Data Point

As The UAW Strike Wore On, General Motors Kept Pushing New-Vehicle Sales

Thursday October 31, 2019

Article Highlights

- During the recent 40-day strike, it was Business as Usual with the GM sales department, as they didn’t lift their foot off the incentive throttle.

- For the most part, GM incentives in October were equal to or greater than the incentives in September.

- In other words, the 40-day strike, at this point at least, had no discernible impact on GM’s incentive strategy.

General Motor’s UAW workers got back to work this past week, resuming production at plants across North America and ending a 40-plus day work stoppage. GM and its dealers went into the strike well prepared in terms of inventory, with new-vehicle stock well above the industry average.

GM’s new-vehicle sales in the U.S. in Q3 were strong, thanks in part to aggressive incentive work. October auto sales will be reported on Friday, November 1, and our team is forecasting GM to come in at approximately 230,000 units, a 5% drop versus October 2018. The market is expected to be mostly flat.

Considering the strike dragged on for most of October, our Cox Automotive Rates & Incentives team took a careful look at GM incentive programs during the month to assess the company’s motivation at a time when new products were not being built to replenish supply. What we found: It was Business as Usual with the GM sales department, as they didn’t lift their foot off the incentive throttle.

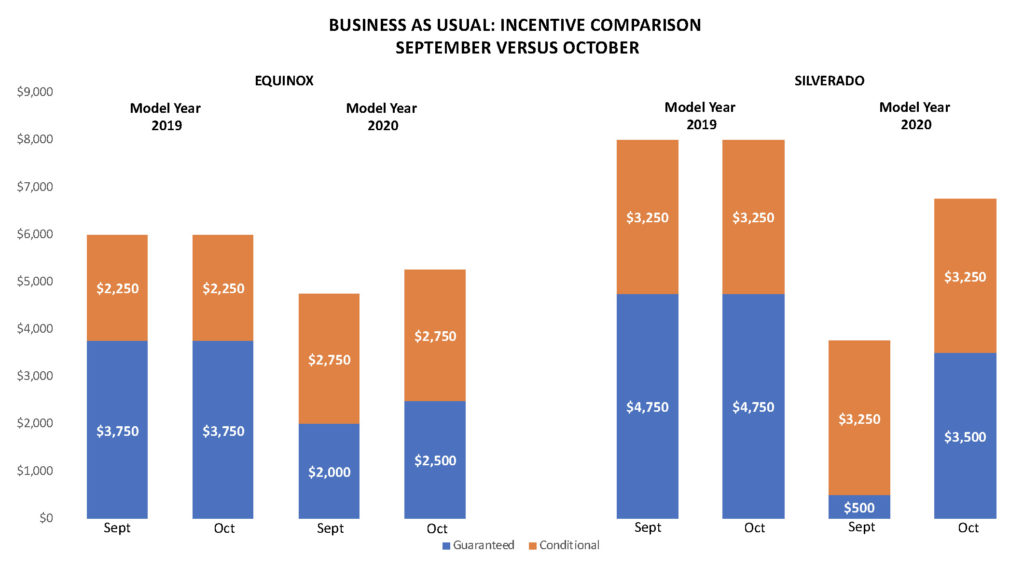

For the most part, GM incentives in October were equal to or greater than the incentives in September. In some cases, the incentive packages improved significantly. Consider the Chevrolet Equinox: The general incentive package of guaranteed and conditional consumer cash was unchanged for 2019 models, September versus October. The incentive package increased by $500 for 2020 models. The same story is true with the popular new Silverado. Incentives on the 2019 models stayed consistent. For 2020 model year vehicles, the offer increased by $3,000 during October, all guaranteed customer cash.

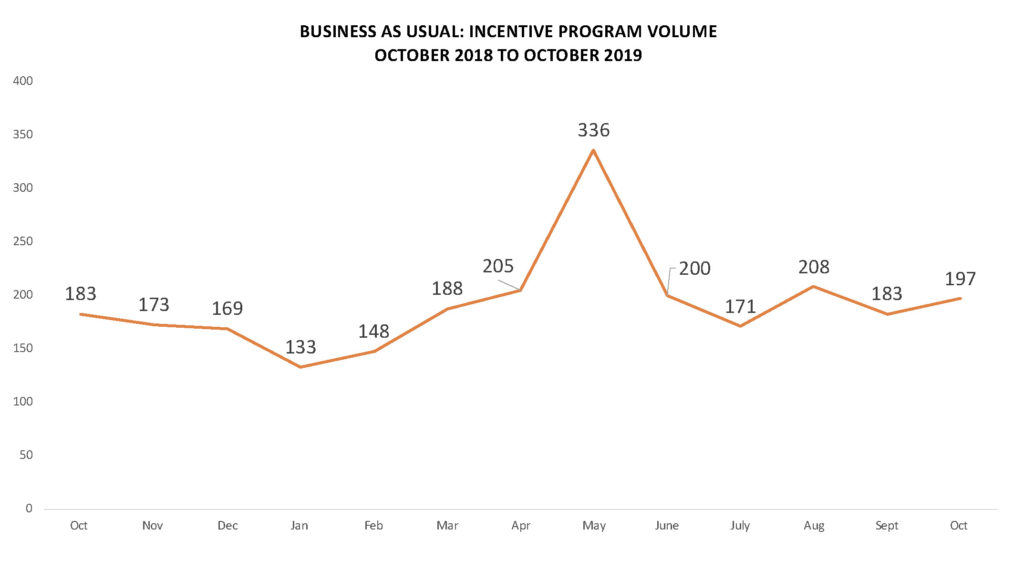

Reviewing total incentive programs tracked by our rates and incentives team shows a similar business-as-usual story in October. By the end of the month, GM had posted 197 different programs across all its brands, a number very similar to its 12-month average of 193.

In other words, the 40-day strike, at this point at least, had no discernible impact on GM’s incentive strategy. From a sales incentive point of view, GM and its dealers continue to focus on moving the metal.

We know many factors shape a company’s incentive strategy, and inventory is just one measure. Certainly, GM’s competitors continued to be aggressive in October, forcing GM to maintain or increase incentives to help their dealers maintain competitiveness – strike or no strike. As long as there is inventory, the sales march must continue.

Our industry insights team will take a careful look at GM inventory at the beginning of November. How that number impacts GM’s incentive behavior through the end of the year is yet to be seen.

Brad Korner is general manager of Cox Automotive Rates & Incentives. The Cox Automotive Rates & Incentives (CAR&I) team has developed a methodology for measuring the accuracy of data used to calculate pricing and payment information presented through dealer service provider tools (e.g., dealer websites, inventory management, digital retailing & advertising, desking, equity, etc.). Approximately 17,500 individual dealerships – rooftops, in automotive parlance – in the U.S. rely on CAR&I incentive data for powering 5 different software applications through Cox Automotive native software/sites and our many industry partners. In all, an estimated 88,000 applications are relying on CAR&I data every month, providing valuable information to 40 million shoppers.