Key Highlights:

- Existing home sales fell to a seasonally adjusted annual rate of 4.00 million in April, matching Great Recession lows, even as inventory rose 20.8% year over year and prices increased 1.8%.

- Continuing jobless claims rose to 1.90 million, reflecting slower hiring, but overall unemployment trends remain below pre-pandemic levels.

- Auto loan defaults surged 20.1% month over month in April, pushing the annualized default rate to 3.49%—its highest since 2010—despite improving delinquency rates.

Existing and New Home Sales

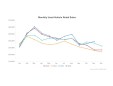

Existing home sales declined in April to Great Recession levels. Inventory increased, but overall supply remains tight, and prices were up 1.8% year over year.

- Existing home sales fell 0.5% in April, missing expectations for a 2% gain, and settled at a seasonally adjusted annual rate of 4.00 million.

- This marks the slowest pace since last September and mirrors the depressed levels seen during the 2009 Great Recession.

- Inventory rose 9% month over month and 20.8% year over year, yet the 4.4 months’ supply still signals a tight market.

- The median sales price climbed to $414,000, up 1.8% from a year ago, reflecting continued demand despite affordability challenges.

New home sales increased in April, leading total home sales higher for the month, but sales were down year over year.

- New home sales jumped 10.9% month over month to an annualized pace of 743,000, with strength concentrated in the Midwest (+35.5%).

- Year over year, sales were up 3.3% overall, though the Northeast saw a 25.8% decline.

- Inventory of new homes dipped slightly month over month but remained elevated at 8.1 months of supply.

- Combined, total home sales rose 1.1% for the month but were still down 1.2% year over year, highlighting the uneven recovery in housing.

Jobless Claims

Continuing jobless claims are moving higher but are not at worrisome levels.

- Initial jobless claims declined by 2,000 to 227,000 for the week ending May 17, remaining within a historically normal range.

- Continuing claims rose by 36,000 to 1.90 million, indicating that more job seekers are staying on unemployment longer as hiring slows.

- The broader measure of continuing claims, which includes all forms of unemployment assistance, fell by 70,600 to 1.80 million.

- Despite the uptick in traditional claims, the broader trend remains below pre-pandemic levels, suggesting labor market resilience.

Auto Credit

Auto loan performance was mixed in April as delinquencies declined, but defaults increased. Auto loan credit tightened in April.

- Access to auto credit declined as most lender types tightened standards, especially for new loans and subprime borrowers.

- Approval rates improved and terms lengthened, but a sharp drop in subprime share offset those gains, leading to an overall tightening.

- Credit access was looser than a year ago for most channels, particularly used loans from franchise dealers, while captives tightened the most.

- Delinquencies improved: 60-day-plus delinquencies fell for the third straight month and were down 0.9% year over year.

- However, defaults surged 20.1% month over month and 15.3% year over year, with subprime defaults up 21.9% from March.

- The annualized default rate hit 3.49% in April – its highest since 2010 – raising concerns about credit quality deterioration despite stable delinquency rates.