Even as the whipsaw of changing tariff policy continued to dominate the headlines, the dynamics of the April new-vehicle market unfolded as expected. New-vehicle sales momentum continued from the end of March and into April, before beginning to taper off. New-vehicle inventory declined further, by 7.4% from March, according to the Cox Automotive analysis of vAuto Live Market View data.

2.49M

Total Inventory

as of May 1, 2025

66

Days’ Supply

$48,656

Average Listing Price

May opened with a total supply of new vehicles on dealer lots across the U.S. at 2.49 million units, down 7.4% from the 2.69 million units at the start of April and down 10.5% from a year ago. Seasonal patterns persist, as it is not unusual to see sales rise during the traditional “spring bounce.” Inventory, however, is not being replenished at the same rate. Some automakers are likely holding the line on deliveries and production, as everyone struggles with the uncertainty surrounding the administration’s tariff policies.

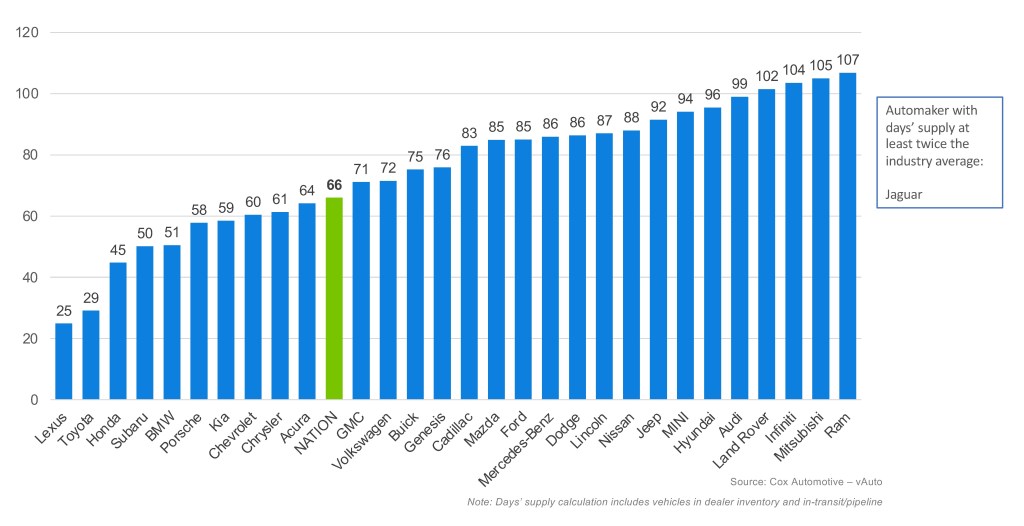

Cox Automotive’s vAuto Live Market View days’ supply is based on the estimated retail sales pace for the most recent 30-day period. New-vehicle days’ supply, at the start of May, was 66, down 16 days compared to last year and down six days from last month. As automakers prepare to bring 2026 model year vehicles to showrooms and introduce post-tariff-announcement pricing, inventory is expected to rise, but higher prices may further slow the pace of sales.

April Days’ Supply of Inventory by Brand

The 30-day sales pace peaked in mid-April but ended the month higher by less than 1%, as the market cooled notably in the final two weeks. Clearly, the real urgency was in late March and early April, but that push faded as consumer sentiment stabilized after the rhythm of trade negotiation announcements became normalized, and consumers shifted to a more measured car-buying approach. We may indeed be back to a more normal balance of “wait and see” and “buy now” attitudes. Year over year, the sales pace was up 10.8% at the end of April.

New-Vehicle Listing Prices Increase in April

This is a supply-side story, though, and there was clearly more demand and traffic in the showroom during March and April, selling down available vehicles. The increase in average listing price shows market-level dynamics had more of an impact on pricing than a change in invoice or manufacturer’s suggested retail price.

The average new-vehicle listing price at the end of April was $48,656, up $774 (1.6%) from the revised $47,882 at the start of the month and up $1,318 (2.8%) from a year earlier. The increases were not across the board, though, as some brands like BMW, Buick, Mitsubishi, and Dodge saw declines month over month. This continues to reinforce the uneven distribution of impacts that the tariff uncertainty is creating in the market. Among volume brands, RAM, Lincoln and Cadillac saw the largest month-over-month increases in listing prices.

As reported earlier, according to our Kelley Blue Book team, the average transaction price (ATP) of a new vehicle was $48,699 in April, up 2.5% month over month and up 1.1% year over year. In April, new-vehicle sales incentives declined to 6.7% of ATP, down from 7.0% in March.

What to Expect in May and Beyond

Consumers are currently questioning what it means to be “made in America” and whether the preferred model or preferred segment is of greater significance. The data indicates that the impact of additional costs from tariffs on some automakers will indeed be at the model level; however, it remains uncertain how these costs will be reflected in consumer pricing.

Ford is among the few brands that have announced higher pricing for specific vehicles manufactured outside the United States, while other brands continue to develop their pricing strategies and promise to hold the line on current model-year products. This period presents a challenge to market share, and despite the potential shift towards a seller’s market, thorough research by consumers can lead to unexpected purchasing decisions.