Data Point

Kelley Blue Book Report: New-Vehicle Prices Hold Steady in March As Sales Increase Ahead of Anticipated Tariff-Driven Price Hikes

Wednesday April 9, 2025

Article Highlights

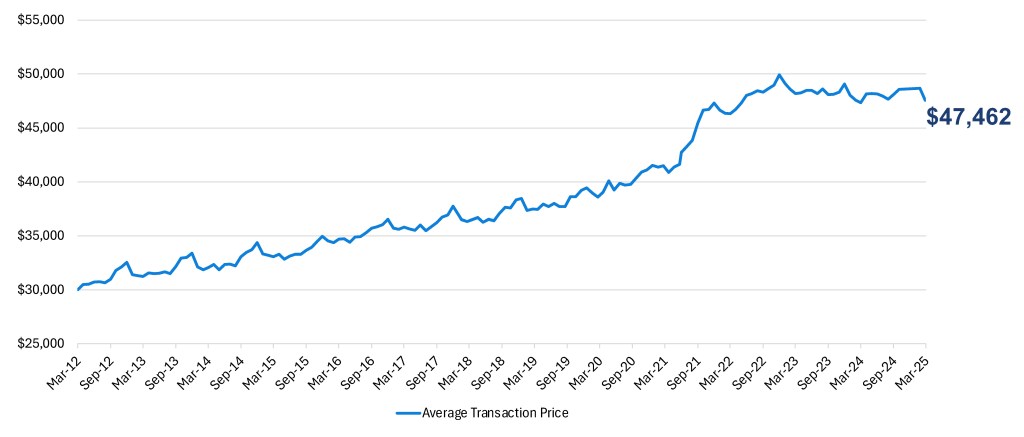

- The estimated March new-vehicle ATP from Kelley Blue Book was $47,462 In March, down slightly from the revised-lower ATP of $47,577 in February.

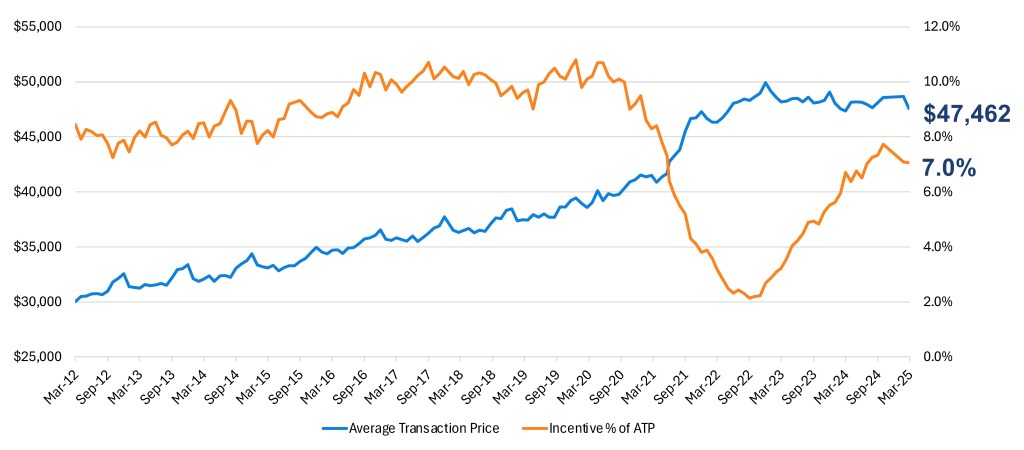

- Sales incentives in March were flat compared to February at 7.0% of ATP, but higher by 5% than year-ago levels when incentives were equal to 6.7% of ATP.

- New electric vehicle prices in March are initially estimated by the team to be $59,205, higher year over year by 7.0%.

The monthly new-vehicle average transaction price (ATP) report from Cox Automotive’s Kelley Blue Book was released today. Key takeaways from March include:

- New-vehicle ATP held mostly steady month over month and year over year in March at $47,462, down slightly from the revised-lower ATP of $47,577 in February. In March, new-vehicle ATPs were higher year over year by less than 1%.

- Sales incentives in March were flat compared to February at 7.0% of ATP, but higher by 5% than year-ago levels when incentives were equal to 6.7% of ATP. For a year now, new-vehicle incentives have averaged near 7.1% of ATP; incentives during the past 12 months peaked in November and December of 2024 at 7.9% of ATP. Last month, the average incentive package was $3,339.

- In March, only 26 models had ATPs below $30,000, accounting for roughly 14% of total U.S. sales. Vehicles priced below $30,000 are highly vulnerable to the new tariff policy adopted by the White House. Many vehicles in the category are assembled outside the U.S. and are now subject to 25% tariffs. These include well-known models such as the Buick Envista, Chevy Trax, Honda HR-V, Kia Soul, Mazda3 and Nissan Sentra, and the now-discontinued Mitsubishi Mirage – the only vehicle in the U.S. with an ATP under $20,000.

- While transaction prices and incentives held mostly steady in March, sales roared. According to Kelley Blue Book estimates, new-vehicle sales in March topped 1.59 million units, the best sales volume month in nearly four years. Sales in March were nearly 30% higher than in February, as many consumers rushed to buy vehicles before the expected tariff-driven price hikes took hold.

- Among core, volume brands, most showed price increases year over year in March, with Infiniti, Lincoln, Mazda, Porsche and Volvo all leading the way. Average transaction prices of Infiniti (up 18.9%) and Porsche (up 11.5%) were up the most year over year in March. Jeep (-10.6%), Ram (-5.8%) and Mercedes-Benz (-4.7%) all had lower ATPs year over year in March.

- In segments with significant sales, incentive spending in March was highest in the Luxury Car segment, followed by Compact SUVs and Full-Size Pickups. Shoppers looking for good deals in March were likely most disappointed in the Small/Midsize Pickup segment (average incentives at 4.6% of ATP), Luxury Full-Sized SUV (4.5%), Full-Size SUV (3.8%), and High-Performance Car (2.6%) segments.

NEW-VEHICLE AVERAGE TRANSACTION PRICE

Quote from Erin Keating, Executive Analyst, Cox Automotive

“All signs point to higher prices this summer, as existing ‘pre-tariff’ inventory is sold down to be eventually replaced with ‘tariffed’ inventory. How high prices rise for consumers is still very much to be determined, as each automaker will handle the price puzzle differently. Should the White House posture hold, our team is expecting new vehicles directly impacted by the 25% tariff to see price increases in the range of 10-15%. In addition, considering the market dynamics, we also anticipate seeing at least a 5% increase in prices of vehicles not subjected to the full 25% tariff. There is no way around it: Tariffs are going to push new-vehicle prices higher in the U.S.”

INDUSTRY AVERAGE TRANSACTION PRICE VERSUS INDUSTRY AVERAGE INCENTIVE SPEND AS % OF ATP

Electric Vehicle Prices Continue to Climb in March; Incentive Spending Declines From February Highs

- New EV prices in March are initially estimated by the team to be $59,205, higher year over year by 7.0%. New EV prices increased from the revised-higher February ATP of $57,015.

- Compared to the overall industry ATP ($47,462), EV ATPs in March were higher by nearly 25% as the gap between new ICE and new EV grows wider.

- EV incentives continued to range far above the industry average. In March, the average incentive package for an EV was 13.3% of ATP, down from the revised 14.3% in February.

- Tesla ATPs in March are estimated at $54,582, higher year over year by 3.5% and higher also than in February. ATPs for Tesla’s two core models – Model 3 and Model Y – were higher month over month and year over year in March. Tesla’s sales in Q1 continued their long-term decline after peaking in Q1 2023. Estimates from Kelley Blue Book suggest Tesla’s sales in Q1 2025 were lower year over year by more than 8%.