Data Point

Can Tesla Find New Buyers?

Wednesday January 29, 2020

Article Highlights

- One area our analysts will be watching carefully this year is the sales performance in California, which is far and away Tesla’s No. 1 market.

- This view will be particularly interesting now that valuable federal tax credits have expired, not only in California but across the U.S.

- The challenge for Tesla this year will be to move beyond regional tech hotspots and begin to appeal to a wider demographic.

Tesla will confirm Q4 2019 financial results later today, and we can certainly expect a lot of attention on the numbers and what Elon Musk has to say. After announcing a surprise Q3 profit, Tesla has been on a charge of late, debuting new product – Cybertruck! – and making progress toward overseas production in both China and Europe. Tesla’s stock price has soared recently. In the up-and-down world of Tesla, it’s been all up for Team Elon lately.

One area our analysts will be watching carefully this year is the sales performance in California, which is far and away Tesla’s No. 1 market and was showing signs of weakness in the fourth quarter of 2019. This view will be particularly interesting now that valuable federal tax credits have expired, not only in California but across the U.S. In December 2018, every Tesla came with a $7,500 tax credit in the trunk. In the first half of 2019, the credit fell to $3,750. It dropped further to $1,875 in the back half of the year, and as the clock in 2019 ran out, it dropped to $0.

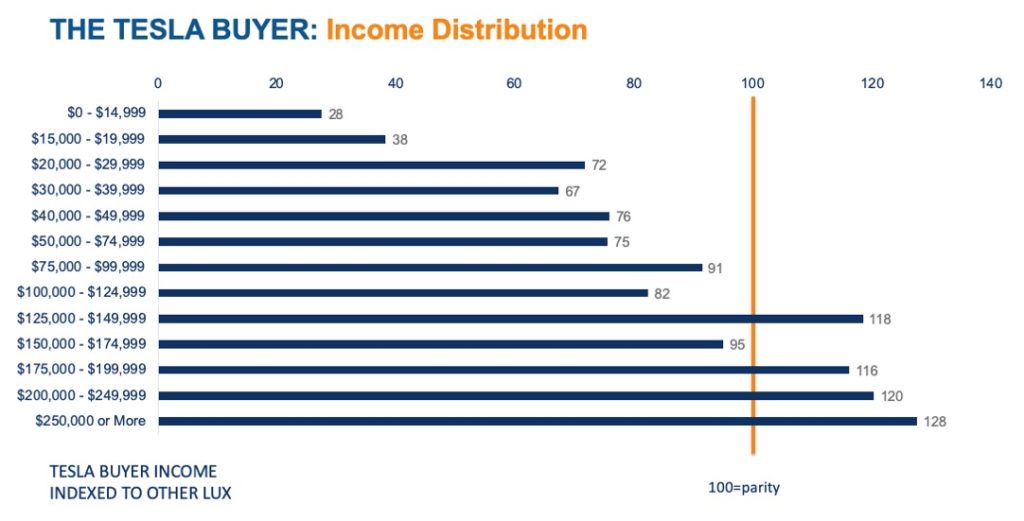

The tax credit certainly helped Tesla generate sales, but it’s doubtful the tax credit was the main purchase driver. Tesla buyers are early tech adopters. They are a unique, desirable demographic and particularly wealthy. Our research indicates 65% of Tesla buyers have annual incomes over $125,000, compared to 55% for other luxury brands.

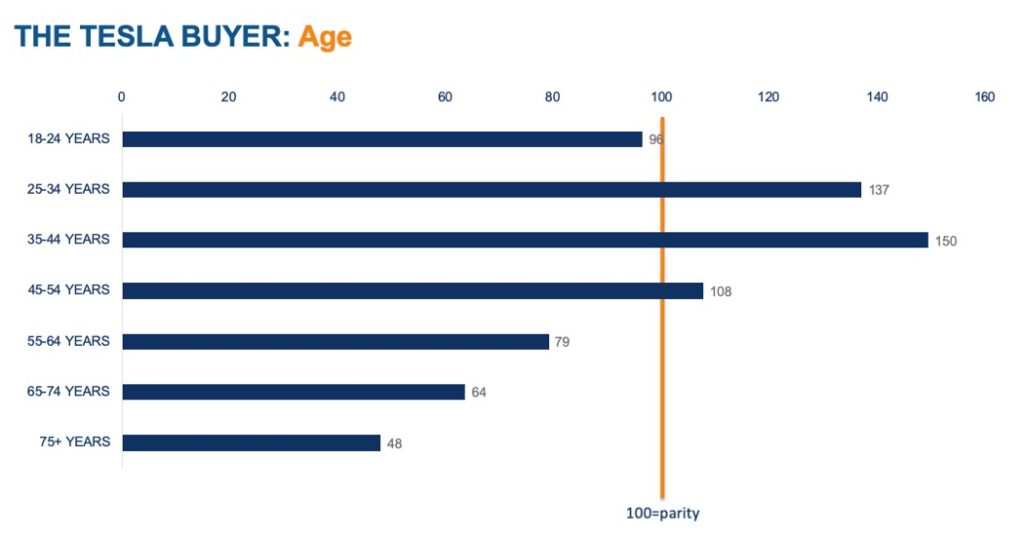

Compared to traditional luxury-vehicle buyers, they are more likely to be younger, male and of Asian descent.

Download all of the related graphs based on a Cox Automotive analysis of IHS Markit data.

The truth is, the average Tesla buyer represents a small, narrow demographic in our society: rich, young males working in tech-related industries. Traditional luxury brands spend their days working to attract these buyers. At the same time, with a limited product line, just three products right now, one can’t help but wonder how much upside is left in Tesla’s critical California market. Has Tesla reached a saturation point with this core demographic? At what point does the Model 3 become the Toyota Camry for the tech-industry – an excellent vehicle, but lacking the uniqueness high-end car buyers desire?

This fact can’t be lost on Tesla’s leadership, as they are desperately moving quickly to launch new product and establish sales in new markets. As even a novice in this industry knows: If you’re not growing, you’re dying. And new product and new markets is the only way to grow in automotive.

The challenge for Tesla this year will be to move beyond regional tech hotspots and begin to appeal to a wider demographic. Last week, Tesla won the right to sell its products in Michigan, which it had been trying to do for years. This settlement is a step forward in making Tesla products more easily accessible to more people. Prior to the agreement, Michiganders had to travel to neighboring states to buy a Tesla.

Currently, Tesla owns the tech world and the people who live there. They need to find new worlds, and that’s a challenge not only for Tesla but for the EV market in general. There were 16 EVs in the market in 2019. Our team puts the number at 54 by 2022. To achieve long-term success, Tesla – and the EV segment – will have to find new buyers.

Download Tesla Buyer Demographics Graphs

These graphs include an analysis of income distribution, age, gender and ethnicity of Tesla buyers.

Download