Data Point

Auto Credit Access Climbs for Third Straight Month in July, Driven by Higher Approvals and Competitive Rates

Friday August 8, 2025

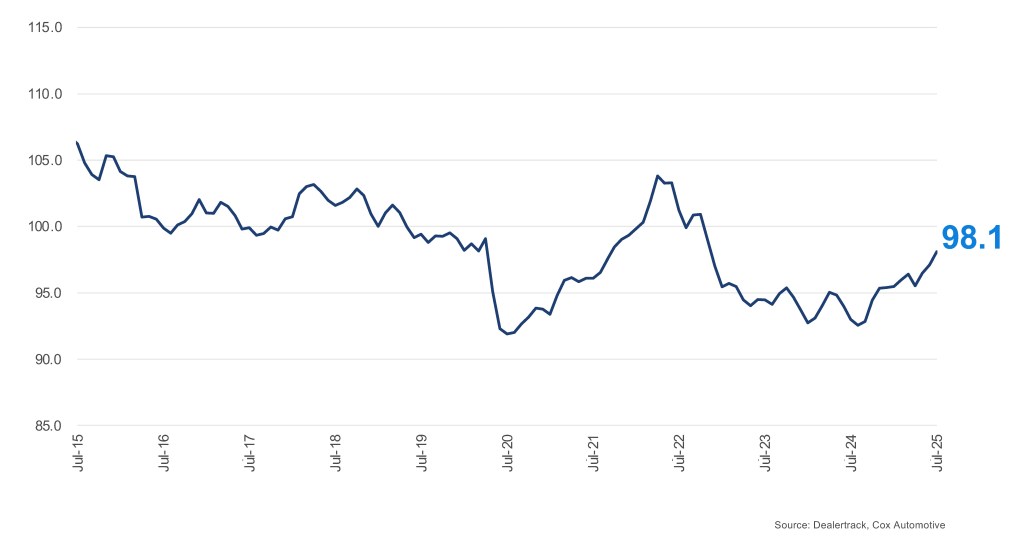

In July 2025, the Dealertrack Credit Availability Index continued its upward trend, reflecting a third consecutive month of improved credit access. The All-Loans Index rose to 98.1, up from 97.1 in June, marking a 1.0-point increase month over month. This extends the broader run of loosening credit conditions that began in late summer 2024. The only notable interruption in this trend was in April, likely driven by market uncertainty following tariff announcements, which temporarily tightened access.

Dealertrack Credit Availability Index

Auto loan access was up in July and up year over year

All Auto Loans Index (Jan 2019 = 100)

Key Metrics

- Approval Rates: The approval rate for auto loans rose to 74.4%, up from 72.3% in June – a gain of 210 basis points (BPs). This strong gain reflects lenders’ confidence in borrower profiles and heightened competition for volume.

- Subprime Share: The share of loans issued to subprime borrowers decreased by 50 basis points to 13.6% from 14.1% in June, indicating a move toward lower-risk lending practices despite a general easing of credit standards.

- Yield Spread: The yield spread narrowed by 35 BPs, driven by a 36-basis-point drop in the average contract rate, which fell from 11.23% to 10.87%. The 5-year Treasury yield also declined slightly, from 3.96% to 3.95%. This suggests lenders are offering more competitive rates as rate pressure eases.

- Loan Term Length: The share of loans with terms greater than 72 months decreased by 60 BPs, potentially reflecting a shift toward shorter-term financing or tighter affordability constraints.

- Negative Equity Share: The proportion of borrowers with negative equity fell by 70 BPs, which is still the second highest level observed in the index. Those who previously relied on rolling negative equity into new loans may face tighter constraints.

- Down Payment Percentage: The average down payment percentage declined by 20 BPs, the lowest since November 2022. A decline in average down payment percentage reduces upfront costs, expanding access to credit for budget-conscious consumers.

Channel and Lender Trends

- Channels: Credit access improved across all sales channels in July. The largest gains were seen in the independent used segment, followed by all used and all new. Only certified pre-owned (CPO) saw a slight decline, which could be driven by tight supply.

- Lender Types: Lender performance was mixed. Auto-focused finance companies showed the most significant loosening, followed by captives and banks. In contrast, credit unions tightened slightly, possibly reflecting more conservative underwriting or portfolio adjustments.

Year-Over-Year Comparison

Compared to July 2024, credit access was looser across most channels and most lender types:

- Channels: The most notable year-over-year improvements were in non-captive new and franchised used, indicating stronger credit availability in both new and used vehicle segments. Independent used also improved, though more modestly.

- Lender Types: Banks and auto-focused finance companies led the year-over-year loosening, while credit unions also improved. Captives, however, showed a slight decline, suggesting a more cautious stance compared to a year ago.

Implications for Consumers and Lenders

- Consumers: The continued improvement in credit access, especially in used and non-captive new vehicle segments, offers more financing opportunities. The drop in down payments and contract rates may enhance affordability. However, consumers should remain mindful of shorter loan terms and stable negative equity levels when evaluating loan offers.

- Lenders: The mixed performance across lender types reflects varying risk appetites and strategic priorities. Finance companies, captives, and banks appear to be expanding access, while credit unions are slightly more conservative. As credit conditions evolve, lenders must balance growth with prudent risk management, especially amid shifting rate environments and consumer behavior.

Overall, the July Dealertrack Credit Availability Index reflected a continued loosening in auto credit conditions, supported by broader lender participation and easing rate pressures. Credit access improved across all sales channels and most lender types, with finance companies and captives leading the expansion. Consumers benefited from slightly lower borrowing costs and increased approval rates, while lenders balanced growth with cautious adjustments to risk exposure. finance companies and captives leading the expansion. Consumers benefited from slightly lower borrowing costs and increased approval rates, while lenders balanced growth with cautious adjustments to risk exposure.

The Dealertrack Credit Availability Index tracks six factors that affect auto credit access: loan approval rates, subprime share, yield spreads, loan term length, negative equity and down payments. Reported monthly, the index indicates whether access to auto credit is improving or declining. This typically means that it is cheaper and easier for consumers to obtain a loan or more expensive and harder. The index is published around the 10th of each month.

Jonathan Gregory

Jonathan Gregory is a Senior Manager on Cox Automotive’s economic and industry insights team, which works to find actionable insights for the industry posed by Cox Automotive clients. Jonathan works with the Sales, Finance, and Data Science organizations and creates innovative solutions often combining proprietary data from other Cox Automotive brands. Jonathan joined Cox Automotive in 2022.