Data Point

New-Vehicle Affordability Sees Modest Rebound in June After Tariff-Driven Decline

Tuesday July 15, 2025

New-vehicle affordability improved slightly in June, reversing some of the deterioration following the announcement of new tariffs, according to the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

“Tariffs remain a major headwind for vehicle affordability,” said Cox Automotive Chief Economist Jonathan Smoke. “Even with some trade relief, the added cost – up to $5,700 per imported vehicle – hits the most affordable models hardest, limiting options for price-sensitive buyers. We are in the early stages of seeing how manufacturers deal with these added costs, but we do not believe that the American consumer can absorb it all.”

The estimated average auto loan rate increased in June by 5 basis points to 9.94%1, which was lower year over year by 75 basis points but at the highest level since December. According to Kelley Blue Book, the average new-vehicle price increased 0.2% for the month. Income growth remained relatively strong at 3.3% year over year. Higher incentives and higher incomes helped to mitigate the impact of higher prices and higher interest rates on new auto loans.

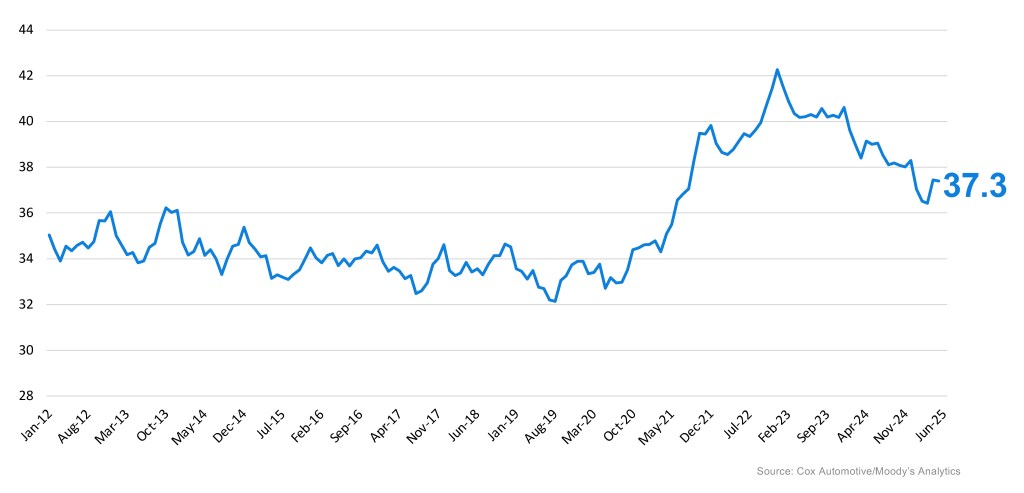

In June, the typical payment increased by 0.1% to $757, marking the highest monthly payment since December, despite a 1.4% year-over-year decline. The number of median weeks of income needed to purchase the average new vehicle declined to 37.3 weeks in June from 37.4 weeks in May. The average monthly payment peaked at $795 in December 2022.

COX AUTOMOTIVE/MOODY’S ANALYTICS VEHICLE AFFORDABILITY INDEX

June 2025

Weeks of Income Needed to Purchase a New Light Vehicle

New-vehicle affordability in June was better than a year ago, when it took 39.1 weeks of media income to purchase the average new vehicle, which was 4.5% higher. A year ago, prices were 1.2% lower, but interest rates were higher. Incomes and incentives were also lower in June 2024.

Click here for the full methodology for the Cox Automotive/Moody’s Analytics Vehicle Affordability Index.

The next update of the Cox Automotive/Moody’s Analytics Vehicle Affordability Index will be published on Aug. 15, 2025.

1 The index input of the average interest rate paid by consumers is calculated to reflect a 72-month, fixed-rate loan. For the latest Dealertrack estimated, volume-weighted average new loan rate, visit the Auto Market Snapshot.

The Cox Automotive/Moody’s Analytics Vehicle Affordability Index (VAI) is updated monthly using the latest data from government and industry sources, including key pricing data from Kelley Blue Book, a Cox Automotive brand. This important industry measure will be released at mid-month to indicate if the prices paid for new vehicles are moving out of consumers’ financial reach or becoming more affordable over time.