CAMIO

Auto Credit Availability Tightened in 2022

Wednesday June 7, 2023

Auto credit access tightened in 2022 as a slowing economy, deteriorating auto loan performance and tighter monetary policy led to a reversal of the substantial loosening of credit in 2021. By the end of 2022, the aggregated All Loan Index in the Dealertrack Credit Availability Index indicated it was harder to get a loan than the prior year and slightly harder than in February 2020 before the pandemic began. In addition, every channel but certified pre-owned (CPO) was tighter than the preceding year, and every lender type was tighter except for auto-focused finance companies.

Each Dealertrack Credit Availability Index tracks the shifts in loan approval rates, subprime share, yield spreads and loan details, including term length, negative equity, and down payments, to judge if credit is harder or easier to get relative to a point in time. The index is baselined to January 2019 to show how credit access has shifted since then.

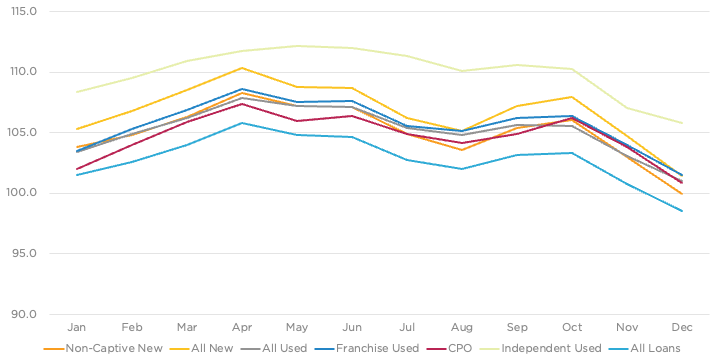

Following a year in which auto credit availability expanded by 7% according to the Dealertrack Credit Availability Index for all types of auto loans, credit availability declined by 3% in 2022. Within the year, auto credit conditions initially loosened, peaking in April. But conditions tightened substantially in the final months of the year.

Dealertrack Credit Availability Index — All Loans

All underlying factors except term length moved against consumers in 2022, resulting in tighter conditions in December 2022 compared to the prior year. Three factors caused most of the decline in the Credit Availability Index: declining approval rates, the declining subprime share of borrowers, and widening yield spreads. By the end of 2022, consumers were less likely to be approved, seeing yield spreads that had widened by 23 basis points (BPs) and with fewer subprime borrowers represented in the mix.

By December 2022, all channels except CPO saw lower credit availability compared to the year prior. New loans excluding captives tightened the most. CPO loans saw slightly higher credit availability.

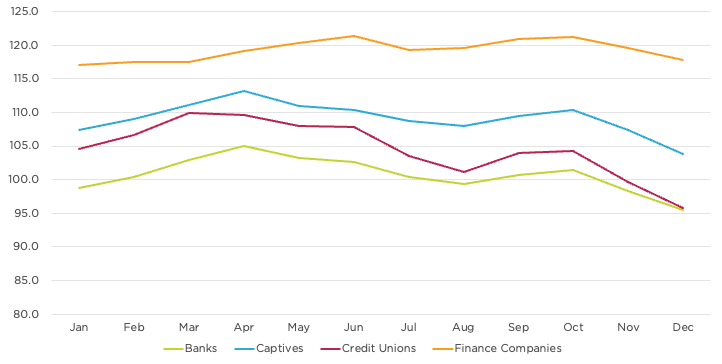

Auto Credit Availability By Lending Type (Jan2019=100)

Compared to February 2020 before the pandemic began, auto credit availability in 2022 remained stronger across all channels, with Independent Used having seen credit availability expand the most.

By lender type, credit unions had tightened the most year over year in December 2022, but banks and captives had also tightened. Only auto-focused finance companies had higher credit availability in December 2022 than in December 2021.

Auto Credit Availability by Lender (Jan2019=100)

THE OUTLOOK: Given an uncertain economic outlook and the Federal Reserve likely to tighten monetary conditions further, auto loan credit availability is more likely to worsen than improve in 2023. In addition to the Fed increasing rates, concerns about stability in the banking sector are leading more broadly to tighter credit conditions. Lenders are also likely to tighten standards if loan performance continues to deteriorate. The biggest worry for credit access would be in the case of a recession unfolding, in which we would expect to see credit tighten substantially as job losses always lead to higher loan defaults. If we avoid a recession, it is possible that yield spreads could narrow as 2023 progresses, and that could reverse one of the factors that led to tightening in 2022.