Data Point

Cox Automotive Analysis: GM’s Q3 2020 U.S. Market Performance

Wednesday November 4, 2020

Article Highlights

- GM Q3 sales fell 10%, on par with the industry decline.

- GM incentives boosted incentives 6%, averaging $5,520 per vehicle.

- GM’s ATP rose 2% to $43,480.

General Motors reports third-quarter 2020 financial results Thursday, Nov. 5. If the better than expected results of Ford and Fiat Chrysler are any indication, GM should have a good quarter – on the strength of trucks and SUVs. Analysts predict GM’s revenues will be up.

Here are key data points from Cox Automotive on GM’s third-quarter performance in the U.S. market, where the company derives the bulk of its profits.

Sales and market share

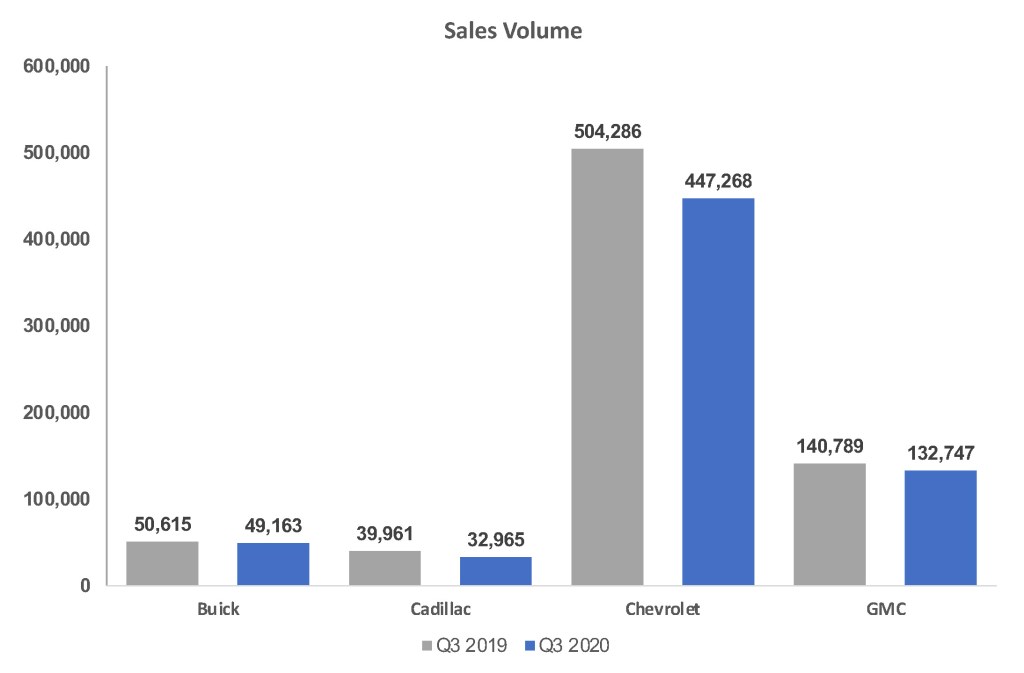

GM sold 662,143 vehicles in Q3, down 10% from the year earlier and on par with the industry’s decline. GM’s market share was flat at 17%. All division posted declines, with Cadillac’s drop the most and Buick’s the least.

GM’s highest volume division, Chevrolet, had sales drop by 11% to 447,268 units. GM truck sales were down, in part, due to tight inventories. In particular, Colorado, which had extremely limited stock, had sales down 14%. Silverado sales were off by 5%. Highlights of Chevrolet sales were the Blazer, up 45% to nearly 30,000 units, Bolt EV, up 18% to nearly 6,000 units, and the new Corvette, up 33% to 6,355 units.

Buick sold 49,163 vehicles, down 3%. Only one model, the Envision SUV, reported a gain in the quarter, and it was a big one. Envision sales were up 44% to 11,655 units. Buick is selling down a number of models, including all of its traditional cars as it repositions itself as an all-SUV brand.

Cadillac sales fell 18% to 32,965 vehicles. Cadillac is eliminating some models in its line, launching new ones and eventually moving to an all-electric brand. In Q3, the new CT4 added 1,536 sales. The relatively new XT6 also helped, boosting sales by 45% to 6,249 vehicles.

GMC’s sales of 132,747 trucks and SUVs dipped 6%. The full-size Sierra pickup truck eked out a 2% sales gain to its highest Q3 level in the past five years. Sales of other GMC models fell. Canyon, in short supply along with the Chevrolet Colorado, fell 13%.

Incentives

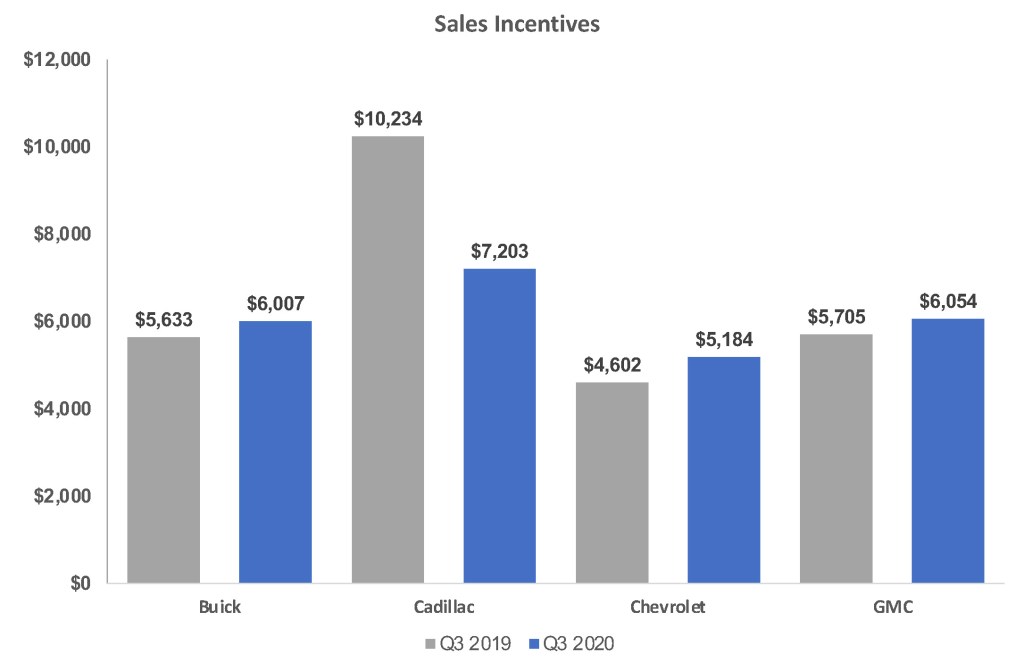

GM ramped up overall incentives by 6% in the quarter to an average of $5,520 per vehicle, according to Kelley Blue Book calculations. That is the highest level for any third quarter in the past five years. Three of GM’s four divisions increased incentives. Only Cadillac decreased them.

Cadillac reduced its incentives by 30% to a still high average of $7,203 per vehicle. In Q3 2019, Cadillac was offering a whopping $10,234 per vehicle in incentives. This year’s third quarter had incentives more in line with the range of the past five years.

Buick raised incentives by 7% to an average of $6,007 per vehicle. GMC raised its incentives by 6% to an average of $6,054, the highest Q3 level in the past five years. Chevrolet upped incentives by nearly 13% to an average of $5,184 per vehicle, likely to keep its trucks competitive and reaching its highest Q3 level in the past five years as well.

Average Transaction Prices

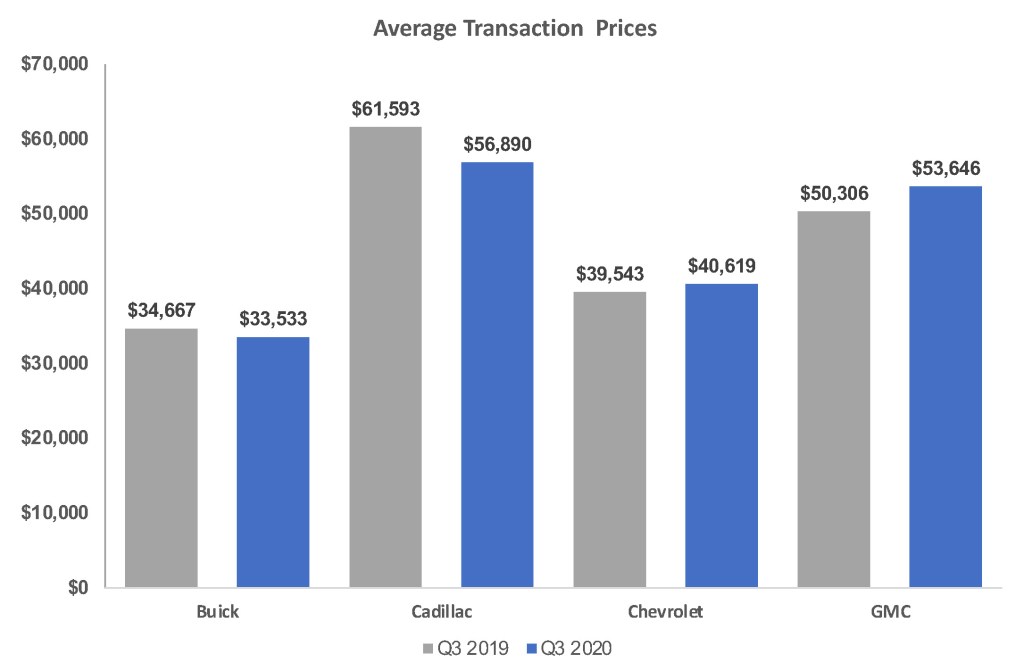

GM’s overall average transaction price (ATP) edged 2% higher to $43,480, according to Kelley Blue Book calculations.

Buick’s ATP dropped 3% to an average of $33,533 per vehicle, the brand’s lowest in five years. All Buick models had lower ATPs than they had a year ago.

Cadillac’s ATP fell 8% to an average of $56,890 per vehicle, off its high of $60,000-plus of the past couple years. It was a mixed bag of ups and downs by model.

Chevrolet’s ATP gained 3% to $40,619, surpassing the $40,000 mark for the first third quarter in the past five years. The new Corvette had a hefty 7% rise in ATP to an average of $78,087 per sports car, the highest in five years. Chevy’s new, big SUVs had higher ATPs: Tahoe, up 12% to $65,014; and Suburban, up 4% to $66,504. Silverado’s ATP rose 2% to an average of $49,408 per vehicle.

GMC posted a 7% rise in ATP, at an average of $53,646 per vehicle, its highest third-quarter ATP in the past five years. The Sierra’s ATP rose 9% and surpassed the $60,000 mark – $61,136, to be exact. The ATP for the Savana cargo van rocketed by 21% to an average of $42,194. As with Chevrolet, GMC’s new, large SUVs grabbed higher ATPs. The Yukon’s ATP is up 9% to $72,622.