Data Point

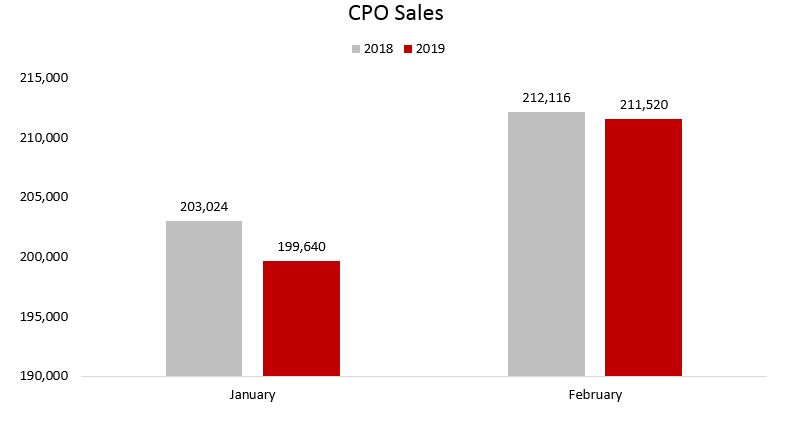

2019 CPO Sales Off to Sluggish Start

Wednesday March 13, 2019

Sales of certified pre-owned sales are off to a slow start in 2019. Sales are down 1 percent year-to-date compared to the same time last year, according to Cox Automotive. Much of the weakness has been driven by a sluggish January where sales were down 2 percent.

Even with the slow start, Cox Automotive is forecasting CPO sales to come in at roughly 2.75 million units this year, which would be another record year. CPO sales are being driven by favorable supply as well as strong used retail demand. As new-vehicle transaction prices keep going up, affordability pushes more consumers into the used-vehicle market, particularly these gently-used, high-content vehicles. Analysts at Kelley Blue Book reported on March 1 the estimated average transaction price for a light vehicle in the United States was $36,590 in February 2019. New-vehicle prices increased $993 (up 2.8 percent) from February 2018, while decreasing $205 (down 0.5 percent) from last month.