Data Point

Auto Credit Availability Increased Again in April But Trends Varied by Channel and Lender

Tuesday May 11, 2021

Article Highlights

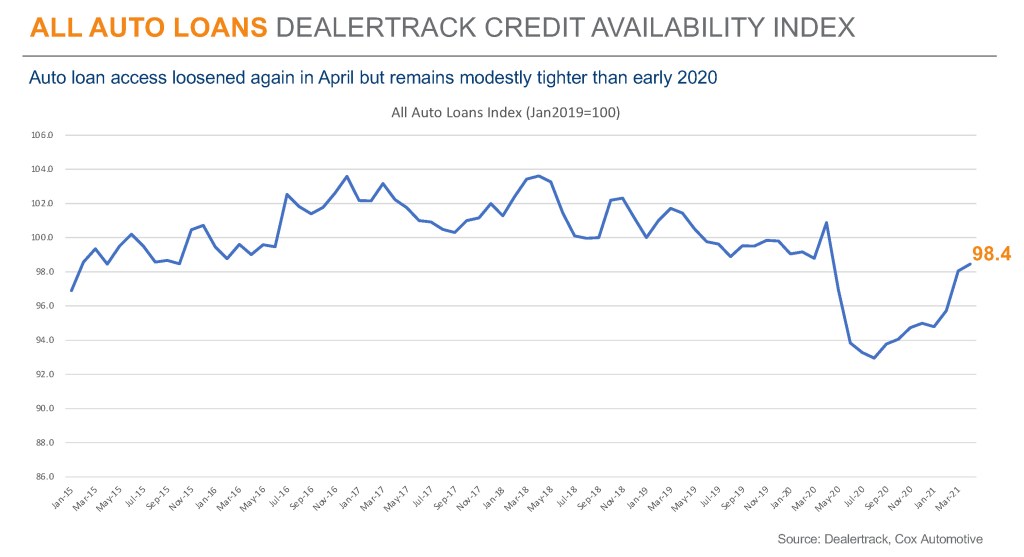

- Access to auto credit increased again in April, and auto loan credit was the most accessible since April 2020, according to the Dealertrack Auto Credit Availability Index for all types of auto loans. A

- The All Loans Index increased 0.4% to 98.4 in April, reflecting that auto credit was easier to get in the month compared to March.

- Access is tighter by 2.4% year over year, but that comparison is against abnormal credit conditions in April 2020. Compared to February 2020, access is tighter by 0.7%.

Access to auto credit increased again in April, and auto loan credit was the most accessible since April 2020, according to the Dealertrack Auto Credit Availability Index for all types of auto loans. The All Loans Index increased 0.4% to 98.4 in April, reflecting that auto credit was easier to get in the month compared to March. Access is tighter by 2.4% year over year, but that comparison is against abnormal credit conditions in April 2020. Compared to February 2020, access is tighter by 0.7%.

Trends diverged by loan type in April. New Loans loosened the most, while financing provided through independent used dealers tightened the most. On a year-over-year basis, independent used financing, non-captive new vehicle financing, and franchised used financing are now looser. Other channels remain tighter year over year, with new vehicle loans and certified pre-owned having tightened the most.

Credit trends were also mixed by lender types. Credit loosened the most in April at captives by 1.1%, while credit tightened at credit unions by 1.3%. On a year-over-year basis, auto-focused finance companies and banks have loosened credit access, while credit unions are unchanged, and captives have tightened. However, the year-over-year comparison for captives is against a time when lending by captives was particularly aggressive during the pandemic lockdown period.

The Dealertrack Credit Availability Index is a new monthly index based on Dealertrack credit application data and will indicate whether access to auto loan credit is improving or worsening. The index will be published around the 10th of each month.