Data Point

Cox Automotive Analysis: Honda Motor Company’s Quarterly U.S. Market Performance

Tuesday May 9, 2023

Article Highlights

- Honda’s quarterly sales rose nearly 7% from a year ago for a 7.9% market share.

- Honda increased incentives by 5% to an average of $1,217 per vehicle.

- Honda’s average transaction price rose 5% to $38,655.

Honda Motor Company has struggled with chip shortages and COVID outbreaks that have hampered production. In February, the Japanese automaker said the chip shortage was bottoming out but would probably drag on through the second half of this year.

Financial results for the quarter that ended March 31, the end of Honda’s fiscal year, are set to be reported in Tokyo on May 11, which should show if there has been further improvement yet in production and sales as was seen in Honda’s third quarter.

In the U.S., the automaker has seen improvement in supply that resulted in a sales gain. Honda and Acura combined sales in March resulted in the automaker’s best month since July 2021. That led to a nearly 7% rise in sales for the full quarter, after a decline in the same quarter the year earlier.

Still, for the past year, Honda has had one of the lowest inventories among automakers in the U.S. Still experiencing chip shortages, Honda has told dealers that inventories would not be fully recovered until the fall of 2023. Even with inventory hovering at just under 30 days’ supply, Honda saw increased sales.

Honda raised incentives by 5% to $1,217 per vehicle, the first bump since 2021. It also increased its average transaction price (ATP) by 5% to $38,655.

Here are some data points from Cox Automotive on Honda’s quarterly market performance in the U.S.

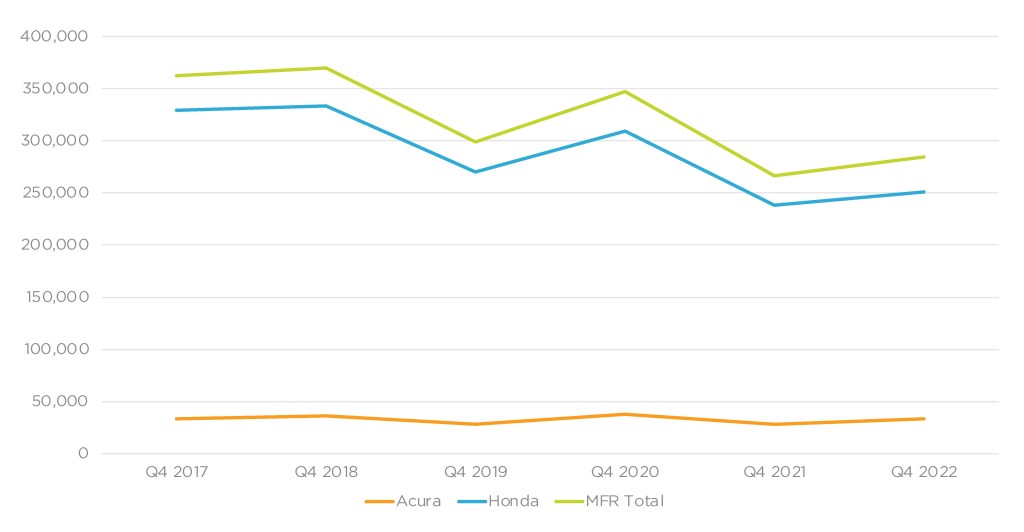

Sales Up, Market Share Down from Year-Ago Levels

American Honda’s U.S. sales totaled 284,507 in its fourth quarter, up 6.8% from the same quarter a year ago, but total market share dropped almost imperceptibly to 7.9%, down only 0.05 percentage point. In 2021, Honda owned nearly 9% of the U.S. market.

Honda U.S. SALES PERFORMANCE FOR Q4 FISCAL YEAR 2022

Honda brand sales totaled 251,042 vehicles in the U.S., up 5.4%. But the Honda brand increase was less than the market increase and that pushed its market share down 0.14 percentage point to 7%. All but one of Honda’s models was up in quarterly sales – Accord 2%, Civic 18%, CR-V -15%, Pilot 3%, Odyssey 77% and Ridgeline 41%. The HR-V saw a 37% decline.

Acura’s U.S. sales were up by 18.5% to 33,465 units, beating the market, and its market share was up to 0.93%, a gain of 0.09 percentage point.

Acura had only two models post sales gains – the TLX and the volume-leading MDX SUV. Acura’s core model, the popular MDX, was up 12%, selling 15,223 units. Acura sold just over 7,000 units of the newly resurrected Integra, which was not in the lineup last year. The remaining RDX saw a 14% decrease, selling only 6,809 units.

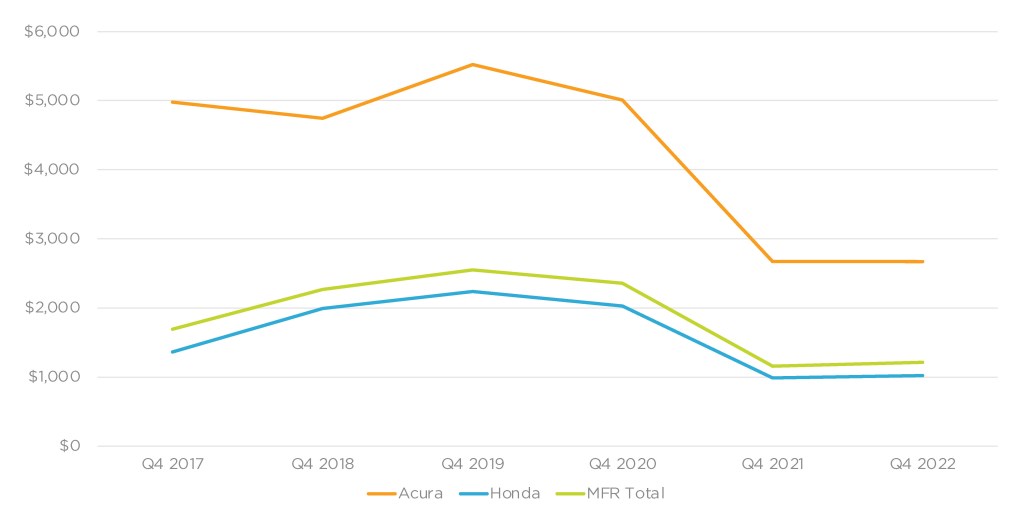

Honda Raised Incentives for First Time Since 2021

Always among the lowest for incentive spending, Honda boosted incentives in the latest quarter. In total, Honda raised incentives by 5% to an average of $1,217 per vehicle, according to Cox Automotive calculations. Incentives averaged only $1,159 in 2022.

Honda U.S. INCENTIVE SPENDING FOR Q4 FISCAL YEAR 2022

Honda brand incentives were up 4.4% to an average of $1,023 per vehicle, the first time in the quarter that was above $1,000 per vehicle since 2021. Acura incentives were reduced by 0.1% to an average of $2,670 per vehicle after hitting a record high of $5,523 per vehicle in 2020 during the pandemic.

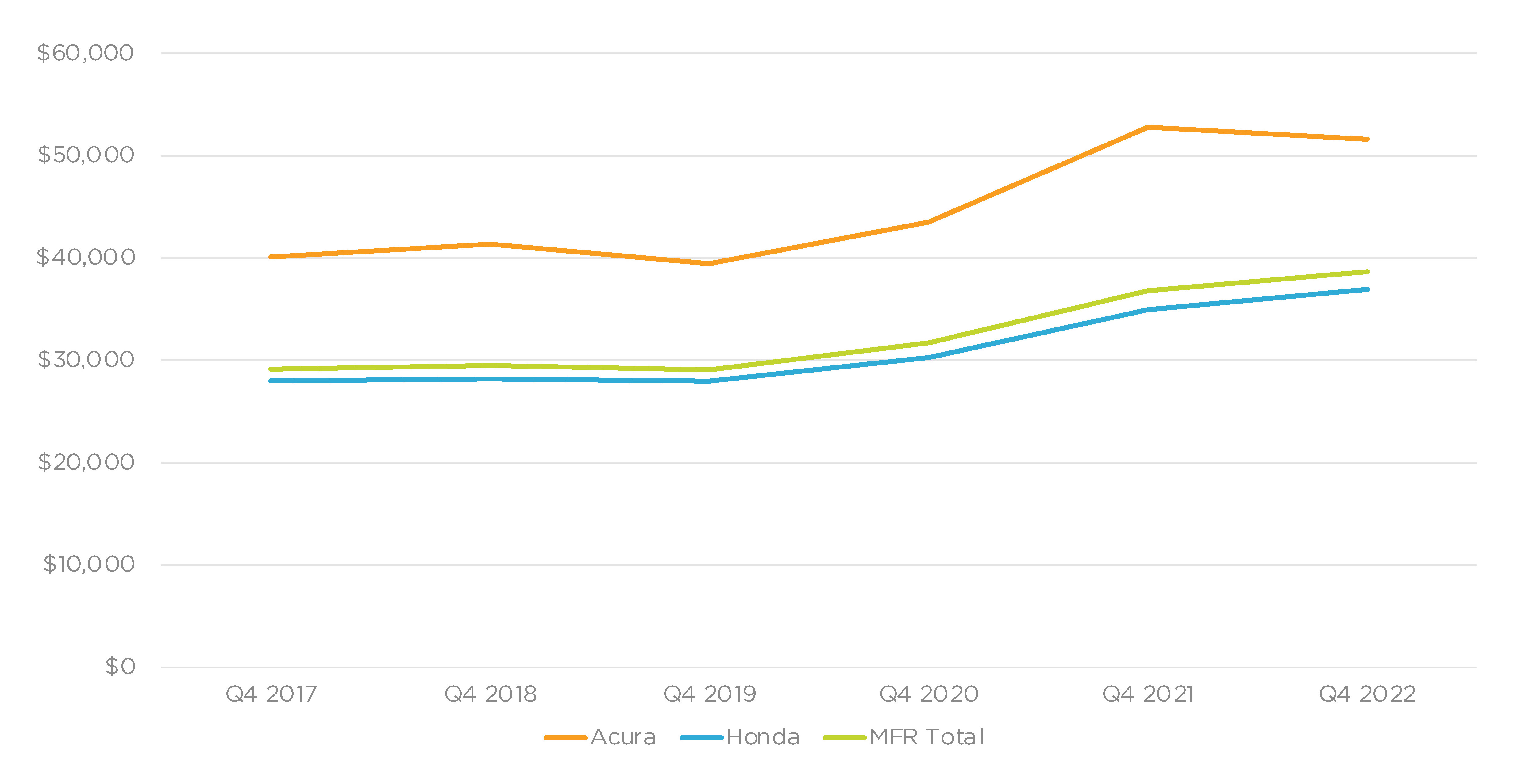

Honda’s Average Transaction Price Remains Over $38,000

The Honda brand’s overall ATP rose 5% to $36,928 compared to the same quarter in 2022, according to Cox Automotive calculations. Popular models such as the Civic and CR-V rose 3% and 8%, respectively. The newly redesigned HR-V was up 6% to $29,558, and the Pilot was up 5% to $48,167.

Honda U.S. AVERAGE TRANSACTION PRICE FOR Q4 FISCAL YEAR 2022

Two of Acura’s models showed increases, with the biggest being the TLX, which saw ATP rising 8% for the quarter to $51,156. The RDX had an ATP of $49,818, an increase of 0.5%. The MDX slipped by 1.6% to $60,170. The ATP on the new Integra was $36,524.

Rebecca Rydzewski is a research manager for economic and industry insights for Cox Automotive.

Rebecca Rydzewski

Rebecca Rydzewski is an automotive analyst with over 20 years of experience in the industry. She supports Cox Automotive’s OEM clients as well as the Mobility and Fleet Services business, focusing on Class 4-8 trucks and the freight market. Rydzewski joined Cox Automotive in March 2022.