Data Point

Cox Automotive Analysis: General Motors’ Q3 2023 U.S. Market Performance

Monday October 23, 2023

Article Highlights

- GM sales rose 21%; market share was 16.83%, nearing pre-pandemic levels.

- GM’s average incentive of $2,299 per vehicle was up 56% from a year ago and an increase from this year’s second quarter.

- GM’s ATP of $52,117 was up from a year ago but down from the second quarter.

The UAW strike against GM and the other Detroit automakers will overshadow what had been expected to be a solid quarter for the automaker, which reports third-quarter financial results before the stock market opens on Tuesday, Oct. 24.

The UAW strike started Sept. 15 against three U.S. assembly plants, one for each automaker. GM’s Wentzville, Missouri, plant that makes its midsize Chevrolet Colorado and GMC Canyon pickup trucks, which were just being introduced in redesigned form, was hit by the strike. A plant in Lansing, Mich., which makes the Chevrolet Traverse and Buick Enclave, later was targeted. Other assembly plants have been impacted by the strike, forcing GM to lay off workers.

At the close of the third quarter, GM acknowledged that the strike had cost it $200 million in lost revenue to that point. Analysts put the cost higher than that, up to $500 million. One analyst said GM is losing $21 million a day in revenue. Another suggested GM would lose up to $2 billion if the strike passes eight weeks. On GM’s third-quarter conference call, analysts will grill GM on this issue.

In reporting its U.S. third-quarter vehicle sales, GM said that it ended the quarter with the largest inventory of new vehicles on dealer lots since 2020, the first year of the pandemic. However, of the Detroit automakers being struck by the UAW, GM is the most vulnerable because its Chevrolet and Cadillac brands have the lowest supply of the Detroit Three brands. More specifically, the supply of big profit-generating models like the Cadillac Escalade, Chevrolet Tahoe and Suburban, and GMC Yukon and Yukon XL are below average and the most vulnerable.

Strike aside, improved inventory levels did help GM’s third-quarter sales gain, outpacing the industry and leading to a slight increase in market share. Like the rest of the industry, GM’s incentives were up from a year ago and from the second quarter, though incentives at GM remain historically low and fell below the industry average in the quarter. Also, like the rest of the industry, GM saw another rise in average transaction prices, however, it was a minuscule increase. Average transaction prices, which soared through the pandemic and chip shortage, have increased at a far slower pace, flattened or even retreated in some cases.

Here are some data points from Cox Automotive on General Motors’ third-quarter market performance in the U.S., the automaker’s most important market.

GM’s Q3 Sales Up 21%, Outpacing the Industry

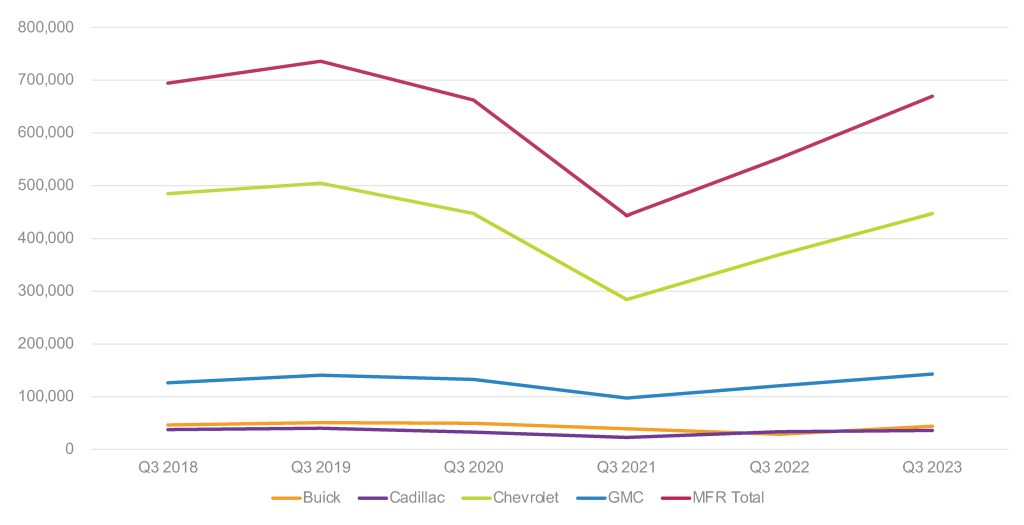

GM sold 669,199 vehicles in the third quarter, up 21% from the 2022 third quarter but down from the second quarter. It was GM’s highest level of third-quarter sales since 2019.

GM U.S. Sales Performance for Q3 2023

The high-volume Chevrolet brand had sales of 446,815 vehicles, up 21% from the year-ago quarter. More models had increases, many of them double-digit percentage gains, than had declines.

The all-new, completely redesigned Trax, which went on sale earlier this year, had a nearly 500% increase in sales to about 38,000 units for the quarter. Trailblazer was up 76% to more than 30,000 units. Traverse climbed 27% to more than 32,000 units, but production of the Traverse was halted in late September due to the strike at the plant that makes it. The highly profitable Silverado saw sales increase by 21% to 139,351.

The Suburban and Tahoe, both in low supply, had sales declines. The Bolt EUV, which goes out of production by year-end, was down 21%, but the regular Bolt nearly doubled sales.

Cadillac saw sales increase to 35,638 in the quarter, up only 6% from a year ago – the smallest sales gain of GM’s four brands and the lowest volume of the four, being outsold in the quarter by Buick.

Cadillac Escalade and Escalade ESV, both in low supply, were up 12% and 1%, respectively. The CT5 had sales up 47%. The Lyriq EV kicked in more than 3,000 sales. Sales of the XT4, XT5, XT6 and CT4 were down.

Buick in the third quarter – as was the case in the second quarter – had the biggest percentage gain among GM’s four brands. Sales soared by 54% to 43,978, Buick’s highest sales volume for the quarter since the third quarter of 2020. After a few years of being in a sales slump, Buick is headed back toward its pre-pandemic, pre-chip shortage volume.

Sales of its volume-leading model, the Encore GX, doubled to more than 20,000 units. Sales of the Enclave, which is made at a plant now on strike, rose 34% to more than 10,000 units. Sales of the Envision, imported from China, were flat at just over 7,000 units. The Encore, replaced by the Encore GX, was down 80% to only 701 units.

GMC sales climbed 19% to 142,768 vehicles, the brand’s highest Q3 volume in the past six years. The volume-leading Sierra, a profit maker for GM, had a 46% gain to 73,219 sales. Sales of the Yukon and Yukon XL, in short supply, were up single digits. GMC Hummer EV sales – both the pickup and SUV – were up significantly, but Hummer is still in the launch phase, and sales for the quarter totaled just over 1,000 units.

GM’s new commercial unit, Brightdrop, is still in start-up mode and sold a mere 35 EVs. GM idled production in Canada of its electric delivery vans until spring.

GM Outpaced the Market, Edging Up Market Share

GM outpaced the overall market, which had sales up 16% for the quarter. GM’s market share inched up 0.69 percentage points to 16.83%, according to Cox Automotive calculations. GM’s market share has rebounded, nearing pre-pandemic, pre-chip shortage levels.

Chevrolet’s share was 11.24%, up .44 percentage points, its highest share for the quarter since 2020. GMC’s market share hit 3.59%, the highest since at least 2018 for the quarter. Cadillac’s share stood at just under 1%, its highest share since the third quarter of 2019. Buick’s share edged up as well to 1.11%, more in the territory it had been before its recent two-year slump.

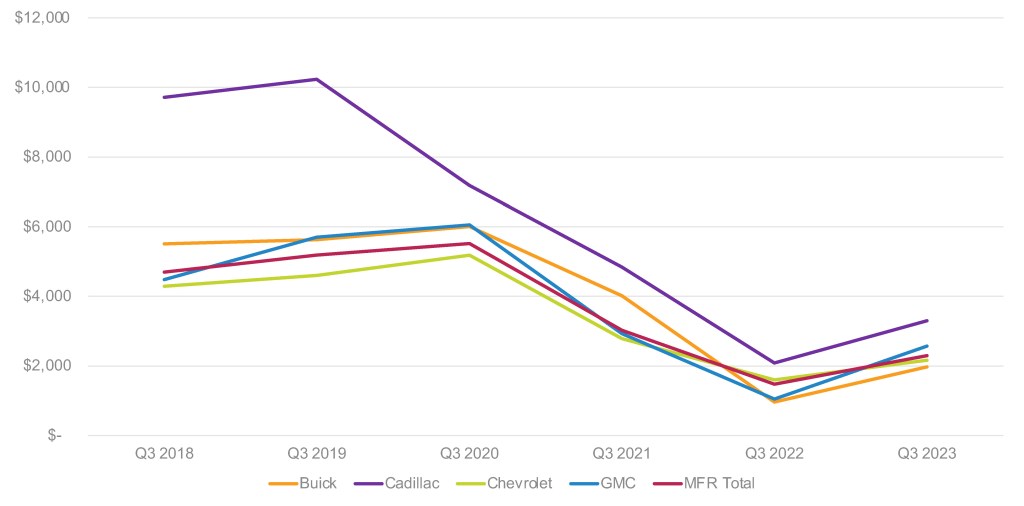

GM Boosts Incentive Spending to an Average of More Than $2,000 Per Vehicle

After cutting incentives through the chip shortage and inventory crunch, GM, following the industry trend, increased incentives further in the third quarter. GM’s average incentive was $2,299 per vehicle, up 56% from the year-ago third quarter and up from $2,006 per vehicle in this year’s second quarter, according to Cox Automotive calculations. Before the chip shortage, GM spent on average between $3,000 and $5,500 per vehicle on incentives. GM’s third-quarter average incentive is below the industry average of $2,368 per vehicle but the highest for the company in the past 24 months.

GM U.S. Average Incentives for Q3 2023

GMC had the biggest increase in incentives in the quarter, up 145% for an average of $2,567 per vehicle and up from an average of $1,993 per vehicle in the second quarter. However, GMC is still spending far less than before the chip shortage, when incentives averaged between $3,000 and $5,500 per vehicle.

Buick had the second largest percentage increase, with incentives up 104% to an average of $1,968 per vehicle, only slightly more than Buick spent in the second quarter.

Cadillac boosted incentives by 58% compared to one year ago to an average of $3,296, up slightly from the $3,115 average incentive in the second quarter. Still, Cadillac incentives are far lower than in the past when they ranged from $4,500 to $6,000 per vehicle.

Chevrolet incentives had the lowest percentage increase, still a healthy 35% bump to an average of $2,166 per vehicle. Before the pandemic, Chevrolet incentives ranged from an average of $3,000 to $6,000 per vehicle.

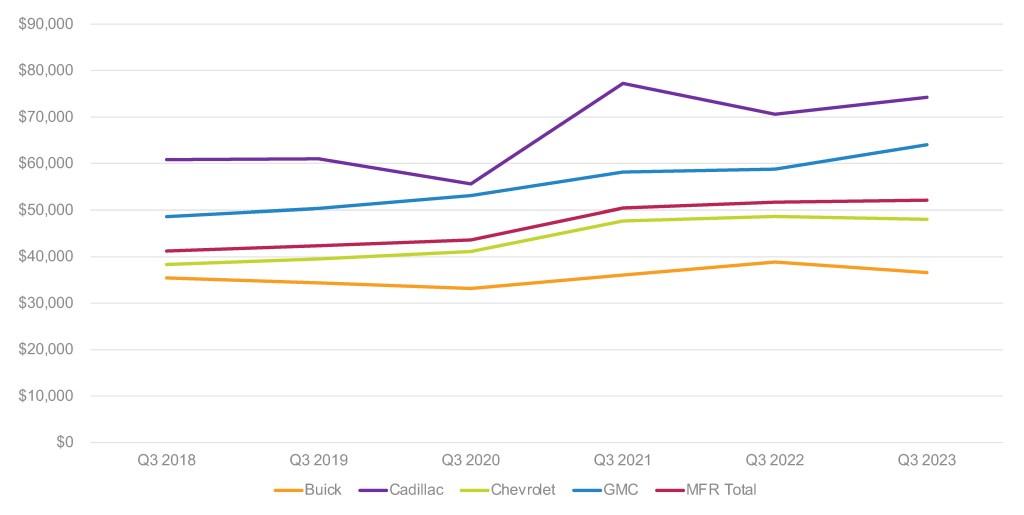

GM’s ATP Edged 1% Higher to 52,117, Off the Second-Quarter Record

GM’s average transaction price (ATP) edged 1% higher to $52,117, the highest ever for a third quarter but down from the second-quarter record of $52,451, according to Cox Automotive calculations.

GM U.S. Average Transaction Price for Q3 2023

GMC had the biggest hike in ATP, up 9% to $64,049, the highest ever for a third quarter and up $1,000 from the second quarter. The Canyon, just launching in redesigned form when the strike hit the plant that makes it, had a 20% jump in ATP, putting it at nearly $50,000. Aside from the Hummer models, the Yukon XL is GMC’s most expensive model at $87,284, followed by the Yukon at $83,531. The low-volume Hummer EV and EV SUV have an estimated ATP of $128,256. The ATP for the volume-leading Sierra pickup edged 4% higher to $71,718. ATPs for the Terrain and Acadia were flat.

Cadillac’s ATP rose 5% to $74,224, its highest for a third quarter and above the second quarter’s $72,688. The Lyriq EV had the biggest bump, up 13% to $65,983. The Escalade models had small increases pushing their ATPS to $114,004 for the Escalade and $116,496 for the Escalade ESV.

Chevrolet’s ATP edged 1% higher from a year ago to $48,074. Chevrolet’s average ATP in the third quarter was down from the record $48,459 in the second quarter. The Corvette, Chevrolet’s most expensive model, had a hefty 18% hike in ATP to more than $103,000. The Colorado, the newly redesigned midsize pickup produced at a plant now on strike, had one of the biggest gains, up 9% to $42,239. Suburban and Tahoe had gains of 5% and 6%, respectively, to $76,594 and $72,976. The ATPS for the soon-to-be-discontinued Bolt and Bolt EUV fell double digits, as price pressure builds in the EV segment.

Buick’s ATP dropped 6% to $36,590 from a year ago and was down from $37,769 in the second quarter. The large volume of the Encore GX pulled down the brand’s ATP. The Encore GX’s ATP edged down 1% to $29,725. The Encore is Buick’s least expensive model at $26,267, which was down 4% from a year ago. The Enclave’s ATP dipped 3% to $52,294, still Buick’s most expensive model. The Envision’s ATP eked out a 1% rise to more than $40,000.