Data Point

Cox Automotive Analysis: GM’s Q4 2021 U.S. Market Performance

Monday January 31, 2022

Article Highlights

- GM was outsold by Toyota in the fourth quarter and full-year 2021 for the first time.

- GM slashed incentives by 65% to an average of just under $2,000 per vehicle.

- GM’s average transaction prices soared 19% to just shy of $54,000.

General Motors reports fourth-quarter and full-year 2021 financial results after the stock market closes on Tuesday, Feb. 1, and is expected to post solid results.

The headline news for the year was that GM was outsold by Toyota, in the fourth quarter and for the full year. GM vastly underperformed the U.S. market in sales in the fourth quarter, causing its market share to plummet. Still, GM is expected to report solid earnings because it slashed incentives and garnered hefty average transaction prices (ATP) despite lower sales. GM clearly focused on the production of its high-ticket models, some of which had sales increases combined with ATP gains.

Here are the key data points from Cox Automotive on GM’s fourth-quarter performance in the U.S. market, which accounts for the bulk of GM’s revenue and profits.

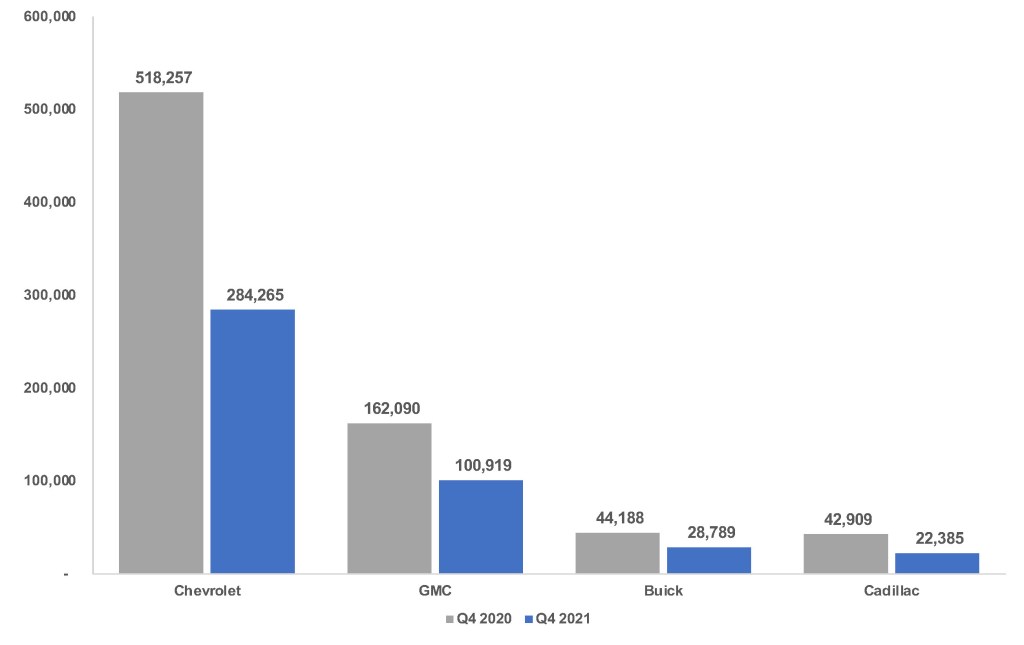

Sales and Market Share

GM sales plummeted by 43% to 436,358 vehicles in the fourth quarter. Due to the global computer chip shortage that caused production cuts and inventory shortages, GM vastly underperformed the overall market, which was down 21% in the quarter. That resulted in market share plunging to 13.2% from 18.3% in the year-earlier quarter.

SALES VOLUME

GM’s volume-leading Chevrolet brand tumbled 45% to 284,265 vehicles. Of all GM brands, Chevrolet had the biggest falloff in market share, down 3.8 percentage points to 8.6%. The only models that posted sales hikes were its big SUVs, the Tahoe and Suburban. Chevrolet sold virtually no Bolt EVs in the quarter due to the recall that triggered a production shutdown while new batteries were installed into the recalled Bolts.

Trailblazer, Corvette and Camaro had the smallest declines – in the single digits. The rest of Chevrolet’s line saw hefty double-digit decreases.

GMC sales were down 38% to 100,919 units. The Savana van, on the strength of a strong commercial market, had a 37% gain in sales. The Yukon XL was the only other GMC model to post an increase, up 16%.

Buick was down 35% to 28,789. The Envision SUV was its only model to report a sales gain, up 10%.

Cadillac’s quarterly sales dropped 47.8% to 22,385, representing the largest year-over-year decrease among the GM brands. Only two models – the Escalade and Escalade ESV – saw meager increases of 1.7% and 3.1%, respectively.

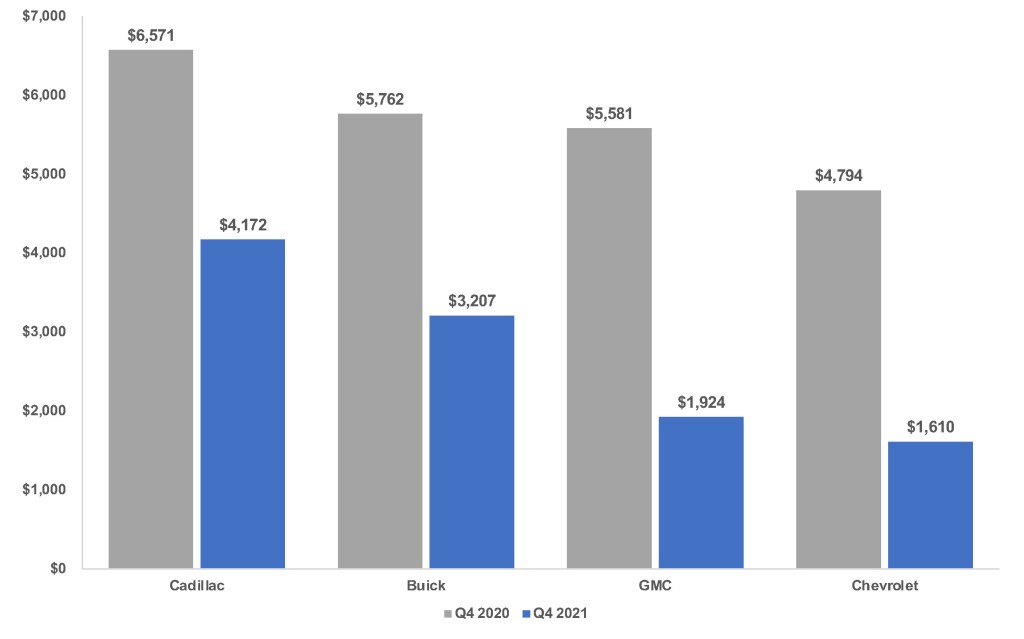

Incentives

The lack of inventory meant GM had no need for big incentives. In total, GM slashed incentives by 65% to an average of $1,919 per vehicle, compared with $5,115 per vehicle in the fourth quarter of 2020, according to Cox Automotive calculations.

INCENTIVE SPEND

Chevrolet accounted for the biggest drop, down 66% for an average of $1,610 per vehicle. GMC also saw a 66% decline to an average of $1,924 per vehicle. Cadillac still had the highest incentives at an average of $4,172 per vehicle, but they declined by 37%. Buick cut discounts by 44% to an average of $3,207 per vehicle.

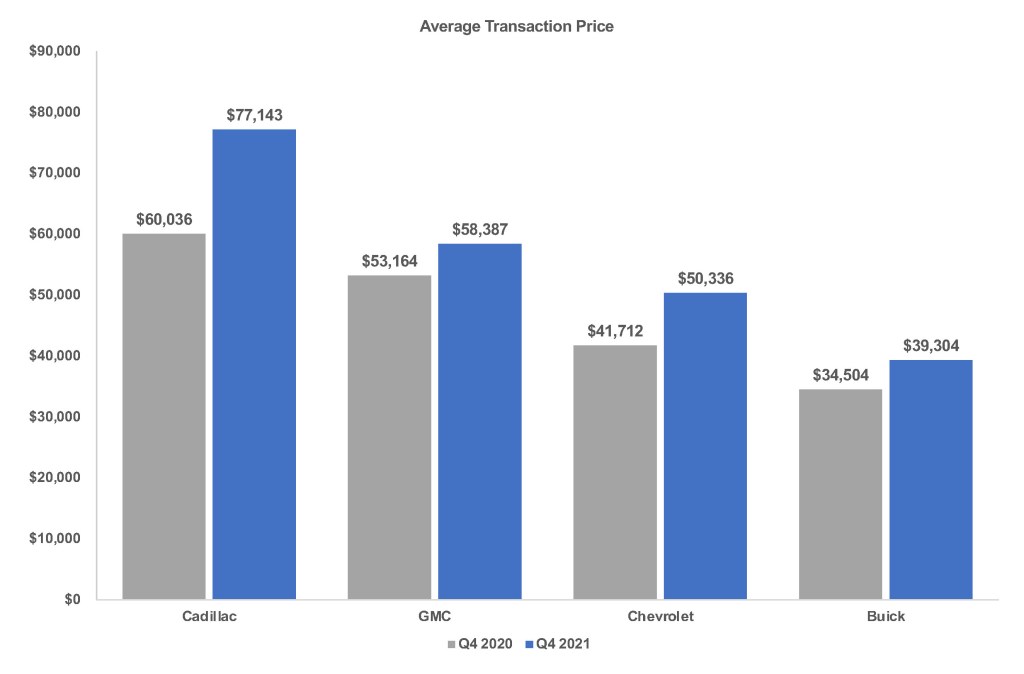

Average Transaction Prices

Also, like other automakers, GM experienced a boost in average transaction prices (ATP). GM’s overall average transaction price (ATP) rose 19% to $53,797 in the fourth quarter of 2021, according to Cox Automotive calculations.

Average Transaction Prices

Cadillac had the biggest increase, up 29%, to $77,143, or over $17,000 more than in the fourth quarter of 2020. All Cadillac models had higher ATPs, but the biggest increases were on Cadillac’s biggest ticket models. The Escalade’s ATP climbed 12% to $107,336, and the Escalade ESV was up 10% to $108,093.

Volume-leading Chevrolet had the next biggest hike. Its ATP was up 21%, putting it at over $50,000 – $50,336, to be exact. The gains were largely across the board, except for models that are still being sold but have been discontinued. The biggest increases were for the Express delivery van and the Camaro sports car, each with an ATP over $44,000. Chevrolet’s bestseller, the Silverado pickup, had an 8% gain in its ATP to $54,432. Chevrolet’s lowest ATP on vehicles still in production is for the Spark subcompact at $17,258. The most expensive, of course, is the Corvette with an ATP just shy of $85,000.

Second to Cadillac, GMC had the next highest ATP at $62,501, up 14%. The Acadia SUV – up 13% to $48,136 – and Canyon pickup truck – up 10% to more than $41,000 – had the biggest gains. The best-selling Sierra had an ATP of $63,181, up 5%. GMC’s most expensive models are the Yukon at $75,440 and Yukon XL at $78,779.

Despite being categorized as a luxury brand, Buick had the lowest overall ATP of all GM brands, up 14% to $39,304. All four of Buick’s models had gains. The two Encore models have ATPs under $40,000. Buick’s priciest model is the Enclave with an ATP of $51,283. The Envision posted the biggest increase, up 10% to just shy of $40,000.