Data Point

Still Tight Used-Vehicle Inventory Pushes Prices Higher

Tuesday September 21, 2021

Article Highlights

- The average used-vehicle listing price is approaching $26,000.

- Days’ supply has held steady for months due to slowing sales.

- After edging higher for a couple of months, available supply dipped by the end of August.

Revised Oct. 21, 2021 – The average listing price for used vehicles set another record in August as vehicle inventory dipped, according to the Cox Automotive analysis of vAuto Available Inventory data. Though available supply fell, days’ supply held steady throughout August because sales slowed.

2.27M

Total Unsold

Used Vehicles

end of August

38

Days’ Supply

$25,890

Average Listing Price

67,811

Average Mileage

“The lack of supply in the new market is also affecting the used market,” said Cox Automotive Senior Economist Charlie Chesbrough. “Used sales have slowed in recent weeks due in large part to the lack of supply in the new market. Prospective buyers unable to purchase a new vehicle and not trading in their existing vehicle limits the availability of used products at dealers.”

He added: “This situation is likely to persist until the new-vehicle supply crisis passes.”

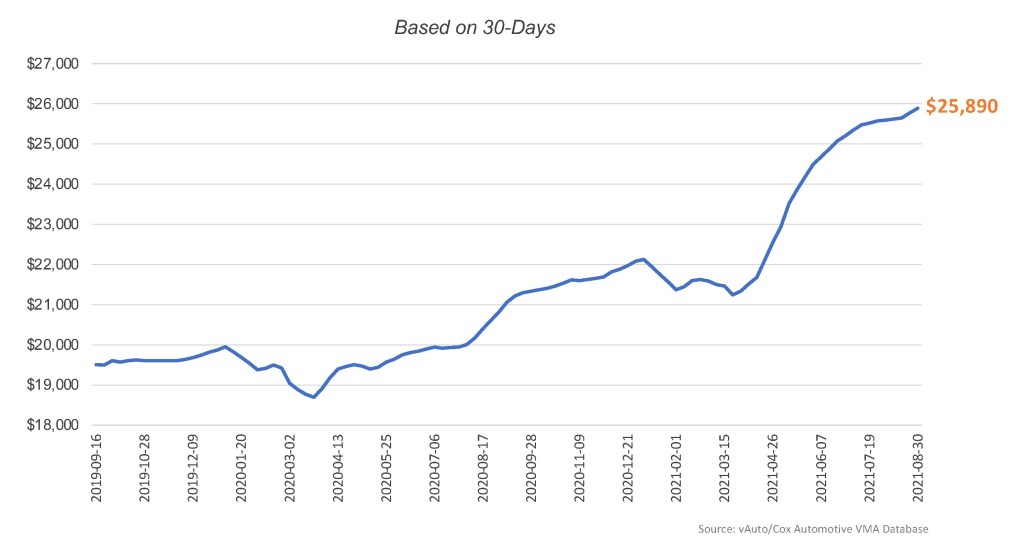

The average listing price for used vehicles hit a record $25,890 at the end of August. The average listing price was 24% higher at the end of August compared with end of August 2020 and 34% higher than the same pre-pandemic period in 2019.

AVERAGE USED-VEHICLE LISTING PRICE

In August 2020, the average listing price surpassed the $20,000 mark for the first time ever. The pace of increase has accelerated since spring with the average listing price rising every week since mid-March.

The total supply of unsold used vehicles on dealer lots across the U.S. slipped to 2.27 million units at the end of August, compared with Cox Automotive’s revised number of 2.40 million at the end of July. Used-vehicle inventory, which had been edging slightly higher, closed August with supply falling back to late-June levels. Used-vehicle supply at the end of August was up .89% from the end of August 2020 but 19% below 2019.

Since end of June, the days’ supply of used vehicles had held steady at around 40. However, days’ supply closed August at 38. The days’ supply at the end of the month was up 3% from 2020 but down 15% from 2019.

The Cox Automotive day’s supply is based on the daily sales rate for the most recent 30-day period, which ended August 30. About 1.77 million used vehicles were sold in that period, down from the 1.78 million sold in July. Compared with August 2020, sales were off 2% and were down 5% from 2019.

The following commentary, while directionally correct, is unrevised from the original publication on Sept. 21, 2021.

Franchised dealers had about 1.35 million vehicles in inventory at the end of August, a drop from 1.45 million at the end of July and June. That caused the days’ supply to fall to 37. The average listing price for used vehicles on franchised dealer lots was $27,802, about $400 more than at the end of July, setting another record. The average mileage of a used car on franchised dealers’ lots was 61,517, a number that has been dipping for the past few months.

Independent dealers had 1 million vehicles in inventory at the end of July, up slightly from July and June. As August closed, days’ supply was 44, close to what it was at the end of July. The average listing price of a used vehicle on independent dealers’ lots was $22,902, up $273 from the end of July for another record. The average vehicle had 77,842 miles on it, down slightly from the past couple of months.

By price segment, used vehicles under $10,000 had the lowest supply at the end of August at only 30 days, the same as July. Vehicles priced between $10,000 and $25,000 had between 34- and 38-days’ supply. Vehicles between $25,000 and $35,000 had a 42 days’ supply. Those costing above $35,000 had the highest supply at 48 days.

For more insights on used-vehicle inventory using a 30-day rolling sales methodology to calculate days’ supply, reach out to the Cox Automotive Public Relations team.

Michelle Krebs is executive analyst at Cox Automotive.