Data Point

Cox Automotive Analysis: Ford Motor Company’s Q1 2023 U.S. Market Performance

Monday May 1, 2023

Article Highlights

- Ford Motor Co. Q1 sales in the U.S. rose almost 10%.

- Ford slashed incentives to an average of $1,209 per vehicle.

- Ford’s average transaction price hit a new high of $55,711.

Driven partly by strength from its electric vehicles, Ford Motor Co. could deliver better-than-expected financial results for the first quarter of 2023 when it reports them on Tuesday, May 2.

Wall Street analysts expect a year-over-year decline in earnings on higher revenues. The consensus is that earnings per share will drop by 5%, but revenues will be up 13% to $36 billion. Ford closed 2022 on a negative note with lower-than-expected results due in part to write-offs from the shuttered Argo AI autonomous vehicle company.

Ford’s U.S. business could help its first-quarter bottom line as sales outperformed the industry, and Ford slashed incentives while hitting a new high for average transaction prices.

The U.S. is Ford Motor Company’s most important market. Here are some data points from Cox Automotive on the automaker’s Q1 market performance.

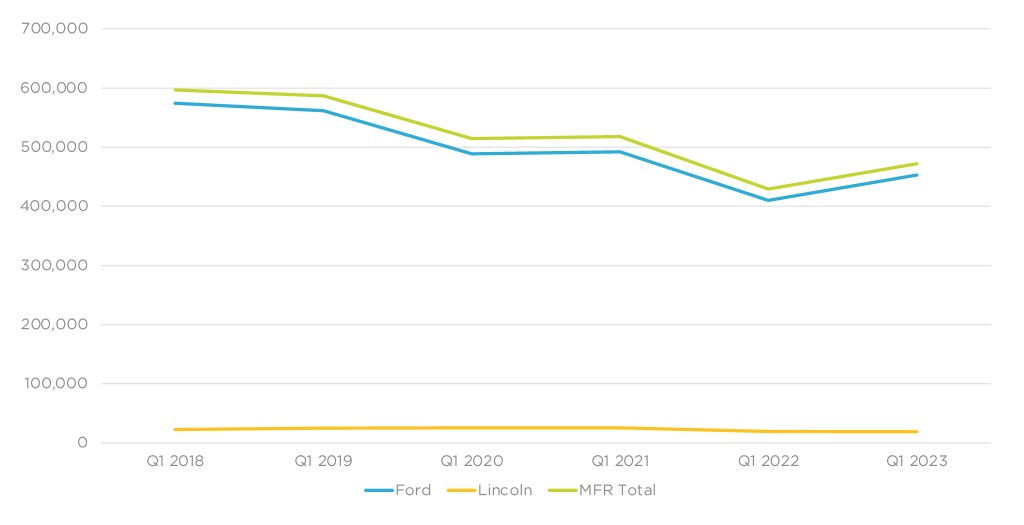

Sales Increase Along with the Industry

Ford Motor Co. sold 471,861 vehicles in Q1 2023, up almost 10% from the year before on strong EV, truck and SUV sales. Ford brand accounted for the bulk of the increase. The brand sold 452,927 vehicles, up 10% year over year.

Ford Motor Company U.S. Sales Performance for Q1 2023

Ford model sales were mixed with big gains and big losses. Thanks to robust fleet sales, the Transit van saw a boost of 86% to 32,015 units, up from just 17,211 units in 2022. Sales for the Expedition were up 99%, surpassing 2018’s pre-pandemic level, and the small Maverick pickup truck, which comes standard with a hybrid system and is optional with a gas engine, had a sales increase of 12% to 21,478 units. The new Bronco had a sales increase of 38% to 32,430 units, while its main competitor, the Jeep Wrangler, saw sales drop 17% for the quarter, implying that Bronco is attracting more conquest buyers. The Edge, Escape and Ranger pickup truck were all down between 23% and 47%, respectively.

The electric Mustang Mach-E declined 20% to 5,407 units, primarily due to the automaker’s plant being down for most of the first quarter as it prepares to boost production of the model. Though not an electrified model, Bronco had a sales increase of 38% to 32,430 units, while its main competitor, the Jeep Wrangler, saw sales drop 17% for the quarter, implying that the Bronco is attracting more conquest buyers. Ford’s all-important F-Series, which accounts for most of Ford’s sales and profits and includes the electric F-150 Lightning, increased a healthy 21% to 170,377 trucks.

Lincoln brand sales dipped by 1% to 18,934, its lowest sales for any first quarter in the past six years. Lincoln’s highest volume model, the Corsair, saw sales decline by 42%, while sales of the luxury Navigator were up 94%.

Ford Market Share Rises Incrementally

With Ford’s total sales rising nearly 10% and the industry up 8%, Ford gained 0.29 percentage points of share, according to Cox Automotive calculations. Ford’s total share increased to 13.7%, about even with its market share in 2021.

The Ford brand’s share accounted for the increase. Its share came in at 12.6%, up 0.34 percentage points. Lincoln’s share was 0.5%, off only 0.05 percentage point compared to Q1 2022, basically a rounding difference. Lincoln’s share has ranged from 0.5% to 0.6% in recent years.

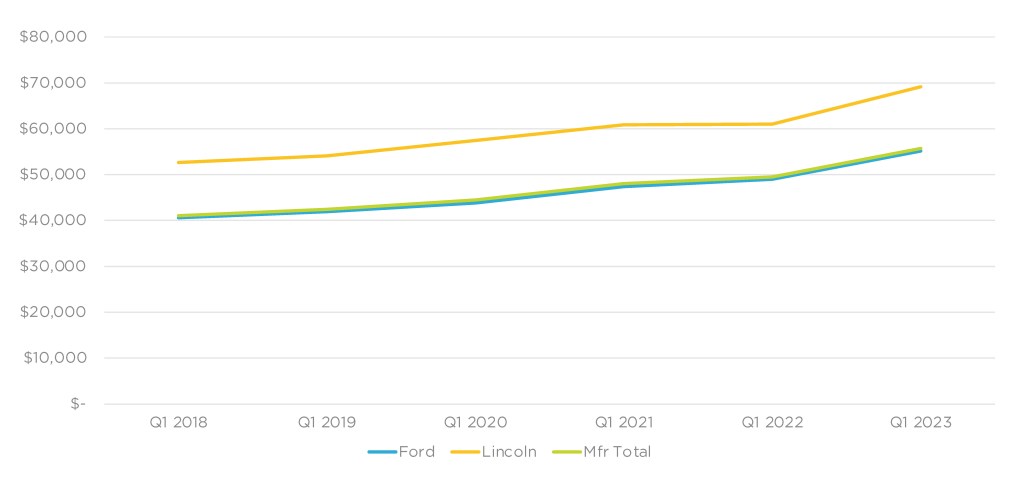

Ford Average Transaction Price Climbs to $55,711

Ford’s total average transaction price (ATP) climbed by 13% to a new high of $55,711 in Q1 2023, according to Cox Automotive calculations. Both brands saw ATPs jump to their highest level for any first quarter.

FORD MOTOR COMPANY U.S. AVERAGE TRANSACTION PRICE FOR Q1 2023

The Ford brand saw prices up nearly 13% to $55,149. The biggest gainer was the Transit commercial van, up 18% to $57,041. Transit Connect was up 15% to $35,541. The popular Bronco was up 10% to $57,012, while F-Series was up 7% to $65,727. Other models had single-digit increases. The electric Mustang Mach-E had an ATP of $61,941 in Q1 2023.

Lincoln’s ATP rose 13% to $69,158, the highest price in six years. The Navigator had the biggest percentage increase, up 8% to $105,291, the first time ever ATPs were over $100,000 in Q1. The Corsair was down 2% to $45,565.

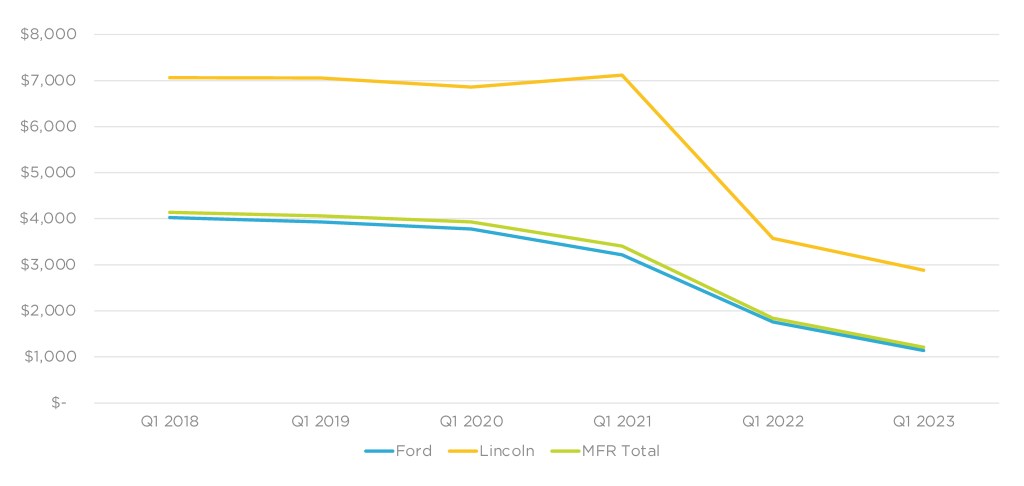

Ford Incentives Slashed Drastically

Ford Motor Co. slashed incentives by 34% to an average of $1,209 per vehicle, according to Cox Automotive calculations.

FORD MOTOR COMPANY U.S. INCENTIVE SPENDING FOR Q1 2023

The Ford brand chopped incentives the most, by more than 35% to an average of $1,139 per vehicle, the lowest in years. Before the chip shortage, the Ford brand typically spent more than $3,000 per vehicle on incentives.

Lincoln cut incentives by 19% to an average of $2,882 per vehicle, also the lowest in years by a wide margin. Before the chip shortage, Lincoln typically spent an average of more than $7,000 on incentives per vehicle.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the industry. She supports Cox Automotive’s OEM clients as well as the Mobility and Fleet Services business, focusing on Class 4-8 trucks and the freight market. Rydzewski joined Cox Automotive in March 2022.