Data Point

Cox Automotive Analysis: Honda’s Quarterly U.S. Market Performance

Tuesday November 8, 2022

Article Highlights

- Honda’s quarterly sales fall 36% from a year ago for a 6.5% market share.

- Honda slashed incentives by 56% to an average of $896 per vehicle.

- Honda’s average transaction price rose 13.7% to $39,297.

Few brands have been squeezed more on supply because of the global chip shortage than Honda, and it has been most hurt on sales.

Honda reported lower U.S. sales in September, marking 14 straight months of decline; the last time the Honda brand posted a year-over-year sales gain in the U.S. was July 2021. Sales for the July-September quarter also dropped, making it the fifth consecutive quarter of losses.

For the past year, Honda had the lowest inventory of any automaker in the U.S. Globally, the company was forced to cut output in its factories, primarily in China and Japan, due to parts shortages and shipping issues.

In the U.S., Honda sales fell 36% in the quarter. At the same time, demand was high for vehicles from Honda, which is the nation’s fuel-efficiency leader. High gas prices triggered high demand for Honda’s hybrids and fuel-efficient models, but the inventory for those was among the lowest of the low. Honda stated that its focus will be on getting vehicles to waiting consumers.

On the plus side, Honda slashed incentives by 56% to under $1,000 per vehicle for the first time in years and increased its average transaction price (ATP) by 13.7% to $39,297. Popular models in short supply had the biggest increases.

Here are some data points from Cox Automotive on Honda’s quarterly market performance in the U.S.

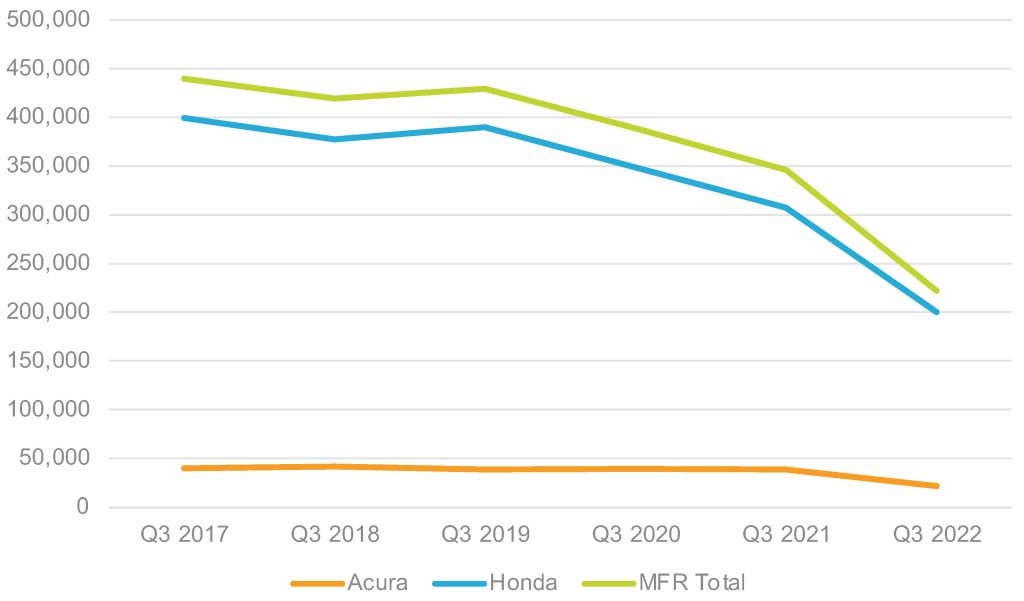

Low Inventory Led to a 36% Year-Over-Year Drop in U.S. Sales

American Honda’s U.S. sales totaled 222,049, down 36% from a year ago and over 100,000 below the 345,000 plus of the first quarter of 2021. Honda’s total market share dropped to 6.5%, down 3.6 percentage points. In 2021, Honda owned more than 10% of the market.

Honda U.S. SALES PERFORMANCE FOR Q2 FISCAL YEAR 2023

Honda brand sales totaled 200,257 vehicles, down 35%. That pushed its market share down 3.1 percentage points to 5.9%. The majority of Honda models were down by double digits in sales for the quarter – Accord 31%, HR-V 47%, Civic 59%, CR-V 19% and Pilot down 28%. The only exception was the U.S.-built Ridgeline, with a 92% sales increase to 12,515 vehicles, up from 6,502 in the same quarter a year ago.

Acura sales dropped by 44% to 21,792 units. Its market share fell to 0.6%. Acura had one model, the low-volume NSX sports car, with higher sales in its final year of production. NSX sales were up 52% for the quarter. All other models saw double-digit declines, the biggest being the TLX, with a decrease of 73%.

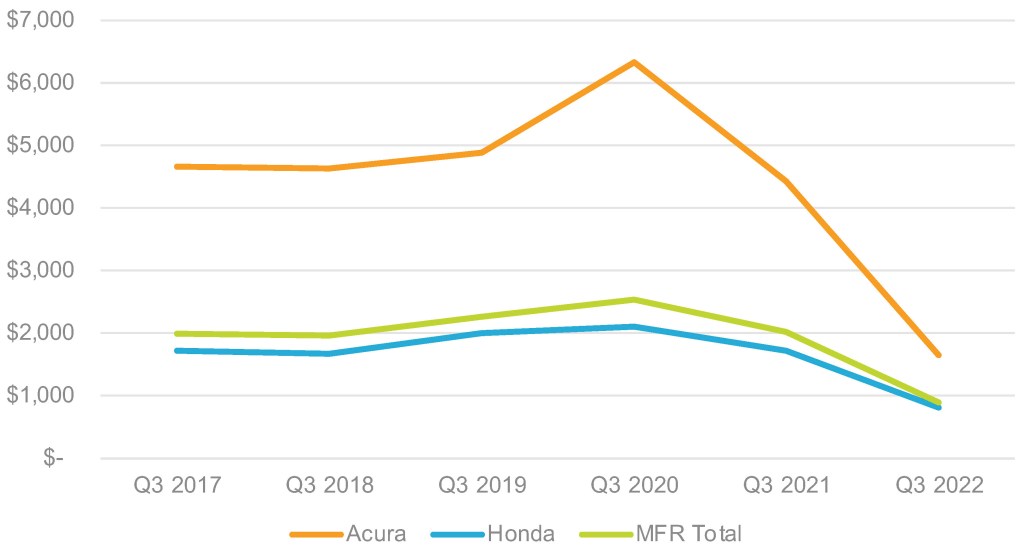

Honda Cut Incentives by 56% to Under $900 per Vehicle

Honda drastically slashed incentives. In total, Honda cut incentives by 56% to an average of $896 per vehicle, according to Cox Automotive calculations. It was the first time in the past six years for the quarter that incentives averaged below $1,000 per vehicle. This was below the industry average ATP of $1,079 for the quarter.

Honda U.S. INCENTIVE SPENDING FOR Q2 FISCAL YEAR 2023

Honda brand incentives were slashed by 53% to an average of $814 per vehicle, the first time in the quarter it fell below $1,000 per vehicle. Acura incentives were reduced by 63% to an average of $1,650 per vehicle, though the past five years, Acura incentives averaged more than $4,000 per vehicle.

Honda’s Average Transaction Price Rose to Over $39,000

Honda’s overall ATP rose 13.7% to $39,297, according to Cox Automotive calculations. The average transaction price for the Honda brand was $37,728, up 14%. Popular models such as the Accord and Civic rose 9% and 13%, respectively. The highest increases were for the newly redesigned HR-V, up 15% to $30,388, and the Odyssey, also up 15% to $48,360.

The average transaction price for the Acura brand was $53,722, up 14%. Acura models all showed increases, with the biggest being the NSX, which saw ATP rising 28% for the quarter.

Rebecca Rydzewski is a research manager for economic and industry insights for Cox Automotive.