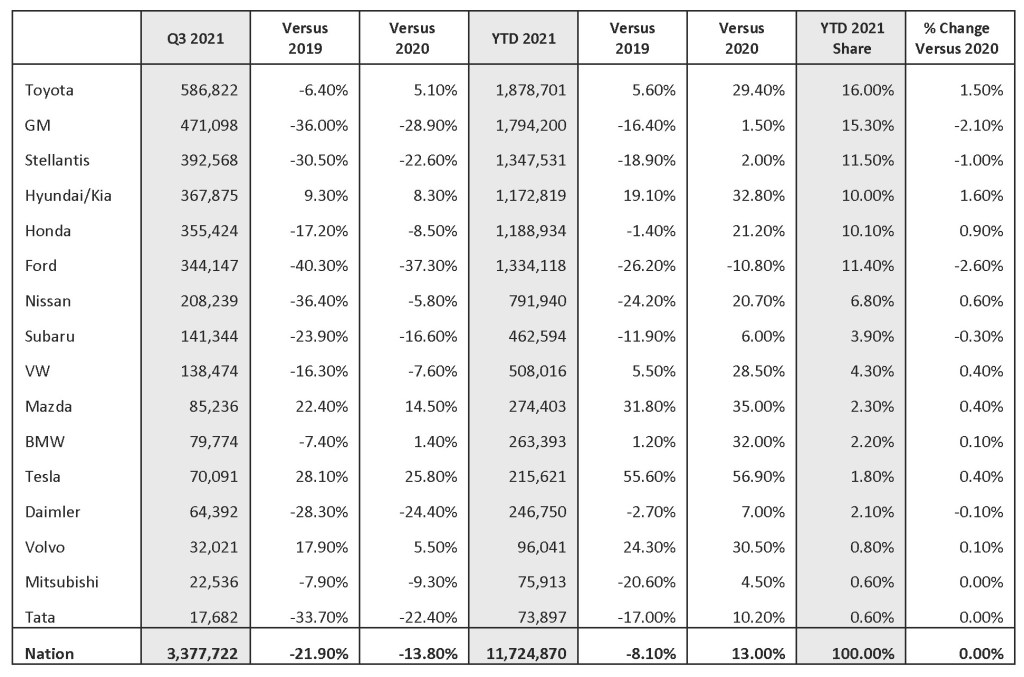

Some automakers are grabbing market share in 2021, including Toyota, Hyundai/Kia, and Honda. In fact, through the first nine months of 2021, Toyota is outpacing General Motors. For nearly 100 years, GM has been the top automaker in the U.S. The possibility that GM might fall to No. 2 in America is notable indeed, and an indication of how disruptive the supply-chain issues – first-and-foremost global microchip shortages – have been. The story in the fourth quarter will continue to be inventory, a story the Cox Automotive team will continue to watch closely.

For a review of the industry’s performance last quarter, check out the Cox Automotive Q3 2021 Forecast Call held on September 30. A recording is available in the Cox Automotive Newsroom.

ATLANTA, Sept. 27, 2021 – September U.S. auto sales are forecast to be significantly hampered by an ongoing lack of new-vehicle inventory. According to a forecast released today by Cox Automotive, the pace of auto sales, or seasonally adjusted annual rate (SAAR), is expected to finish near 12.1 million, the slowest pace since May 2020, when much of the country was closed during the first wave of the COVID-19 pandemic. The September 2021 sales pace will be down from August’s 13.1 million pace and down from the September 2020 pace of 16.3 million.

Sales volume is forecast by Cox Automotive to come in near a notably low 1.0 million units. The low volume expectations for September 2021 put the month on course to be among the worst in the past decade. Sales volume is expected to be down nearly 26% from last September and down 8.5% from last month.

The sales pace in the U.S. market has fallen every month since reaching a peak of 18.3 million in April. According to Cox Automotive Senior Economist Charlie Chesbrough: “After a strong spring selling season, the supply situation has worsened precipitously and is dragging sales down with it. The monthly declines have been large – the sales pace has declined by more than a million units in each of the past five months. Available supply on dealer lots is now 58% lower than last September, down nearly 1.4 million units.”

The new-vehicle supply shortage is impacting the market in many ways. Manufacturers have cut back significantly on incentives, and transaction prices have risen as a result. In addition, the lack of new-vehicle inventory is steering many dealers and consumers into the used-vehicle market, resulting in higher prices for both wholesale and retail used vehicles.

Q3 2021: The Auto Industry Finds the Bottom

With lower sales forecast for September, the third quarter of 2021 is forecast to finish with auto sales down 14% versus Q3 2020 and down 22% compared to the same period in 2019. Cox Automotive will officially revise its full-year forecast, with new projections scheduled to be released on September 30.

The underlying economic conditions in the U.S. are currently healthy enough to support higher new-vehicle sales levels. The demand is there. Inventory levels, however, are the unique problem facing the automotive market right now, with disruptions to the global supply chain challenging all automakers, severely impacting available inventory, and pushing many would-be buyers out of the market. In recent research by Cox Automotive’s Kelley Blue Book team, nearly half of would-be buyers indicated in August that they will likely step back from the market, many for three months or more.

Inventory conditions, however, are anticipated to improve in the coming months. “The expectation is that OEM supply issues will improve such that Q4 should have better selling SAARs than the September rate, but that doesn’t mean good selling rates,” said Chesbrough. “Vehicles are getting produced, and some OEMs have improved their supply situation. In recent months, OEMs seem to be managing the situation better now that they’ve had time to adjust. For example, automakers are improving their ability to redirect existing chips to the most important vehicles in their portfolios. This strategy should support better sales in the fourth quarter compared to the third quarter.”

September 2021 Sales Forecast Highlights

- New light-vehicle sales are forecast to fall to 1.0 million units, or down 357,000 units, nearly 26% from last year. Compared to last month, sales are expected to fall 92,000 or nearly 8%.

- The SAAR in September 2021 is estimated to be 12.1 million, down from last September’s early COVID recovery pace of 16.3 million and down from August’s 13.1 million supply-constrained level.

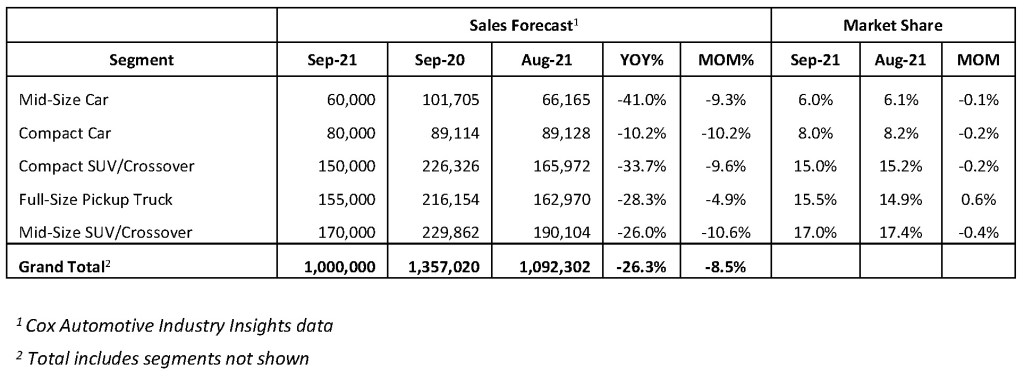

- No segment saw a sales increase in September with the Mid-Size Cars and Compact SUV/Crossover segments seeing the largest year-over-year decreases at -41.0% and -33.7%, respectively.

September 2021 New-Vehicle Sales Forecast

All percentages are based on raw volume, not daily selling rate.

Q3 2021 Sales and Year-to-Date Forecast

Cox Automotive Q3 U.S. Auto Sales Forecast Call

Chief Economist Jonathan Smoke and the Industry Insights team will share their take on the overall industry performance on Thursday, September 30, at 10 a.m. EDT. In addition to the economic factors influencing the market, the Industry Insights team will cover the industry’s hottest topics, including inventory, vehicle prices, and valuations. The revised Cox Automotive full-year forecast will be explained, including insights into the outlook for the remainder of the year. Register to attend.

About Cox Automotive

Cox Automotive Inc. makes buying, selling, owning and using vehicles easier for everyone. The global company’s more than 27,000 team members and family of brands, including Autotrader®, Dealer.com®, Dealertrack®, Dickinson Fleet Services, Kelley Blue Book®, Manheim®, NextGear Capital®, VinSolutions®, vAuto® and Xtime®, are passionate about helping millions of car shoppers, 40,000 auto dealer clients across five continents and many others throughout the automotive industry thrive for generations to come. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately-owned, Atlanta-based company with annual revenues of nearly $20 billion. www.coxautoinc.com

Media Contacts:

Mark Schirmer

734 883 6346

mark.schirmer@coxautoinc.com

Dara Hailes

470 658 0656

dara.hailes@coxautoinc.com