Data Point

New-Vehicle Inventory Volume Drops in August, Days’ Supply Stabilizes

Wednesday September 15, 2021

Article Highlights

- Inventory remains low but days’ supply has held steady as sales slowed.

- Average listing price set another record, but the pace of increase is moderating.

- Toyota, Kia, Lexus and Honda, respectively, had the lowest inventories.

Revised Oct. 14, 2021 – The total volume of new-vehicle inventory declined again in August, as automakers continue to struggle with production due to the computer chip shortage, according to a Cox Automotive analysis of vAuto Available Inventory data. The days’ supply has been holding steady over the past month.

1.01M

Total Inventory

as of Aug. 23, 2021

29

Days’ Supply

$42,392

Average Listing Price

The total U.S. supply of available unsold new vehicles stood at 1.01 million vehicles as August closed. That was down from 1.11 million vehicles in late July, but recent data reviews show supply inching higher but mostly because sales are slowing significantly. Our official September inventory count will be released in mid-October.

Still, inventories remain historically low, running about 57% below a year ago, according to a Cox Automotive analysis. In raw numbers, supply is down about 1.4 million units from the same time in 2020 and more than 2.5 million units below the 2019 level.

The days’ supply of unsold new vehicles was 29 as September opened.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. New-vehicle sales have been losing momentum since June. The August sales pace, or seasonally adjusted annual rate (SAAR), dropped to 13.1 million, down from 14.8 million in July. By comparison, first-half sales were running at a blistering 17 million pace.

The following commentary, while directionally correct, is unrevised from the original publication on Sept. 15, 2021.

Non-luxury inventory again fell well below 1 million vehicles near the end of August for a 30 days’ supply. Luxury vehicle supply fell to just under 163,000 units at the close of the month from about 190,000 units the month earlier.

“New-vehicle inventory is stabilizing a bit,” said Cox Automotive Senior Economist Charlie Chesbrough. “Days of supply has been holding steady because sales have slowed to such a pace that low supply is not being drawn down as rapidly.”

Added Chesbrough: “It is hard to see the situation changing in the near term as many automakers have made announcements of additional production cuts of late.”

Most notably Toyota announced it was slashing global production by 40% for September and recently stated it would also slash October’s planned production by the same amount.

Prices Climb at a Slower Rate

As September opened, the average listing price for new vehicles set another record. It rose to $42,450, up from $41,840 a month earlier. That puts it 10% higher than year-ago levels and 16% higher than 2019. The non-luxury average listing price was $39,182 as August closed, up from $38,483 a month earlier. For luxury vehicles, the average listing price was $62,012, up from $60,069.

It’s a fundamental economic principle that high demand and low supply result in rising prices. In addition, August and September typically are months when automakers and dealers try to sell down old inventory at greatly discounted prices to make room for the new model year products. This year, however, there is no old, discounted inventory to pull down the average price.

Across the price spectrum, the days supply for vehicles under $20,000 was lowest at 21 followed by the $20,000 to $30,000 category at a 24 days’ supply and 27 days’ supply for the $30,000 to $40,000 category. Higher priced segments were 30 days’ supply and higher.

Toyota, Honda Have Lowest Supply

Despite relentlessly low supply, Toyota had been largely spared from massive production cuts earlier in the year. But that ended as fall approached when the Japanese automaker announced it would cut 40% from planned global production schedules for September and October.

Toyota closed August with 19 days’ supply. Lexus was at 21. Their high-volume models got hit hard. Lexus’ volume-leading RX SUV had a scant 14 days’ supply as September opened. At Toyota brand, the CH-R had about the lowest days’ supply of any model at 9. Other Toyota volume models – Camry, Corolla, Highlander, Prius, RAV4 and Tacoma – had days’ supply in the teens. Toyota is building up its supply of the full-size Tundra pickup which is launching now in a redesigned form.

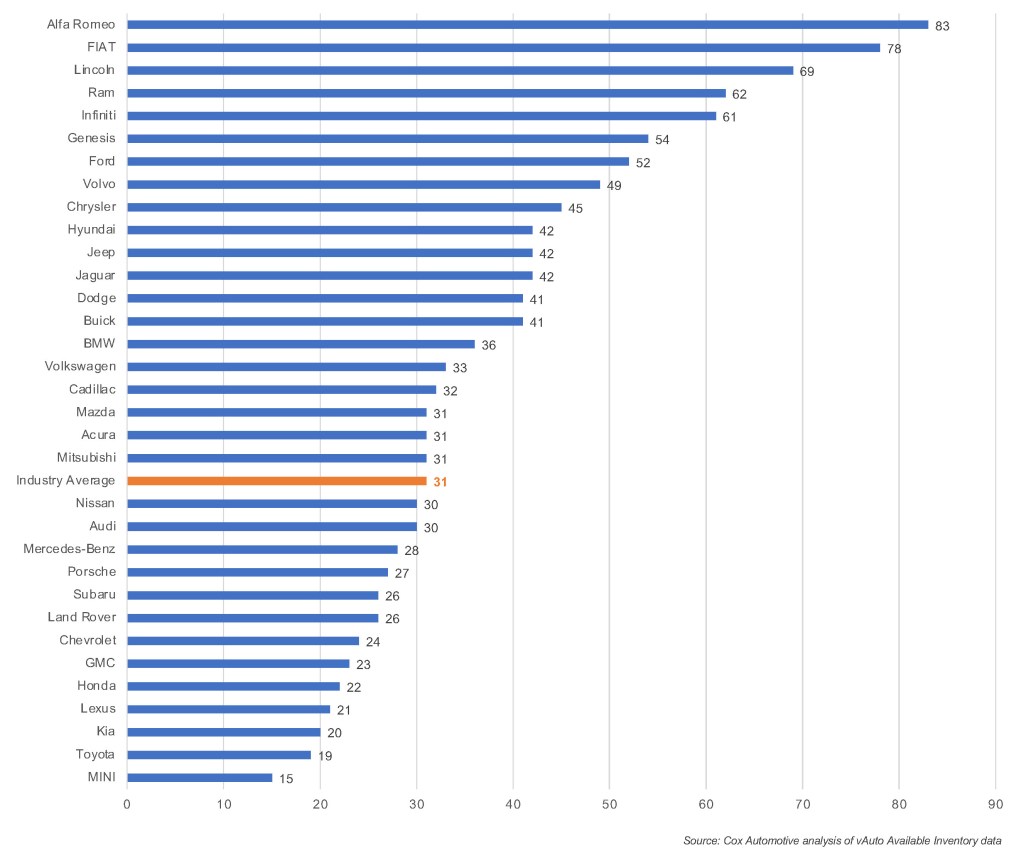

National Days’ Supply by Brand

The Honda brand was in the same position with a days’ supply of 22. The Civic, CR-V and Ridgeline had 17 days’ supply or less. Accord had only slightly more at about 24 days’ supply. Civic, CR-V and Accord account for the bulk of Honda brand sales.

Kia fell between Toyota and Honda in the inventory rankings with only 20 days’ supply. The new Carnival minivan and Telluride SUV each had a skimpy 16 days’ supply.

Last week, GM warned investors that sales and production declines would be worse than expected in the second half, off 200,000 units – double what GM told investors in July – due to Southeast Asia supply chain issues. Its GMC and Chevrolet brands took the brunt with days’ supply even lower than Subaru.

More insights are available from Cox Automotive on new-vehicle inventory, using a 30-day rolling sales methodology to calculate days’ supply.