Data Point

Auto Loan Delinquency Rate Down Slightly After Peak in January

Thursday March 19, 2020

Auto loans and leases total over 84 million accounts and represent $1.28 trillion of outstanding debt at the end of February. The number of accounts outstanding is down slightly from a record in January, but the value outstanding is a new record.

Auto loans that are severely delinquent (defined as 60 days or more behind on payment) were recorded at 1.61% of all auto loans in February. Total severe delinquencies are up 5.6% year over year in February. The delinquency rate fell in aggregate and for subprime (credit score of below 620) in February relative to January, but it remains high year over year in aggregate and for subprime.

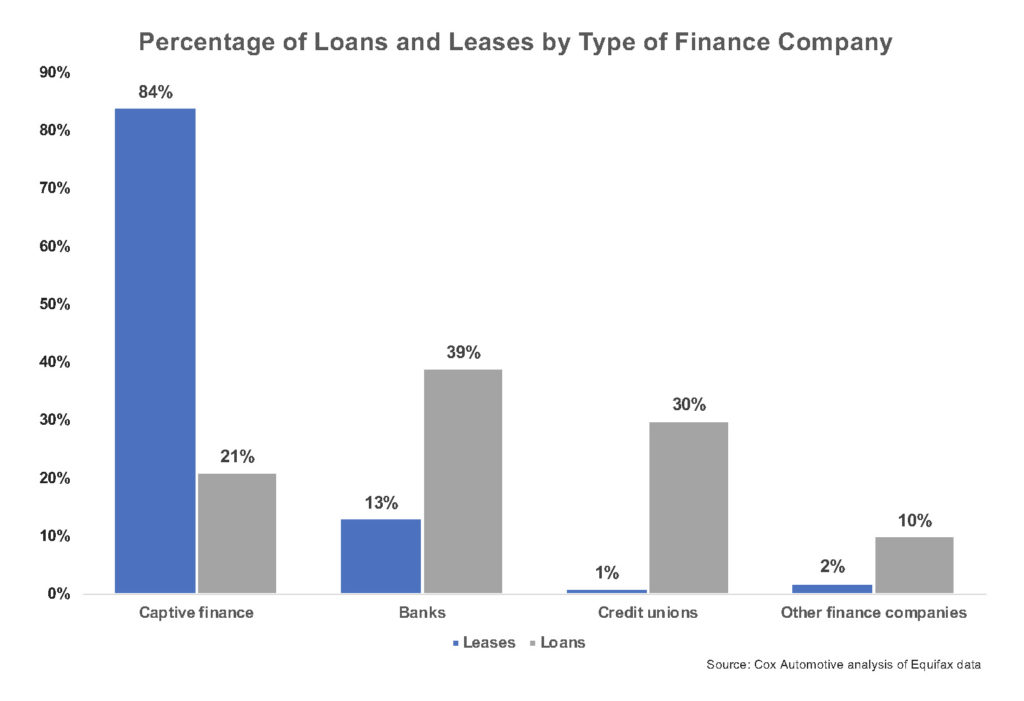

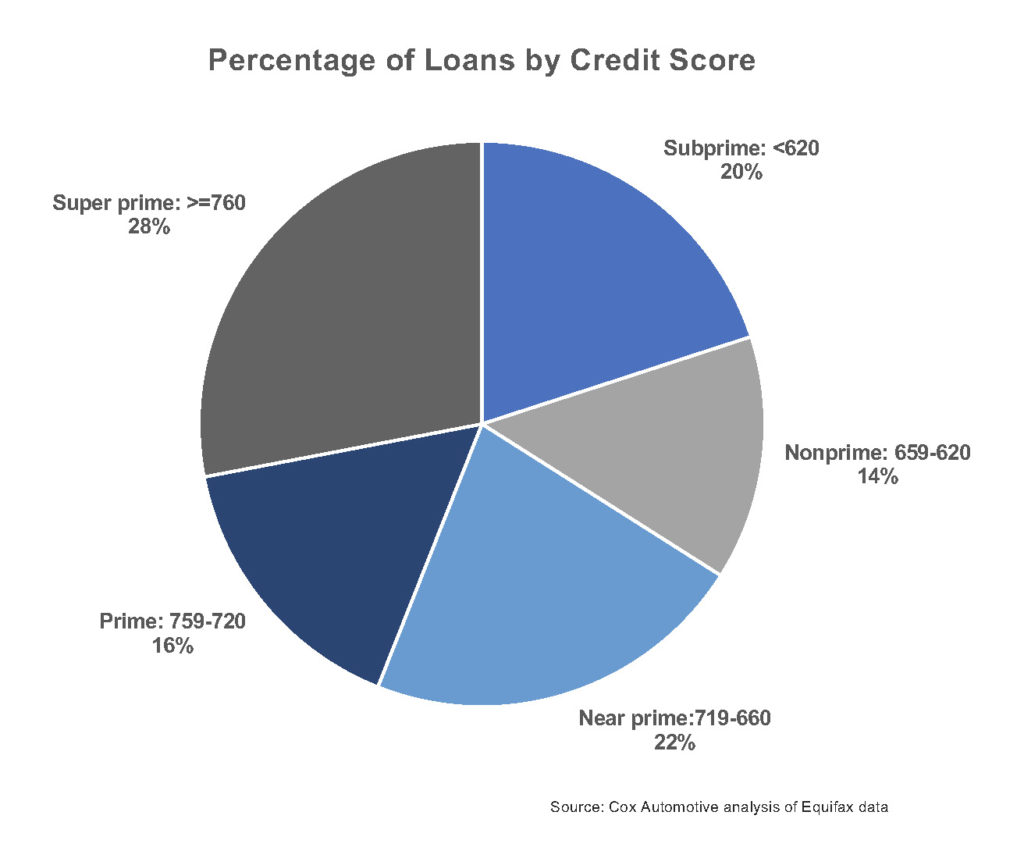

Captive finance companies hold 84% of leases but only 21% of loans as seen in the chart above. Banks represent 13% of leases but 39% of loans. Credit unions represent only 1% of leases but 30% of loans. The remainder of auto loans and leases are represented by other finance companies comprising dealer (including Buy Here Pay Here), independent and monoline finance companies. Subprime loans make up 20% of auto loans and 63% of defaults*. The number of subprime auto loans is up 0.1% year over year in February while the number of subprime defaults is down 12.4% year over year. Severely delinquent subprime accounts are up 5.4% year over year. The percentage of subprime loans that were severely delinquent was 5.66% in February, the highest subprime delinquency rate for February since 2006, as far as we have data.

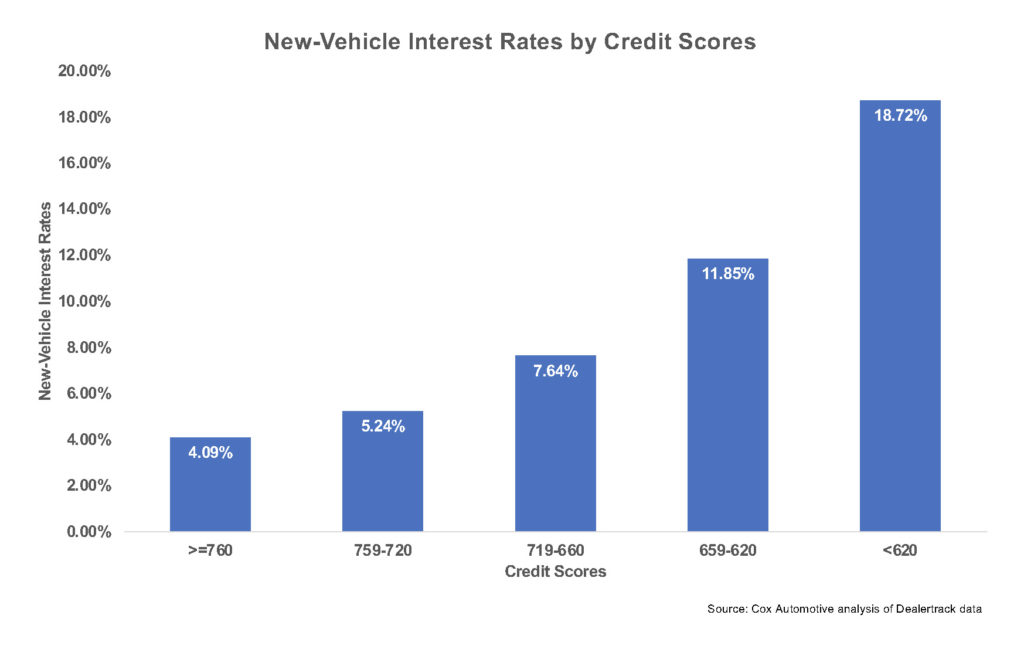

Subprime loans make up 20% of auto loans and 63% of defaults*. The number of subprime auto loans is up 0.1% year over year in February while the number of subprime defaults is down 12.4% year over year. Severely delinquent subprime accounts are up 5.4% year over year. The percentage of subprime loans that were severely delinquent was 5.66% in February, the highest subprime delinquency rate for February since 2006, as far as we have data. New-vehicle interest rates vary widely depending on the consumer’s credit score, according to a Cox Automotive analysis of Dealertrack data. As seen in the chart above, the largest difference – 6.87% – is between the 659-620 (Nonprime) credit score range and credit scores below 620 (Subprime).

New-vehicle interest rates vary widely depending on the consumer’s credit score, according to a Cox Automotive analysis of Dealertrack data. As seen in the chart above, the largest difference – 6.87% – is between the 659-620 (Nonprime) credit score range and credit scores below 620 (Subprime).

*Defaults are not defined as a status but reflect conditions beyond 120 days past due as well as repossessions. Bankruptcy accounts are excluded from this calculation.