Data Point

Used-Vehicle Supply Rises, Prices Reach All-Time High

Thursday January 21, 2021

Article Highlights

- Used-vehicle supply rose to 55 days.

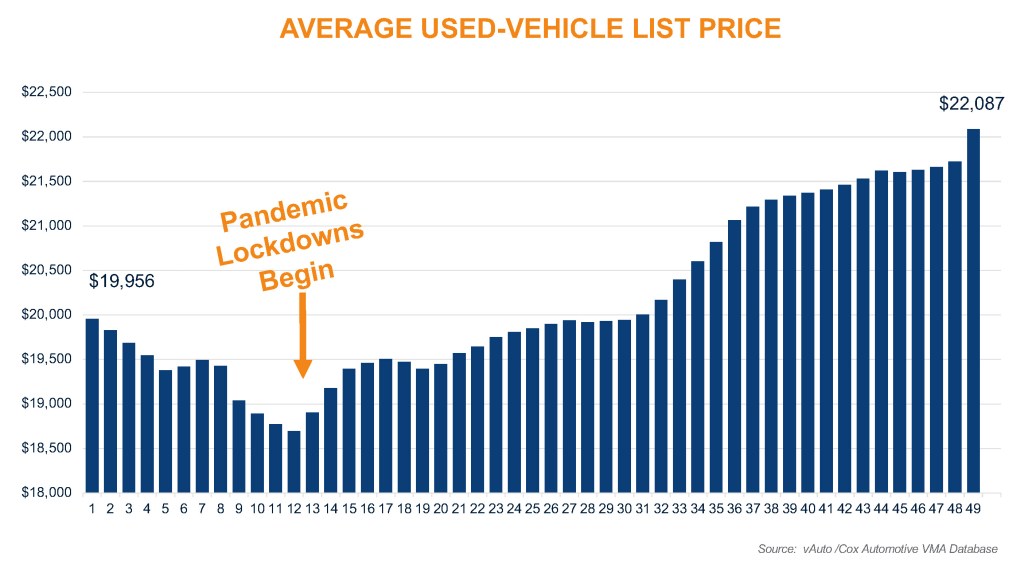

- Average used-vehicle list price sets another record at $22,087.

- Used-vehicle sales pace slowing further.

Used-vehicle inventory and prices climbed throughout December, with the average list price smashing another record, according to a Cox Automotive analysis of vAuto Available Inventory data.

2.68M

Total Unsold Used Vehicles

as of Dec. 1

55

Days’ Supply

$22,087

Average Listing Price

66,387

Average Miles

The total U.S. supply of unsold used vehicles closed December 2020 at 2.68 million vehicles, up from 2.61 million at the end of November 2020 but down from 2.97 million a year ago.

The days’ supply at 55 was up from 51 the month earlier – a level that sustained since the end of October – and slightly above the 53 days’ supply a year ago.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. The pace of used-vehicle sales has shown further weakness, down 14% compared to the year-ago period. The sales pace quickened after the depth of the pandemic, but then began to slow after peaking in July.

The average list price for used vehicles set yet another record at $22,087, breaking the month-earlier record of $21,724. It is the first time the average listing price has surpassed the $22,000 mark. At the depth of the pandemic, the week of March 23, the average list price bottomed out at $18,681. It has been on a steady record-setting rise since then.

“Rising prices are likely to continue in the used-vehicle market, though demand may be undeterred,” said Charlie Chesbrough, Cox Automotive senior economist. “Additional stimulus dollars coupled with limited alternative transportation options is likely to keep interest in used vehicles, and the ability to purchase, elevated throughout 2021.”

Franchised dealers started January with 1.51 million available vehicles, a 50 days’ supply. That was up from 1.48 million available vehicles and 46 days’ supply the month earlier. Independent dealers had an available supply of 1.16 million vehicles, a 61 days’ supply. That’s up from 1.12 million vehicles, a 57 days’ supply, the previous month.

The average listing price for franchised dealers was $23,783, up from $23,276 the month earlier. It was $19,631 for independent dealers, up from $19,294 the previous month.

Once again, the days’ supply was lowest for vehicles listed at under $10,000, which represents a small part of the market. The days’ supply was 43 for that price class. Inventory for vehicles in the other price categories ranged from 52 to 58 days’ supply.

Among mainstream brands, days’ supply were in the same general range. On the low side, though not drastically low, were inventories for Audi, Lexus, GMC, Honda, Subaru and Toyota.

Michelle Krebs is executive analyst at Cox Automotive.