Data Point

Strong Fleet Sales Have Supported New-Vehicle Market This Year, but Growth is Slowing

Wednesday November 6, 2019

Article Highlights

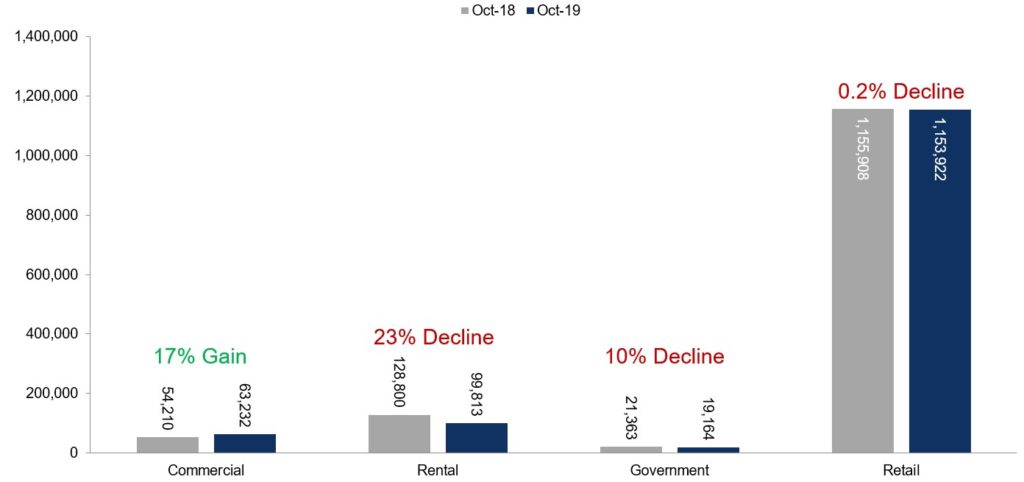

- Combined rental, commercial, and government purchases of new vehicles were down 10.8% year-over-year in October.

- The commercial fleet channel was the bright spot, with sales up 17% year-over-year last month.

- Nissan was the top performing OEM last month with fleet sales increasing 34% year-over-year, with brand’s fleet sales are up 5% year to date through October.

Combined rental, commercial and government purchases of new vehicles were down 10.8% year over year in October. Total fleet volume in October was 182,209, compared to 204,373 in October of 2018. The commercial fleet channel was the bright spot, with sales up 17% year-over-year last month. The other channels declined.

Nissan was the top performing OEM last month with fleet sales increasing 34% year-over-year; fleet sales at Nissan are up 5% year to date through October. According to our analysis of the data, we are estimating that both GM and Toyota saw fleet sales drop more than 40% last month compared to October 2018. Ford, traditionally strong in commercial and government fleet sales, delivered lower fleet sales as well in October. Our team has been expecting fleet sales to slow in Q4 from a red-hot pace through the early part of the year. October seems to indicate slowing has begun.

Through October, fleet sales are up 4.3% and still on course to set an all-time volume record in 2019. Retail sales of new vehicles, on the other hand, were slower in October, down 0.2% from 2018, leading to a retail SAAR of 14.3 million. That is down from 14.9 million last October and the weakest retail SAAR over the last four months. Retail sales are down 2.3% so far in 019, pushing the overall new-vehicle market down 1.2% year-to-date.