CAMIO

New-Vehicle Supply Finally Recovers

Wednesday June 7, 2023

The impact of the global chip shortage on vehicle production and, subsequently, on inventory began to wane in the U.S. by the end of 2021 and progressively improved throughout 2022 and into 2023.

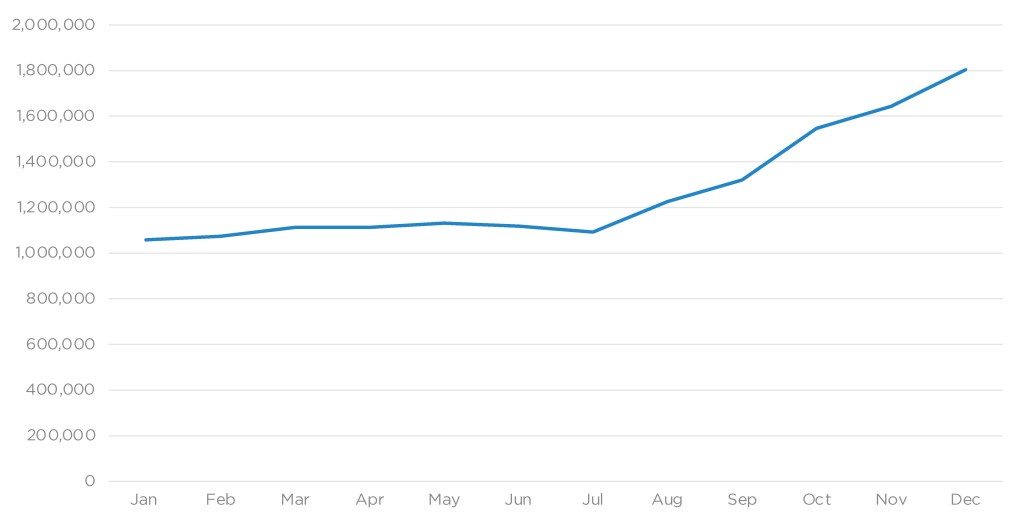

In mid-December 2021, the U.S. supply of unsold new vehicles finally surpassed the 1-million mark, a first since the chip shortage started, according to Cox Automotive’s analysis of vAuto Available Inventory data. September 2021 saw the worst fallout from the chip shortage that massively disrupted production globally as U.S. new-vehicle supply fell to a historic low of under 830,000 units.

By mid-January 2022, the U.S. supply of available new vehicles started climbing, staying just above 1 million units until summer. Still, that was 60% – or 1.6 million units – below January 2021 and 2.2 million less than on the eve of the pandemic in January 2020.

In March 2022, the supply of small, fuel-efficient cars, SUVs, and hybrids plummeted due to high demand and low output. Consumer shopping and buying soared for those models as gas prices spiked. The mostly Asian auto companies that make fuel sippers struggled with production disruptions caused by shortages of chips and other parts, as well as COVID-19 outbreaks in Southeast Asia that slowed manufacturing.

The percentage of inventory levels versus the year earlier began narrowing in late spring. July 2022 marked the first month that the percentage turned positive. Inventory was higher than the same month a year earlier and stayed positive for the rest of the year.

Vehicle assembly picked up significantly, especially for domestic automakers, with few hiccups. Supply mounted. By fall, all automakers were showing increases in inventory. However, Asian automakers still had skimpy supplies.

Throughout the year, affordable vehicles popular with budget-minded consumers had the lowest supply as automakers focused their resources on higher-priced models. Full-size and luxury cars consistently had the highest inventories, while buyers opted for SUVs instead of traditional cars.

The brands with the lowest inventory were the same throughout the year, though the order changed slightly from month to month. Non-luxury brands like Kia, Honda, Toyota and Subaru had the lowest inventories throughout 2022. Lexus was consistently at the bottom among luxury brands with the lowest inventory. Land Rover, Porsche, BMW and Mercedes-Benz occasionally found themselves at the low end.

On the opposite end of the inventory spectrum, Stellantis brands, most notably Jeep and Ram, had the highest inventories. Luxury brands at the high end generally included Buick, Jaguar, Infiniti and Lincoln.

The average listing price in January 2022 retreated from the December peak, dipping below $45,000, according to Cox Automotive’s analysis of vAuto Available Inventory data. The average listing price bounced around some throughout the year but generally trended higher. By the end of December, the average listing price was approaching $48,000.

As 2022 drew to a close, new-vehicle inventory was actually stacking up for some brands, specifically Detroit brands and full-size pickup trucks, indicating some automakers could be forced to bring back incentives to spur sluggish sales and draw down supply in the new year. By year-end, the total U.S. new vehicle supply amounted to 1.8 million units, flirting with the 2-million-unit mark for the first time since April 2021.

2022 New-Vehicle Inventory Volume

Outlook: January 2023 opened with nearly 1.8 million vehicles in inventory, according to Cox Automotive’s analysis of vAuto Available Inventory data. Despite surprisingly brisk sales, inventory at the end of the first quarter of 2023 hit its highest level in two years at 1.9 million vehicles. Cox Automotive forecasts that production will continue to improve in 2023, and supply will keep building, with some brands requiring incentives to draw down an overabundance of new unsold vehicles.