Data Point

Strong Fleet Sales Help Prop Up Slow September

Thursday October 3, 2019

Article Highlights

- Combined rental, commercial, and government purchases of new vehicles were down 7.3% year over year in September.

- Fleet sales are now up 5.8% this year compared to the same nine months in 2018 with all growth coming from rental and commercial fleet channels.

- Fleet SAAR improved to 2.6 million in September, up from 2.5 million a year ago, and we remain on pace for a record year in fleet sales.

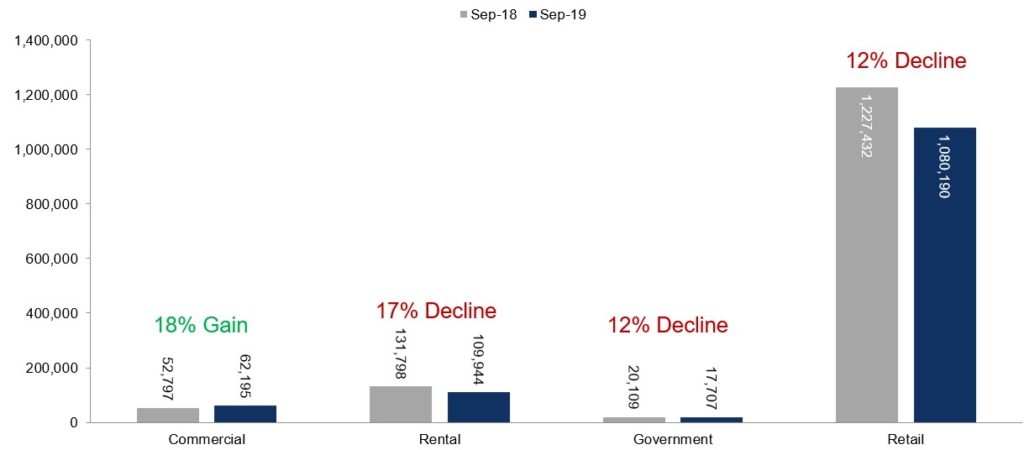

By volume, U.S. auto sales in September were weak, with the overall market down 11% from year-ago levels. One bright spot was fleet sales: Combined rental, commercial, and government purchases of new vehicles were down only 7.3%, beating the overall market. The commercial fleet channel performed particularly well, up 18% year over year in September, most likely continuing to benefit from the 2018 Tax Cuts and Job Act which boosted business purchases of vehicle fleets as well as overall business investment plans.

Nissan was the best-performing large OEM in September as fleet sales increased 18%. Similar brands like Mazda and Subaru had strong gains, though they were off a small base.

Retail sales of new vehicles came in at 1,080,190 units, down 12% in September, leading to a retail SAAR of 14.6 million, down from 14.8 million last September and the weakest retail SAAR over the last three months.

Total fleet sales are up 5.8% in 2019 through September, and retail sales are down 2.5%, as the overall new-vehicle market is down 1.1% this year. Fleet SAAR improved to 2.6 million in September, up from 2.5 million a year ago and 2.1 million in August.

Fleet is 17.4% of the overall new-vehicle market in 2019 versus 16.2% in 2018. As a result, we are still on pace for a record year in fleet sales.