Data Point

Used-Vehicle Prices Open May at All-Time High

Thursday May 20, 2021

Used-vehicle prices hit an all-time high at the opening of May, and supply stabilized though remained well below 2020 and 2019 levels, according to a Cox Automotive analysis of vAuto Available Inventory data.

2.23M

Total Unsold

Used Vehicles

end of April

35

Days’ Supply

$22,568

Average Listing Price

68,063

Average Mileage

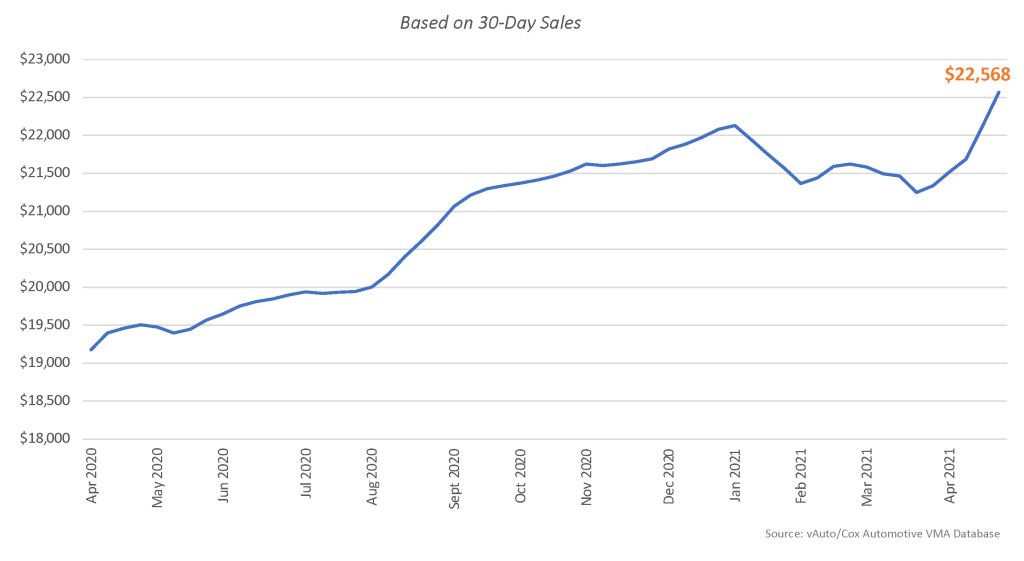

The average listing price surpassed the $22,000 mark for the first time ever in April, closing the month at a new high of $22,568. That compares with $21,343 at the end of March.

Average Used-Vehicle Listing Price

The pace of price increases also sped up. Prices closed April up 16% from a year ago and up 15% from 2019. Last summer, prices surpassed the $20,000 mark for the first time and have been rising ever since.

“Given the strong demand from consumers, and the tight supply situation, it seems likely that used-vehicle prices, already at all-time highs, will continue to rise,” said Charlie Chesbrough, Cox Automotive senior economist. “At some point, prices will become too high, and demand will recede. But we are not there yet.”

The total supply of unsold used vehicles totaled 2.23 million units at the end of April, down from 2.34 million at the end of March, according to the Cox Automotive analysis of vAuto data. While the total supply was in roughly the same range from late March through April, it was still 18% below 2020 and 19% lower than 2019.

The used-vehicle days’ supply ended April at 35, up from 33 days’ supply at the end of March. The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. During April, the sales pace ticked down, lifting the day’s supply metric. Still, days’ supply of unsold used vehicles remained 57% below 2020 and 23% below 2019 at the opening of May.

“The spring bounce we traditionally experience in used vehicles has been especially strong this year, fueled not only by tax refunds as they usually are but also by stimulus checks this year,” said Chesbrough. “The sales pace peaked in mid-April and looks to be slowing.”

Still, sales were running 93% ahead the same period a year ago when the pandemic and subsequent lockdowns hit. They were running 6% ahead of 2019 at the end of April.

Sales over the summer could be slowed further with inventories so low. “Folks can’t buy what isn’t there,” noted Chesbrough.

Franchised dealers had 1.34 million vehicles in inventory at the end of April, up a tad from 1.33 million at the end of March. That put the days’ supply at 34, up from 31 a month earlier. Used vehicles in franchised dealers’ inventory saw a big bump in price. The average listing price hit a new high of $24,348, up from $23,270 a month earlier.

Independent dealers have struggled to obtain vehicles to sell, and it showed in the end-of-April numbers. Their available inventory fell from 1.01 million vehicles at the end of March to 937,934 vehicles at the end of April. The average listing price was $20,034, up from $18,802 at the end of March.

The average number of miles on used vehicles in inventory rose, after holding steady for many months. The overall average was 68,063 miles, after hovering in the 66,000-mile range for months. The average miles on used vehicles on franchised dealers lots was 62,255. Vehicles on independent lots had much higher mileage at an average of 76,956.

Used vehicles priced below $10,000 again had the lowest inventory at 25 days’ supply, up from 23 the previous month. Days’ supply for vehicles priced at over $35,000 had the highest days’ supply at 42. The price categories in between had days’ supply ranging from 32 to 39.

More insights are available from Cox Automotive on used-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.

Michelle Krebs is executive analyst at Cox Automotive.