Data Point

April CPO Sales Nearly Cut in Half Year Over Year

Wednesday May 13, 2020

Article Highlights

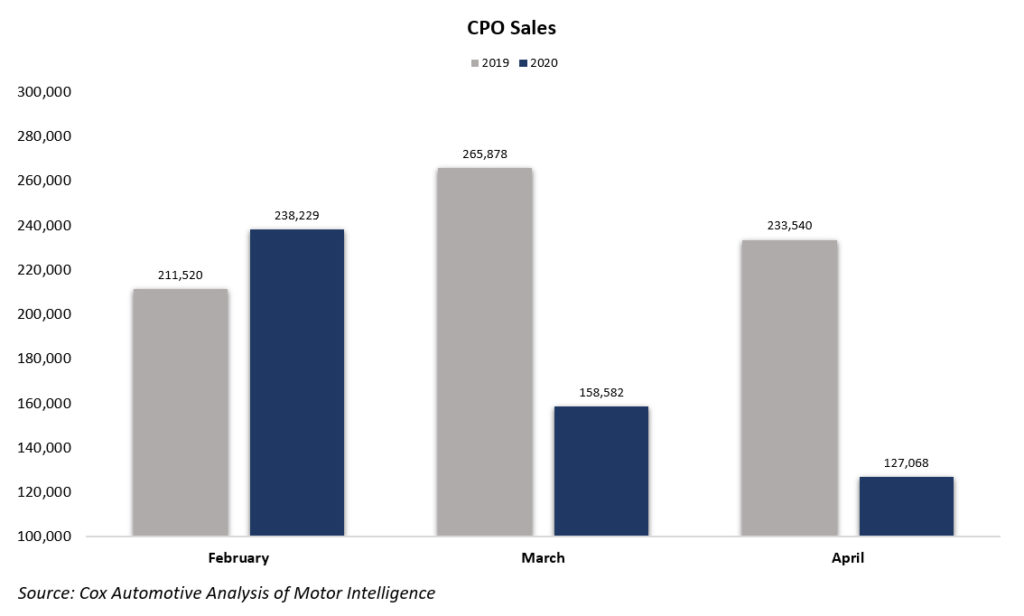

- Sales of certified pre-owned (CPO) vehicles decreased 46% year over year in April with only 127,068 CPO units sold.

- CPO sales were on a record-setting pace for the year before COVID-19 and ended down 20% month over month compared to March.

- This year CPO sales are down 18.7% versus 2019, with 739,838 CPO units sold through April.

Sales of certified pre-owned (CPO) vehicles decreased 46% year over year in April. CPO sales were on a record-setting pace for the year before COVID-19 and ended down 20% month over month compared to March. For April, only 127,068 CPO units were sold. The 46% drop in CPO volume was larger than both the estimated 34% drop in used-vehicle retail volume and the 41% drop in new-vehicle sales. This suggests consumers in market during the COVID-19 pandemic are likely looking for low prices and value, and steered away from CPO. While CPO are excellent used vehicles, with full warranties and benefitting from factory-backed inspections, they are often priced higher than a traditional used vehicles. At the same time, new-vehicle retail sales in April benefitted from high retail incentives and 0% financing deals, improving the value proposition. CPO units, stuck in the middle, suffered.

The 46% drop in CPO volume was larger than both the estimated 34% drop in used-vehicle retail volume and the 41% drop in new-vehicle sales. This suggests consumers in market during the COVID-19 pandemic are likely looking for low prices and value, and steered away from CPO. While CPO are excellent used vehicles, with full warranties and benefitting from factory-backed inspections, they are often priced higher than a traditional used vehicles. At the same time, new-vehicle retail sales in April benefitted from high retail incentives and 0% financing deals, improving the value proposition. CPO units, stuck in the middle, suffered.

This year CPO sales are down 18.7% versus 2019, with 739,838 CPO units sold through April. This means that the CPO market is more than 150,000 units below last year for the first four months of 2020.

Toyota, Honda and Chevy continue to be the biggest players in the CPO market, collectively representing a third of all CPO sales. Those three plus Ford and Nissan account for 45% of CPO sales so far in 2020. Last year, Toyota, Honda and Chevy accounted for 32% of the total industry CPO sales reflecting that brands are maintaining consistent CPO sales share this year compared to 2019.