Data Point

Cox Automotive Analysis: Honda Motor Company’s Quarterly U.S. Market Performance

Wednesday November 8, 2023

Article Highlights

- Honda’s quarterly U.S. sales rose 53% for an 8.5% market share.

- Honda increased incentives by 86% to an average of $1,666 per vehicle.

- Honda’s average transaction price decreased by 3% to $38,159.

With the computer chip shortage easing since last year, American Honda Motor saw improved production and higher inventory. Better product availability has led to substantially higher U.S. sales of late and should help boost Honda Motor’s overall revenue when quarterly results are reported Nov. 9.

Inventory on core models, in particular, improved significantly, prompting a 53% increase in U.S. sales of Honda cars and SUVs for the July-to-September quarter, which is the second quarter of Honda Motor’s fiscal year. Still, some vehicles, like the Pilot SUV, remained inventory-constrained, leading to lower sales.

As with other automakers, American Honda boosted incentives while prices softened. Honda raised incentives by 86% to an average of $1,666 per vehicle, the first hike since 2021. The automakers’ average transaction price (ATP) dropped by 3% to $38,159.

Here are some data points from Cox Automotive on Honda’s U.S. market performance in the latest quarter.

Sales and Market Share Up from Year-Ago Levels

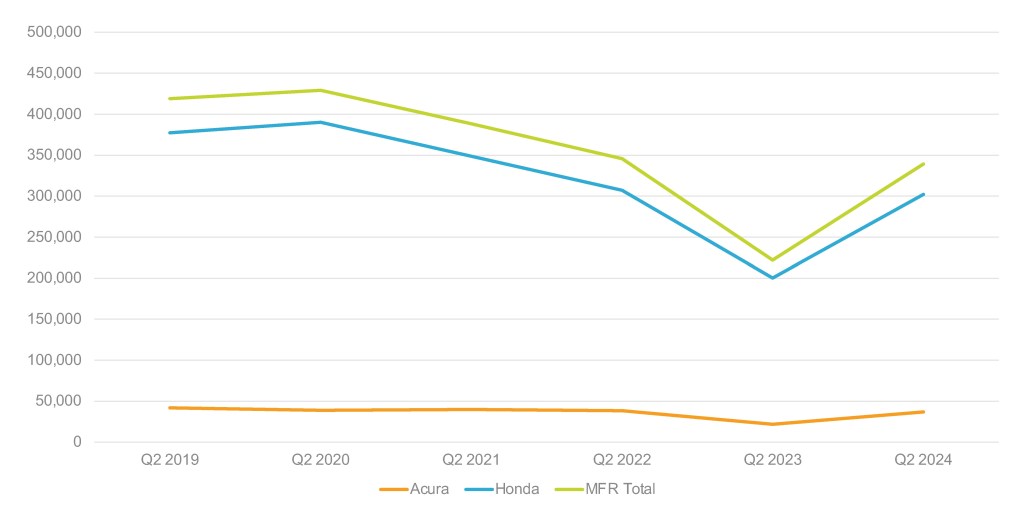

American Honda’s U.S. sales totaled 339,143 in the quarter, up 53% from the same quarter a year ago. Though Honda’s total market share was up 2 percentage points to 8.5%, it remains below pre-pandemic levels.

Honda U.S. SALES PERFORMANCE FOR Q2 FISCAL YEAR 2024

Honda brand sales totaled 302,250 vehicles, up 51%, far exceeding the industry’s sales increase of 16% for the quarter. Honda brand’s market share increased to 7.6% in the most recent quarter from 5.9% in the same quarter one year ago, a 1.7 percentage point increase. Most of Honda’s models jumped in quarterly sales – Accord by 74%, Civic by 104%, CR-V by 59%, Odyssey by 64% and the HR-V by 70%. The Pilot and Ridgeline both had a 3% sales drop.

Acura’s U.S. sales soared by 69% to 36,893 units, beating the market. Its market share increased to 0.93%, a 0.29 percentage point gain.

Acura had four models post sales gains – the TLX, the volume-leading MDX SUV, the new Integra and the RDX. Acura’s core model, the popular MDX, was up 35%, selling 12,955 units. Acura sold 8,320 units of the newly resurrected Integra, an 83% gain year over year. TLX sales were up 101% to 4,091 units, while the RDX was up 108%.

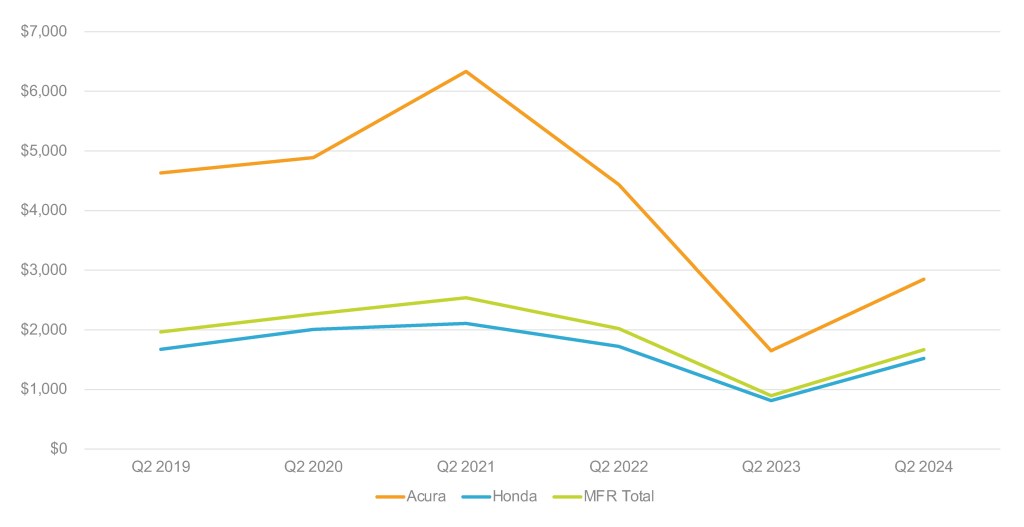

Honda Raised Incentives for the Quarter, Still Behind Industry Average

Always among the lowest for incentive spending, American Honda boosted incentives in the latest quarter. In total, Honda raised incentives by 86% to an average of $1,666 per vehicle, according to Cox Automotive calculations. Honda was still below the industry average of $2,368 for the quarter.

Honda U.S. INCENTIVE SPENDING FOR Q2 FISCAL YEAR 2024

Honda brand incentives were up 87% to an average of $1,521 per vehicle. Acura incentives increased by 73% to an average of $2,853 per vehicle after hitting a record high of $6,334 per vehicle in 2020 during the pandemic.

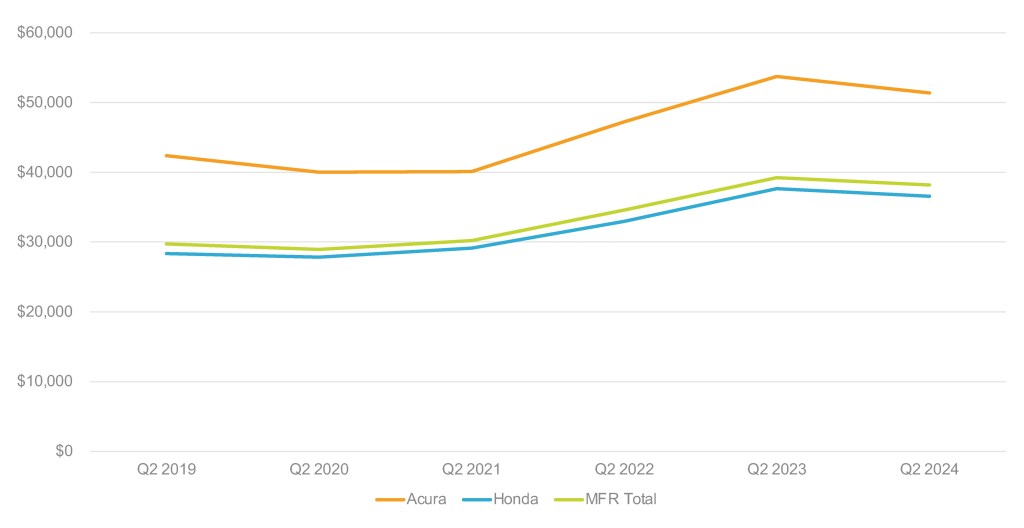

Honda’s Average Transaction Price Hits Declines in the Second Quarter

The Honda brand’s overall ATP dropped 3% to $36,542 compared to the same quarter in 2022, according to Cox Automotive calculations. Only two models saw price increases – Pilot, up 8%, and the CR-V, up 3%. Prices for the rest of the lineup decreased by single digits.

Honda U.S. AVERAGE TRANSACTION PRICE FOR Q2 FISCAL YEAR 2024

The TLX and Integra saw price increases of 5% and 4%, respectively. The MDX was down 3% to $60,852. The RDX was also down 3% to $49,347.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the automotive industry. She provides industry and data analysis using consumer and industry data from Cox Automotive and its brands including Autotrader and Kelley Blue Book. Rydzewski joined Cox Automotive in March 2022.