Data Point

Incentives in May – and Over Memorial Day Weekend – Dropped as Inventory Waned

Monday June 1, 2020

Article Highlights

- Automotive retail slowly improves, driven by pent up demand and the belief that vehicle ownership is essential, particularly during a pandemic.

- Was Memorial Day weekend a good one for dealers and consumers? The answer is “yes” and “no.”

- Very few new programs were put into the market ahead of the holiday with most makers seeing little reason to push fresh offers when inventory was low and replacement vehicles still weeks, if not months, away.

Signs of an economic recovery are growing as markets slowly reopen and businesses hit the relaunch button. Automotive retail, likewise, continues to slowly improve, driven by pent up demand and the belief that vehicle ownership is essential, particularly in the time of a pandemic.

As we close the books on May, the question our team is asking: Was Memorial Day weekend a good one for dealers and consumers? The answer is “yes” and “no.”

Yes, in that the set of online shopping and transaction tools which dealers have adopted made it possible for interested buyers to shop, select and configure price and payment terms before setting foot in a dealership. And, for many of those interested, take home delivery of a new vehicle. That’s real progress.

No, in that a lack of desirable inventory and a pullback in rebates and financial incentives kept sales volume relatively low. If the market was hoping for a blow-out, pop-the-champagne “We’re Back” type of sales weekend, it didn’t happen over Memorial Day.

The automakers went aggressive with offers in late March, with a broad set of 0% financing, payment deferral and buyer assurance benefits designed to give shoppers the confidence to buy in a market reeling from high unemployment and job uncertainty. The results? A steady increase of sales through April and May. And a steady drop in both inventory and incentive volume.

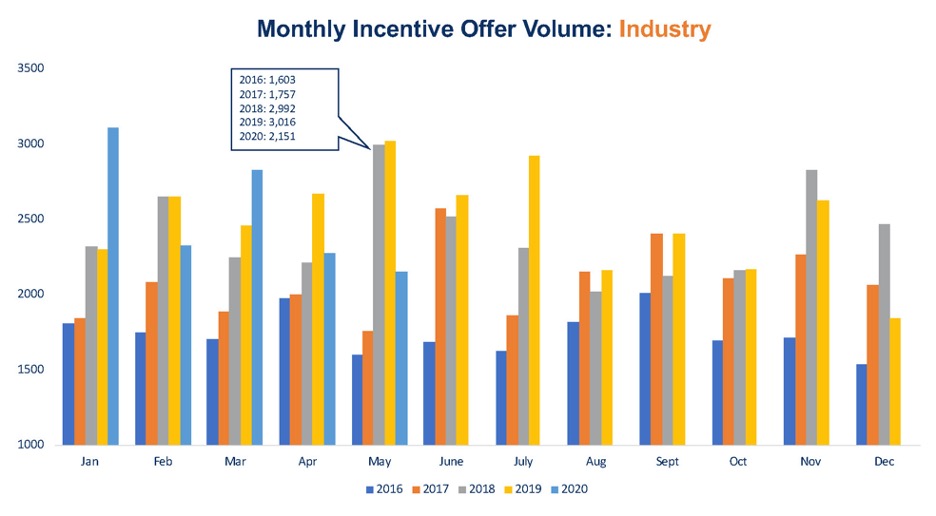

Incentives for new vehicles are a direct reflection of inventory – fewer vehicles available means fewer offers needed to stimulate demand. A quick look at the volume of new-vehicle incentives offers in April and May this year (light blue bar) show a reversal of the trend from the last two years, which saw an uptick in incentive volume.

The volume of incentives – literally a count of the number of different incentive programs in the market in each month – has moved closer to the levels from 2016 and 2017, when demand was strong and new-vehicle sales were less dependent on fresh incentive programs.

Memorial Day weekend traditionally sees the launch of new incentive programs to stimulate the market, driving upward the volume for the month as seen in 2018 and 2019. This year, very few new programs were put into the market ahead of the holiday. Most makers simply held steady, seeing little reason to push fresh offers when inventory was low and replacement vehicles still weeks, if not months, away.