Data Point

2020 Was a Breakout Year for New Form Online Retailers

Wednesday March 3, 2021

Article Highlights

- The latest study saw a significant rise in the number of shoppers visiting “New Form Online Retailers” — online used-vehicle outlets such as Carvana, Shift and Vroom.

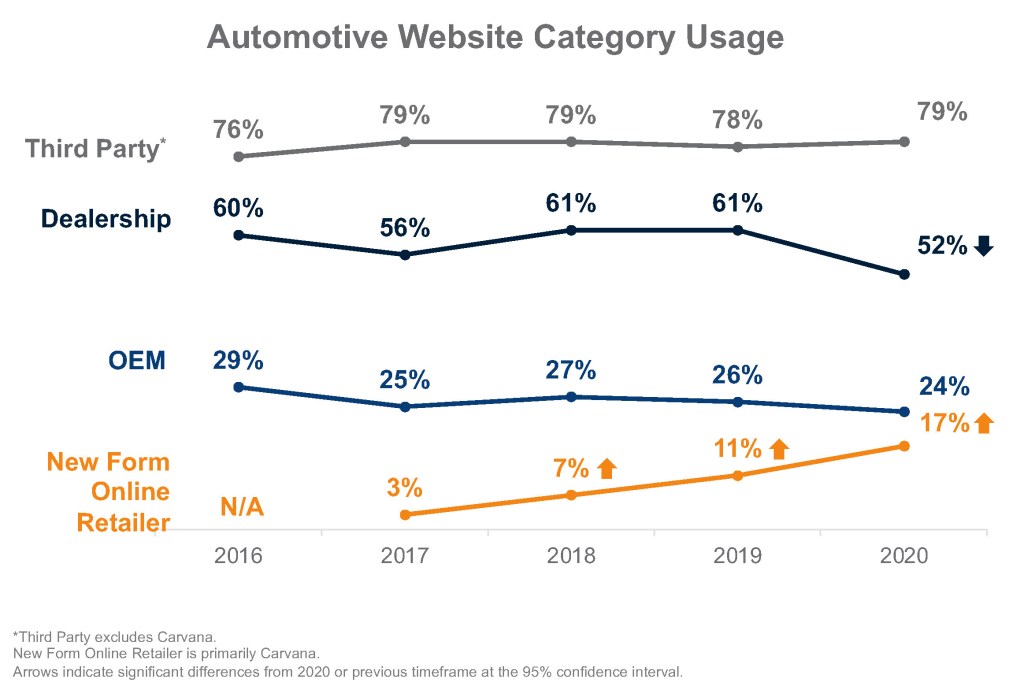

- The percentage of vehicle buyers visiting a New Form Online Retailer website in 2020 was 17%, up from 11% in 2019 and only 3% in 2017.

- After many years of consumers wanting a better car buying process, the pandemic accelerated changes in auto retailing and revolutionized the buying process across the board — at all dealerships, not just the rapidly growing NFORs.

For 11 years now, the Cox Automotive Research & Market Intelligence team has been tracking the journey of car buyers, a winding road roughly 50 million Americans take every year as they set out to buy a vehicle, either new or used. The study, which has evolved over the past decade, is designed to provide a comprehensive look at the vehicle buying process in America, from the earliest research to signing the paperwork and driving home. Our most recent study, the Cox Automotive Car Buyer Journey (CBJ): Pandemic Edition, was released last week.

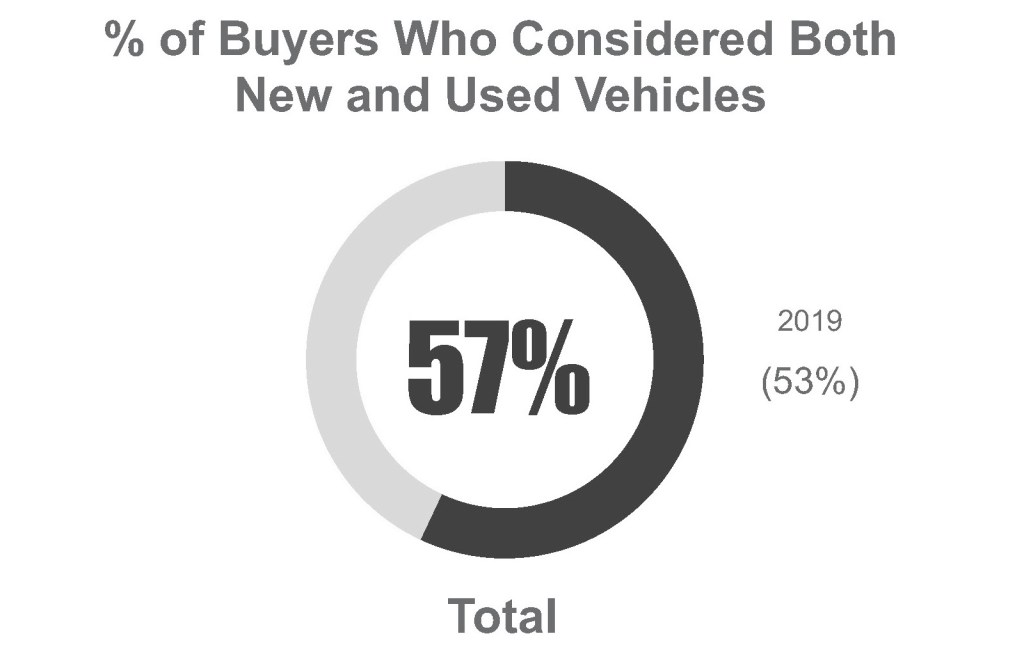

There are a number of interesting takeaways from the latest report, including a significant rise in the number of shoppers visiting what the team labels “New Form Online Retailers” (NFORs) – online used-vehicle outlets such as Carvana, Shift and Vroom. The NFORs are clearly promising what consumers want, and they are catering to a majority of vehicle buyers in America. According to the CBJ study, 57% of vehicle buyers looked at both new and used vehicles last year, up from 53% in 2019. The growing interest in used vehicles stems in part from tight new-vehicle inventory and the negative economic impact the COVID-19 pandemic has had on many households.

With strong interest in used vehicles, it should come as no surprise that these new online retail operations are expanding their reach, finding more visitors on their sites and delivering more sales. Their business models are built on the promise of a completely digital transaction – a “click-to-buy” experience that is relentlessly promoted. And the appeal is working: 17% of vehicle buyers visited a New Form Online Retailer website in 2020, up from 11% in 2019 and only 3% in 2017, while the number of visits to dealership and OEM websites dropped. Third-party sites such as Autotrader.com and Kelley Blue Book’s KBB.com, both Cox Automotive sites, and competitors Cars.com, Edmunds, and CarGurus, continue to hold steady as the most popular online destination for vehicle shoppers.

Carvana, the largest, most established NFOR, had sales of more than 244,000 units in 2020 while newcomers Shift and Vroom posted double-digit volume growth last year. The NFORs are not yet profitable, as their efforts are focused on volume growth, but in terms of consumer awareness and shopping traffic, 2020 was a breakthrough year for many New Form Online Retailers.

According to their online marketing pitches, Carvana offers “The New Way to Buy a Car” and Vroom provides the opportunity for shoppers to “Buy A Car Entirely Online.” And that is a promise that is appealing to consumers. The NFORs, however, are not the only ones shifting the auto buying landscape. In fact, automobile retailing is shifting in general and, according to the 2020 CBJ study, car buyers are benefitting from a more flexible, personalized and streamlined purchase process.

Car buyers in 2020, thanks to more dealers moving more steps of the purchase process online, reported spending less time on the process and demonstrated record levels of satisfaction. Some even reported buying completely online. Importantly, vehicle buyers who did the most steps online were the most satisfied buyers. And those same satisfied buyers will be expecting to move through the process with more steps online when they return to the market a few years down the road.

Last year was a tipping point for automobile retailing. In this transformed world, consumer behavior and demand forced dramatic changes from automotive dealerships, such as rethinking retail operations and embracing technology and innovation. In addition to driving more efficiency into the purchase process by digitizing more steps, more dealers began offering home services such as virtual vehicle walkarounds, test drives at home and vehicle delivery which includes the option of completing the final paperwork wherever consumers are located. After many years of consumers wanting a better car buying process, the pandemic accelerated changes in auto retailing and revolutionized the buying process across the board – at all dealerships, not just the rapidly growing NFORs. If customer satisfaction is the ultimate measure, the car buying journey is changing for the better.