Data Point

Cox Automotive Analysis: General Motors’ Q2 2023 U.S. Market Performance

Monday July 24, 2023

Article Highlights

- GM sales rose 19% year over year to 689,393, approaching pre-pandemic, pre-chip shortage levels.

- GM’s average incentive increased 14% to $2,006 per vehicle.

- GM’s ATP set a second-quarter record at $52,451.

General Motors’ higher vehicle sales and strong ATPs are expected to produce improved financial results from a year ago, when the automaker reports second-quarter earnings before the stock market opens on Tuesday, July 25.

Wall Street analysts have been upping their forecast for GM’s results throughout the second quarter and say they will not be surprised if GM exceeds their expectations, as has been the case for several quarters.

In the U.S., GM posted higher year-over-year sales in Q2 – up 19% – due to improved inventory. It also saw another rise in average transaction prices despite a significant boost in incentives. More importantly, some GM models that posted the biggest sales gains were large SUVs, with beefy profit margins.

GM also experienced a rebound in sales in China during the quarter. Sales were up 9% from the year-earlier quarter.

Here are some data points from Cox Automotive on GM’s Q2 market performance in the U.S., the General’s most important market.

GM’S Q2 Sales Nearly Back to Pre-Pandemic Level

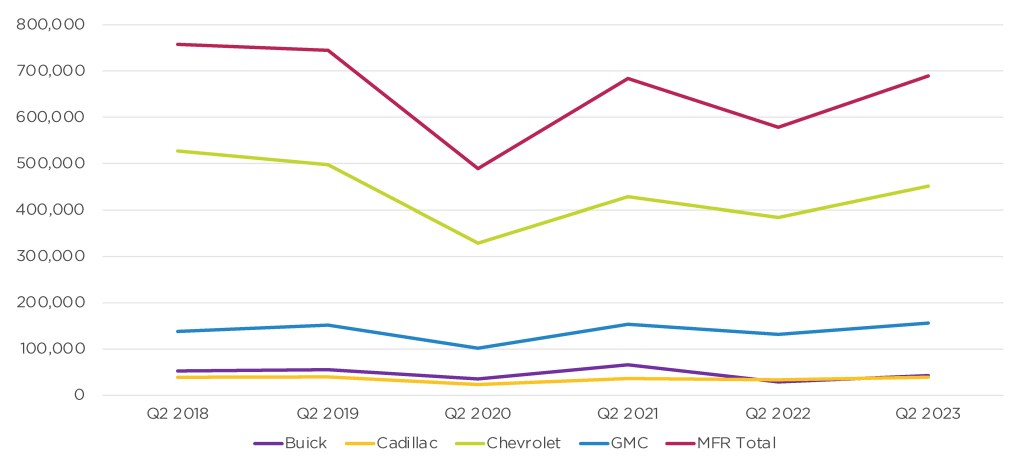

GM slightly outpaced the overall market, which had sales up 17% for the quarter. GM’s market share inched up a scant .33 percentage points to 16.75%, according to Cox Automotive calculations. Still, it was GM’s highest market share since the second quarter of 2019.

GM U.S. Sales Performance for Q2 2023

The high-volume Chevrolet brand had a nearly 16% sales increase to 394,120 vehicles. That remains well below pre-pandemic levels and roughly 75,000 units down from Q2 2018. Chevrolet SUVs made huge gains in the quarter, with the Trailblazer posting a 225% increase in sales. The Tahoe and Traverse had double-digit hikes. The all-important Silverado pickup posted a 4% gain in sales. On the other hand, the Equinox, the volume leader for Chevrolet SUVs, had a dip in sales. The electric Bolt models are back in production, posting a huge sales increase to just under 20,000 units. That helped GM become the No. 2 seller of EVs in the quarter, behind Tesla. The electric Silverado will go on the market soon.

Buick had the largest percentage increase among GM’s brands, nearly doubling, albeit on a low base after a dismal 2022. Sales rose to 38,138 units, still one of the lowest levels for the brand in the past six years of second quarters. All Buick models had sales hikes of double and even triple digits. Buick’s volume-leading Envision, imported from China, posted an increase of 242% to 14,077 units. The Encore GX was up triple digits as well.

Cadillac sales rose nearly 29% to 36,321 units, essentially returning the luxury brand to pre-pandemic volumes. Only sales of Escalade models dipped in the quarter, but that was from extremely high sales levels a year ago. All other models saw big double-digit gains. The Cadillac XT5 was the brand’s volume leader in the quarter, followed by the XT4. Cadillac sold 968 Lyriq EVs, a model which was not on sale until after Q1 2022.

GMC sales rose nearly 8% to 130,608 SUVs and trucks. The brand has not endured the roller-coaster of sales like other GM brands. Sierra pickup sales rose almost 19%. Acadia SUV sales were up 71%. Yukon XL sales were roughly flat, and Terrain and Yukon sales were down. GMC sold only 2 Hummer EVs in the quarter, half of what it did a year ago. Hummer production is expected to increase in the months ahead.

GM Market Share Returns to 2019 Level

GM slightly outpaced the overall market, which had sales up 17% for the quarter. GM’s market share inched up a scant .33 percentage points to 16.75%, according to Cox Automotive calculations. Still, it was GM’s highest market share since the second quarter of 2019.

Chevrolet’s share was 10.79%, up .07 percentage points for its highest share since the second quarter of 2019. GMC’s market share was the highest in at least six years at 3.79%, up .04 percentage points from the year-ago quarter.

Cadillac’s share nearly matched its year-ago share at .94%, off only .01 percentage points, for its second-highest market share in the past six years.

Buick’s share was 1.04%, up .22 percentage points from a year ago but still below pre-pandemic levels.

Brightdrop’s share of the U.S. market remains well below 1%, as the fledgling commercial-vehicle maker begins to add production.

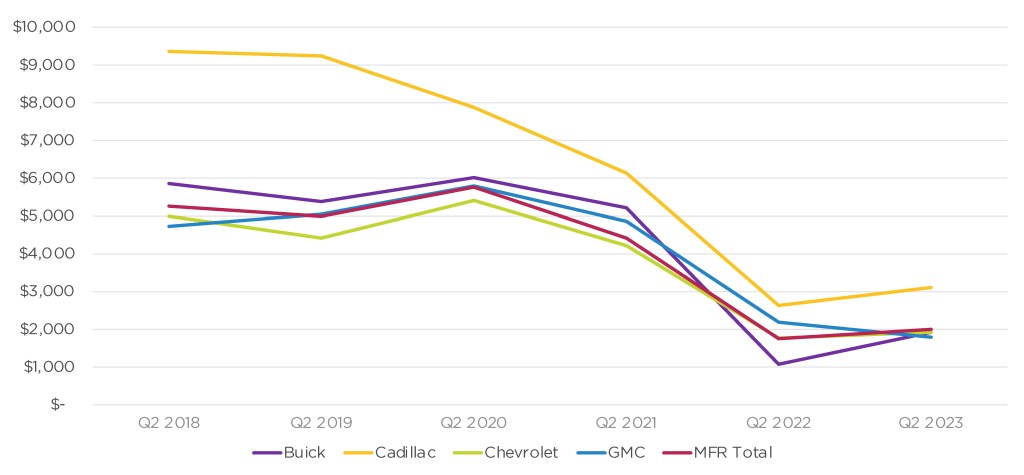

GM Boosts Incentive Spending to More Than $2,000 per Vehicle on Average

After cutting incentives through the chip shortage and inventory crunch, GM, like the industry, reversed course and increased incentives. GM’s average incentive was $2,006 per vehicle, up 14% from the year-ago quarter, according to Cox Automotive calculations. Industrywide, automakers spent on average $2,048 per vehicle, the highest amount since October 2021.

GM U.S. Incentive Spending for Q2 2023

Buick had the largest percentage increase in incentives, which may account for Buick’s highest percentage increase in sales. Buick incentives soared by 79% to an average of $1,923 per vehicle. That is still far below the $5,000 to $6,000 per vehicle Buick was spending in 2021 and earlier.

Cadillac boosted incentives by 18% to an average of $3,115 per vehicle, still well below the past when they were over $6,000 per vehicle in 2021 and more than $9,000 per vehicle in 2018 and 2019.

Chevrolet incentives had the lowest increase at up 9% to an average of $1,924 per vehicle, below the industry average and well below the $4,000 to more than $5,000 that Chevrolet spent what Chevrolet spent from 2018 and 2021.

GMC boosted incentives by 22% to an average of $1,993 per vehicle, also below the industry average and well below the $4,000 to $6,000 plus that GMC spent in the 2018-2021 period.

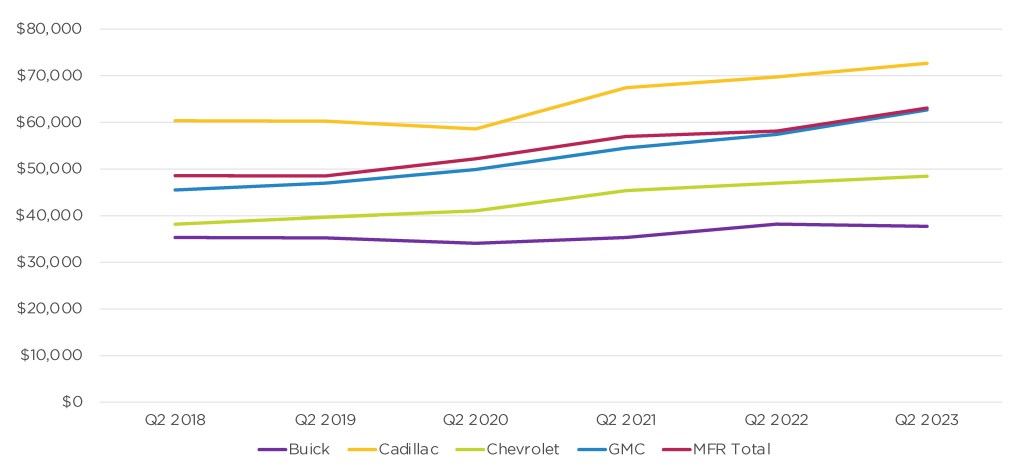

GM’s ATP Sets Quarterly Record at $52,451

GM’s average transaction price (ATP) rose by 4% to $52,451, a record high for any second quarter, according to Cox Automotive calculations.

GM U.S. Average Transaction Price for Q2 2023

GMC had the biggest hike in ATP, up 9% to $63,084, surpassing the $60,000 mark for any second quarter and boosted in part by the Hummer EVs. With new trim models introduced, Hummer’s ATP fell 13% to $99,320, though it was still GMC’s priciest model. Not far behind, the Yukon and Yukon XL had ATPs each rise by 12% to $83,619 and $86, 619, respectively. The new Canyon got a 15% boost to $47,400.

Cadillac’s ATP rose 4% to $72,688, the first time it surpassed the $70,000 mark in the second quarter. The CT4 had the biggest gain, up 11% to $55,018. The Escalade and Escalade ESV had small increases, pushing their ATPS to $112,478 and 114,100, respectively. The Lyriq EV had an ATP of $64,925.

Chevrolet’s ATP edged 3% higher to $48,459, its highest for any second quarter. The Corvette got a hefty 24% increase in ATP to more than $100,000. Suburban and Tahoe saw 8% increases, lifting both to more than $70,000. The Silverado gained 4% to $59,588. The new Colorado got a boost in ATP, pushing it over $40,000.

Buick’s ATP slipped by 1% to $37,769, but it was still higher than any second quarter before 2022. The Enclave is Buick’s most expensive model at nearly $53,000. The Encore has an ATP of just under $30,000. Envision falls in between at about $40,000.