Data Point

Used-Vehicle Supply Rises; Average Listing Price Dips From Record Levels

Thursday February 17, 2022

Article Highlights

- Available used-vehicle inventory climbed, above a year ago, on weaker sales.

- Days’ supply climbed to 56, its highest since late 2020.

- The average used-vehicle listing price dipped below $28,000 from December’s high.

Revised March 17, 2022 – Used-vehicle inventory climbed during January to more normal levels on weaker sales, according to the Cox Automotive analysis of vAuto Available Inventory data. The average list price dipped from record levels in December.

2.55M

Total Unsold

Used Vehicles

as of January 31

55

Days’ Supply

$27,606

Average Listing Price

71,117

Average Mileage

The total supply of unsold used vehicles on dealer lots across the U.S. climbed to 2.55 million units at the end of January, compared with Cox Automotive’s revised number of 2.38 million at the end of December. The supply at the end of January was about 1% above a year ago.

At the end of January, the days’ supply of unsold used vehicles was 55, up from the revised number of 51 at the end of December. Days’ supply began dropping last January, bottoming out at 30 in April and inching its way higher ever since. The days’ supply at the end of January was 26% above the level of the previous year.

The Cox Automotive days’ supply is based on the daily sales rate for the most recent 30-day period. Used-vehicle sales in January were down 19% from January 2021 and down 20% from January 2020. The January used seasonally adjusted annual rate (SAAR) was 32.0 million, down from 39.3 million in January 2021 and up from 36.2 million in December.

“Used vehicles are starting to see some inventory build-up ahead of the prime selling season as tax refunds come in,” said Charlie Chesbrough, Cox Automotive senior economist. “The inventory volume and days’ supply are both above last year, though sales remain low. Spring should see strong demand.”

However, he added, high prices could mute sales. The average used-vehicle price is still high even though it is down from recent peaks and should fall slightly in the coming weeks as it normally does after the holidays.

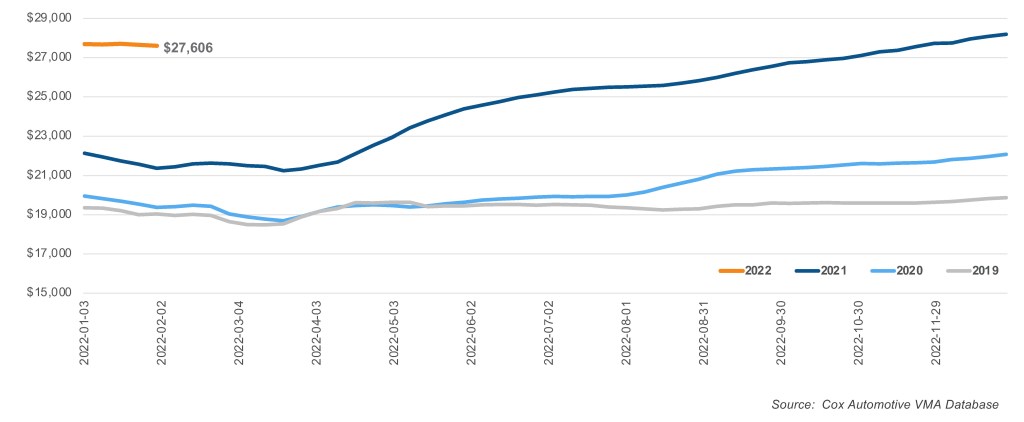

At the end of January, the average listing price had fallen below peak levels to $27,606 when it had been above $28,000, according to Cox Automotive data. Still, the average listing price was 29% above the end of January 2021.

Average Used-Vehicle Listing Price

On the wholesale side, the Manheim Market Report (MMR) values saw weekly price decreases in January that accelerated slightly in the final full week of the month. However, price patterns in the month varied by vehicle age and segment. Older vehicles saw price stability while newer vehicles leaned toward larger declines.

The lowest price segments – under $15,000 – had the lowest inventory and lowest days’ supply at under 40. Price segments from $25,000 and up had the biggest supply in both volume and days’ supply – between 61- and 69-days’ supply. In between segments had between 49- and 57-days’ supply.

For more insights on used-vehicle inventory using a 30-day rolling sales methodology to calculate days’ supply, reach out to the Cox Automotive Public Relations team.

Michelle Krebs is executive analyst at Cox Automotive.