Data Point

Aggressive Incentive Spending Helps First-Half Auto Sales

Monday June 29, 2020

Article Highlights

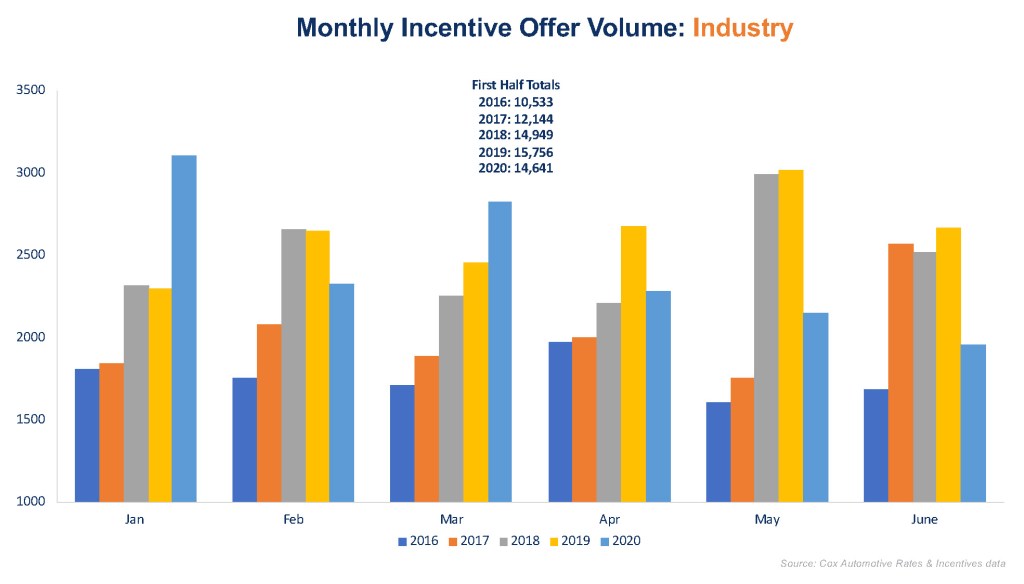

- In total, incentive program volume was down 7% in the first half of 2020 compared to both 2018 and 2019.

- Automakers simplified incentive programs and reduced the number of different offers as inventory fell throughout the second quarter.

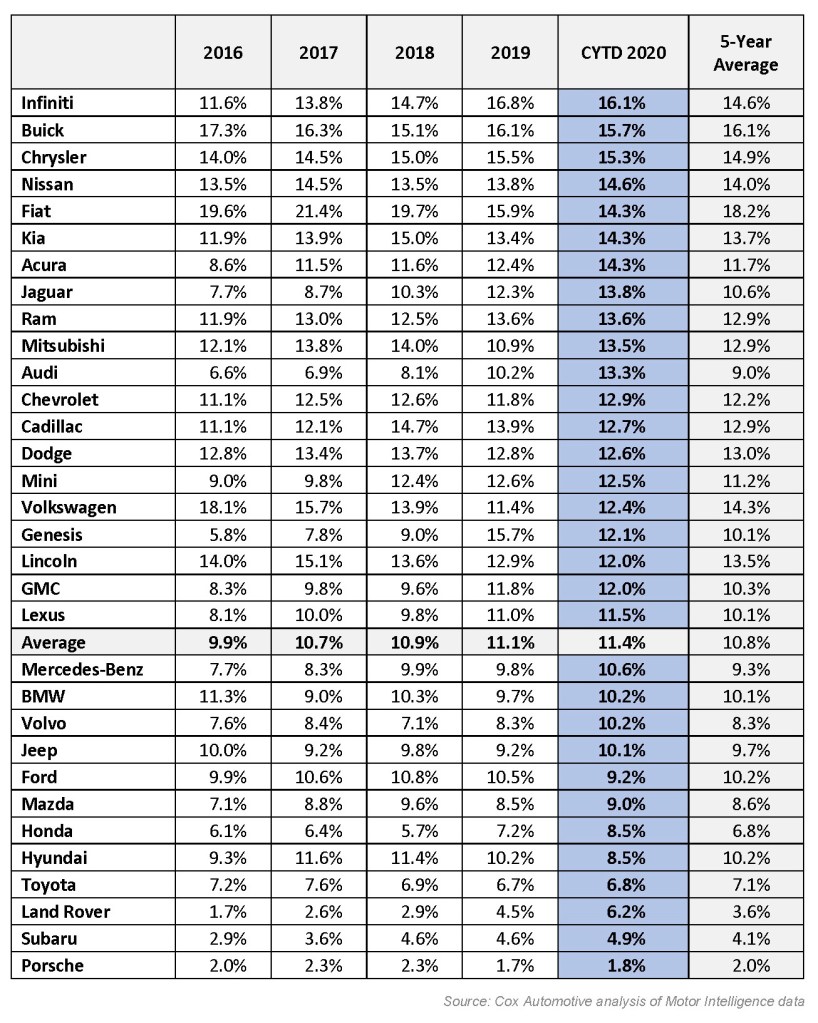

- Incentive spending as a percent of average transaction price, on the other hand, increased by 11.4% in the first half of 2020 compared to 2019 levels.

The Industry Insights team at Cox Automotive is forecasting first-half auto sales to be down 24.2% versus the first half of 2019 – a bad result that might have been worse without aggressive incentive spending by the automakers.

In total, incentive program volume was down in the first half of 2020 compared to both 2018 and 2019. Incentive spending by the automakers increased, however, as automakers pushed heavy incentives to pull would-be buyers off the sidelines. The aggressive spending had an impact on consumers. Research by Cox Automotive in June indicated 92% percent of 6-month intenders were expecting favorable terms with a new-vehicle purchase.

Incentive program volume, which is a simple measure of the total number (not value) of incentives offered in a given month, was down 7% in the first half compared to 2019. After high program volume in January and March, when automakers were adding and changing programs throughout the months to find a mix that worked, volume dropped notably in the second quarter. Automakers simplified incentive programs and reduced the number of different offers as inventory fell throughout the quarter.

Incentive spending as a percent of average transaction price, on the other hand, increased in the first half of 2020 compared to 2019 levels. The industry average of 11.4% is up from 11.1% in all of 2019 and well above the five-year average of 10.8%. Most automakers upped their spending per sale in the first half: 21 of 32 brands showed an increase. Our analysts, however, are expecting the level of spending to decrease in the second half of the year, driven by lower inventory and the need to conserve cash.

Incentives as Percent of Average Transaction Price

Auto sales will be confirmed on Wednesday, July 1.