Data Point

Wholesale Used-Vehicle Prices Decline in April From Seasonal Adjustment

Friday May 6, 2022

Article Highlights

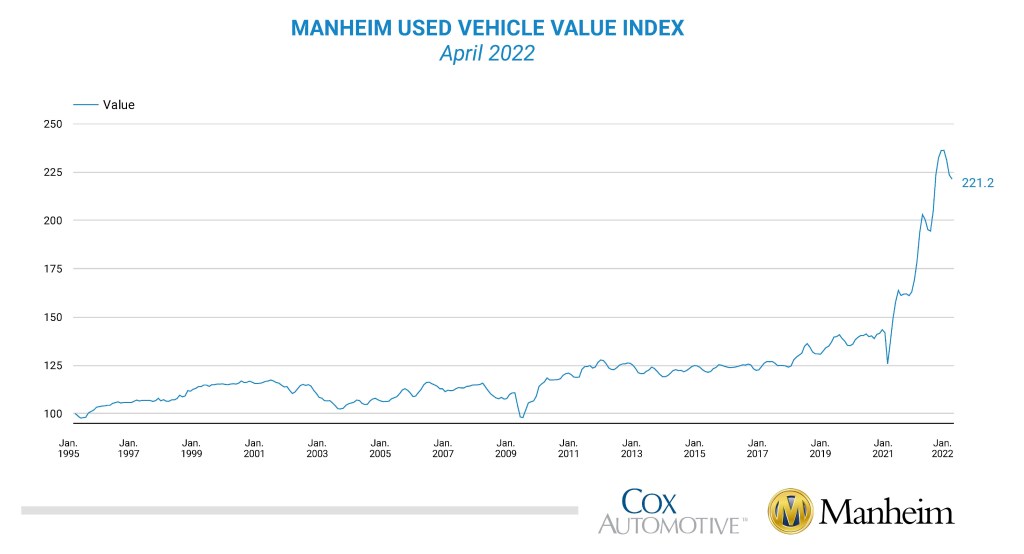

- Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) declined 1.0% in April from March.

- The Manheim Used Vehicle Value Index declined to 221.2, which was up 14.0% from a year ago.

- The non-adjusted price change in April was an increase of 2.9% compared to March, leaving the unadjusted average price up 16.4% year over year.

Wholesale used-vehicle prices (on a mix-, mileage- and seasonally adjusted basis) declined 1.0% in April from March. The Manheim Used Vehicle Value Index declined to 221.2, which was up 14.0% from a year ago. The non-adjusted price change in April was an increase of 2.9% compared to March, leaving the unadjusted average price up 16.4% year over year.

Manheim Market Report (MMR) values saw weekly price increases that were strongest to start April and slowed as the month progressed. Over the last four weeks, the Three-Year-Old Index increased a net 1.7%. Over the month of April, daily MMR Retention, which is the average difference in price relative to current MMR, averaged 99.0%, which meant that market prices were slightly behind MMR values. The average daily sales conversion rate increased to 58.4% but was below normal for the time of year. For example, the sales conversion rate averaged 60.6% in April 2019. The lower conversion rate indicates that the month saw buyers with more bargaining power for this time of year.

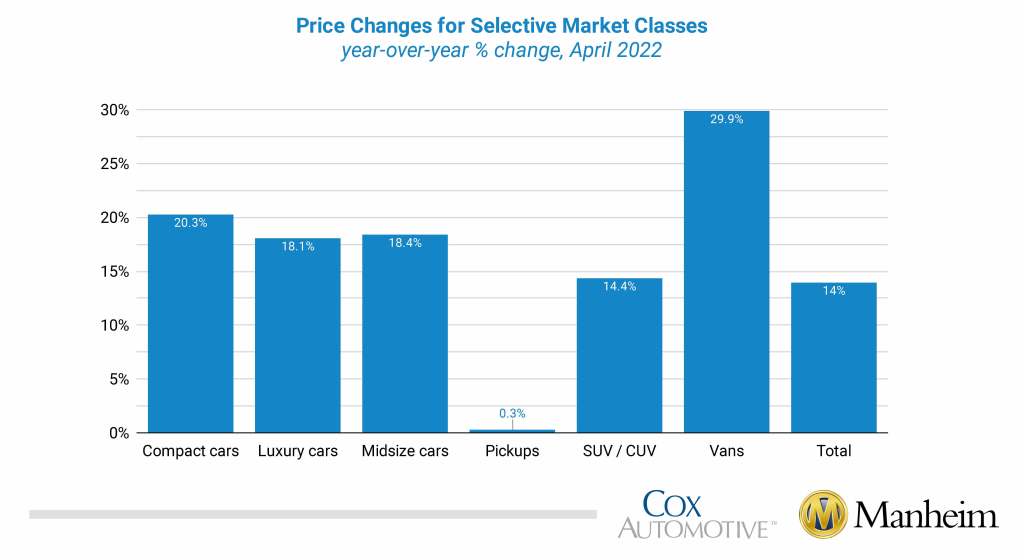

All major market segments saw seasonally adjusted prices that were higher year over year in April. Following closely to March’s figures, vans again had the largest year-over-year performance, followed by compact cars, while pickups lagged the overall market. On a month-over-month basis, half of the major segments saw seasonally adjusted price declines, with compacts declining the most. The seasonal adjustment drove most of the declines. Half of the major market segments saw price gains from March, with full-size and sports cars increasing the most.

Retail used sales slow in April even as tax refunds reach critical mass. Leveraging a same store set of dealerships selected to represent the country from Dealertrack, we estimate that used retail sales declined 13% in April from March and failed to show the larger seasonal increase driven by tax refund season. The Dealertrack estimates indicate that used retail sales were down 21% year over year. The issuance of tax refunds remains about four weeks behind the normal pace but did reach more than 50% disbursed in April. Based on IRS statistics through April 22, we estimate that 68% of this year’s likely number of tax refunds had been issued, when for the same week in 2019, 97% had been disbursed. The average refund is at a new record and up 5% year over year.

Using estimates of used retail days’ supply based on vAuto data, April ended at 46 days, which was down from 47 days at the end of March but higher than how April ended in 2021 at 35 days. Leveraging Manheim sales and inventory data, we estimate that wholesale supply ended April at 25 days, which is higher than how April 2021 ended at 16 days and higher than how March ended at 23 days.

April total new-light-vehicle sales were down 19% year over year, with one more selling day compared to April 2021. By volume, April new-vehicle sales were down 2% from March. The April SAAR came in at 14.3 million, a 22% decline from last year’s 18.3 million, but up 7% from March’s 13.4 million pace.

Combined sales into large rental, commercial and government buyers were up over 4% year over year in April. Sales into rental were down 3% year over year, while sales into commercial fleets were up 15% and sales into government fleets were down 4%. Including an estimate for fleet deliveries into the dealer and manufacturer channels, we estimate that the remaining retail sales were down 21% year over year in April, leading to an estimated retail SAAR of 12.3 million, which was down 23% from 16.0 million last April but up 6% from last month’s 11.6 million rate.

Rental risk mileage increases in month but down from last year. The average price for rental risk units sold at auction in April was up 24% year over year. Rental risk prices were up 1.6% compared to March. Average mileage for rental risk units in April (at 64,400 miles) was down 22% compared to a year ago but up 2% from March.

Measures of consumer sentiment mixed in April. Consumer Confidence according to the Conference Board declined 0.3% in April, erasing some of March’s 1.8% gain. The decline left confidence down 8.7% year over year. The underlying measures of present situation and future expectations moved in opposite directions as present situation declined but future expectations improved. Plans to purchase a vehicle in the next six months increased to the highest level in three months but was slightly lower than a year ago. Plans to purchase a home improved slightly from March but was down substantially year over year. The sentiment index from the University of Michigan increased 9.8% in April as both current conditions and expectations improved, with expectations jumping the most. The Michigan reading had reached an 11-year low in March. The Morning Consult daily index declined 1.3% in April, but it recovered some of the losses it saw in the first half of the month. The index from Morning Consult hit its lowest point for the pandemic on March 14, which was when gas prices initially peaked.

The complete suite of monthly MUVVI data for May will be released on June 7, 2022, the fifth business day of the month as regularly scheduled. If you have any questions regarding the Index or would like to sign up for updates, please contact the Cox Automotive Industry Insights team at Manheim.Data@coxautoinc.com.