Data Point

Average Weighted Manufacturer’s Suggested Retail Price Sets Record in 2019

Wednesday April 22, 2020

Article Highlights

- The average manufacturer’s suggested retail price (MSRP) of all vehicles sold in the U.S. has increased 13% in the past five years.

- Consumers paid 7.5% less on average than MSRP in 2019, with an average transaction price (ATP) of $38,363 for the major segments – cars, trucks and SUVs.

- The average monthly loan payment for a new vehicle was $566 a month in 2019, up 3.4% from the previous year.

You can visualize the relentless rise of new-vehicle prices in the U.S. market in many ways. Average transaction price – ATP – is a common measure, showing the amount consumers pay for a vehicle. Or look to the average monthly loan payment for a new vehicle, which was $566 in 2019, up 3.4% from the previous year. Our own Kelley Blue Book team has multiple data points on vehicle prices, including the Fair Purchase Price, a weekly look at what consumers can reasonably expect to pay in their market for a specific make, model and year of any vehicle. This article uses Kelley Blue Book ATP which is the sale price before anything is applied or added.

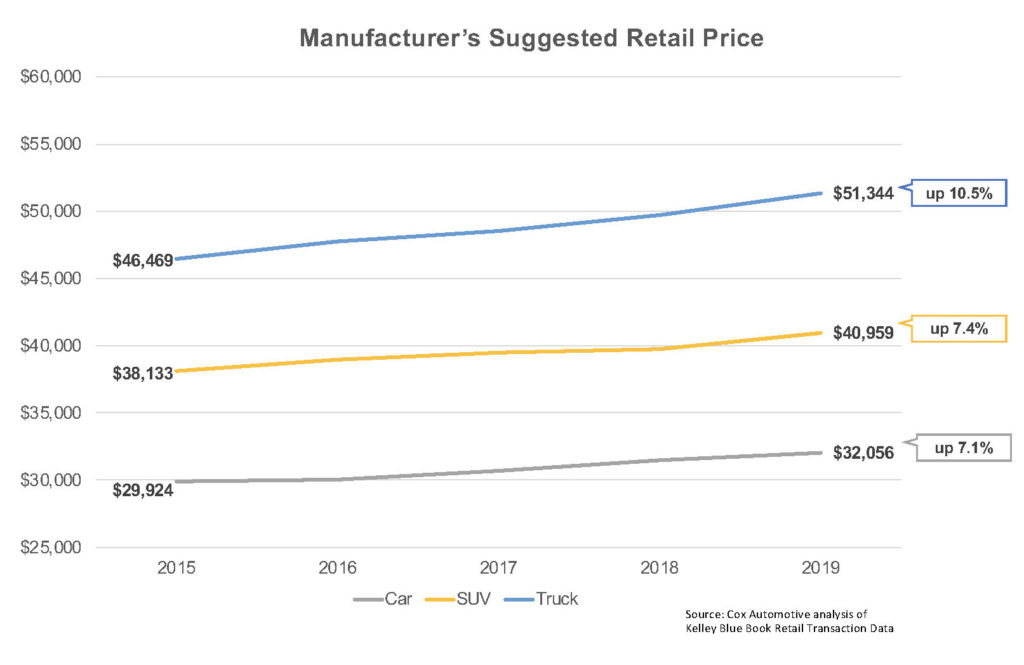

Vehicle price metrics mostly begin with the Manufacturer’s Suggested Retail Price (MSRP). This is the price automakers believe their new vehicles are worth – the starting point of every deal. And, the average weighted MSRP has been tracking upward for years, increasing 8.6% in the past five years and reaching $40,324 in 2019, setting a record. Much of the growth has been driven by segment shifts, with consumers buying more high content SUVs and CUVs and high-end pickup trucks, skewing the numbers upward. Pickup truck prices have moved the most, with MSRPs up 10.5% in 5 years to a whopping $51,344 average MSRP in 2019. SUV/CUV MSRPs have risen 7.4%, despite the launch of many cheaper, subcompact models. Car prices are up as well, but less than 8% in 5 years.

Much of the growth has been driven by segment shifts, with consumers buying more high content SUVs and CUVs and high-end pickup trucks, skewing the numbers upward. Pickup truck prices have moved the most, with MSRPs up 10.5% in 5 years to a whopping $51,344 average MSRP in 2019. SUV/CUV MSRPs have risen 7.4%, despite the launch of many cheaper, subcompact models. Car prices are up as well, but less than 8% in 5 years.

A recent analysis by Cox Automotive illustrates that the segments continue trends started in 2016. SUVs continue to gain share, finishing 2019 at 48%, while cars continue to lose share, finishing the year at 28%. Truck share continues to rise year over year and reached 18% in 2019.

It comes as no surprise that, according Cox Automotive’s 2018 Future of Mobility Study, 48% of consumers feel owning or leasing a vehicle is becoming too expensive, up from 42% in 2015. The average MSRP of all vehicles sold in the U.S. has increased 13% in the past five years (January 2015 – December 2019), creating a steady uphill battle for vehicle buyers. Peak MSRP months are usually November and December, when a high percentage of luxury vehicles typically sell, bending the average even further upward.

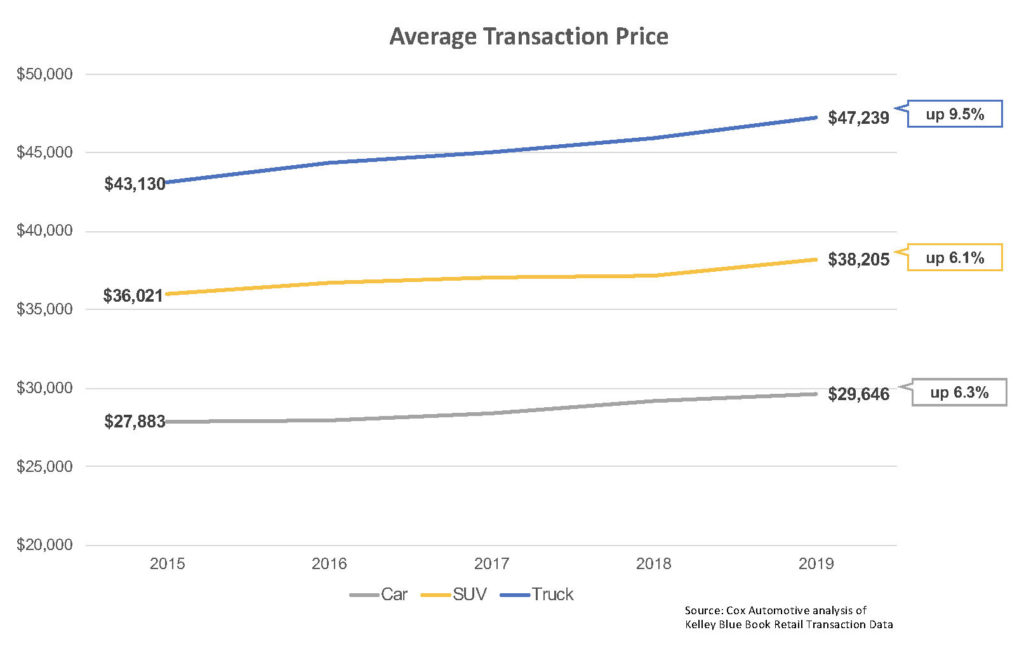

Average Transaction Price has increased 7% over the past five years. Consumers paid 7.5% less on average than MSRP in 2019, with an ATP of $38,363, for the major segments – cars, trucks and SUVs. The truck segment has seen the largest 5-year increase in average transaction price, increasing 9.5% since 2015 to $47,239. At the same time, the truck segment has the largest disparity between MSRP and ATP. Consumers pay 8.3% below the MSRP on average for a mid- or full-sized pickup. The 5-year ATP increases for SUVS and cars are similar at 6.1% and 6.3%, respectively. SUVs had an ATP of $38,205 in 2019 while cars stayed just below $30,000 at $29,646. For SUVs, the difference between MSRP and ATP is 7% while consumers typically pay on average 7.8% less than MSRP for cars.

The truck segment has seen the largest 5-year increase in average transaction price, increasing 9.5% since 2015 to $47,239. At the same time, the truck segment has the largest disparity between MSRP and ATP. Consumers pay 8.3% below the MSRP on average for a mid- or full-sized pickup. The 5-year ATP increases for SUVS and cars are similar at 6.1% and 6.3%, respectively. SUVs had an ATP of $38,205 in 2019 while cars stayed just below $30,000 at $29,646. For SUVs, the difference between MSRP and ATP is 7% while consumers typically pay on average 7.8% less than MSRP for cars.