Smoke on Cars

Auto Market Weekly Summary

Monday August 26, 2019

Article Highlights

- China, U.S. trade battle dominates headlines and leads to stock market declines.

- The yield curve remains negative.

- Home sales boosted by lower interest rates.

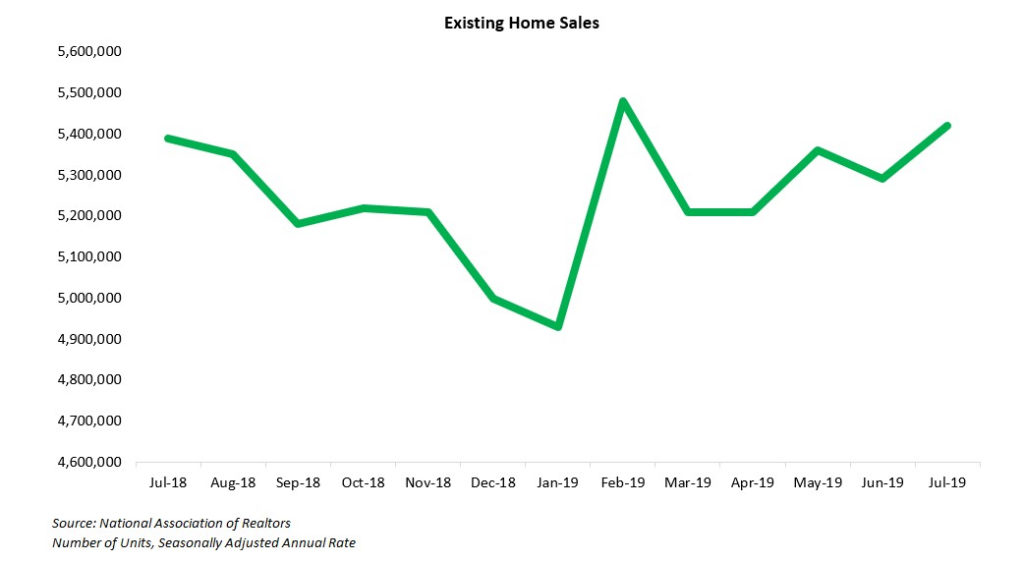

Last week was a light one for new economic data, but the news on home sales this summer looks encouraging with the pace of sales finally seeing gains year over year as a result of lower mortgage rates.

U.S.-China trade: The problem for last week was additional actions taken by China and threats from the U.S. that point towards more challenges ahead on the trade front. China announced additional tariffs on U.S. goods, including vehicles. President Trump threatened additional actions as he also “ordered” American companies to start looking for alternatives to China. The major stock market indices fell nearly 3% the prior week for a fourth straight week of decline and opened lower as last week started. The next round of tariffs starts September 1.

Yield curve negative: The spread between the 10-year and the 2-year U.S. Treasury turned negative again last week. Longer-term rates are normally higher than shorter rates. The 10-2 spread ended the week hovering around zero. The closing levels in the 10-2 spread over the last two weeks have been at their lowest levels for more than 12 years.

Housing mixed: With mortgage rates down by more than a full percentage point from last November, both new and existing home sales this summer are seeing improvement over last year, but the gains so far have been marginal relative to the much more attractive mortgage rates. Existing home sales saw their strongest pace in five months.

More rate cuts possible: The Fed’s next meeting concludes on September 18, and the futures market sees a 100% probability of a quarter-point cut in the short-term rate. A second cut is likely at the October 30 meeting. December is less certain for a cut, but the futures market still suggests that there is a greater than 50% probability for a cut in December.

Looking ahead: This week we’ll get revisions to second quarter GDP, data on July durable goods orders, pending home sales, personal income and spending, and inflation as well as August consumer confidence and consumer sentiment readings.

August is likely to end on a sour note for consumer confidence given the negative trade and financial news.

This was a light week for new economic data, but the news on home sales this summer looks encouraging with sales finally seeing gains year over year as a result of lower mortgage rates.

The problem for last week was additional actions taken by both China and threats from the U.S. that point toward more challenges on the trade front. President Trump at the G-7 Summit could produce more market-moving headlines this week. Stocks ended down for the fourth straight week. The next rounds of U.S. and China tariffs start on September 1. August is likely to end on a sour note for consumer confidence given the negative trade and financial news.