Data Point

Cox Automotive Analysis: Honda Quarterly U.S. Market Performance

Monday February 8, 2021

Article Highlights

- Honda and Acura sales fell 9% to 366,068 units, underperforming the industry.

- Honda’s overall incentives were flat at an average of $2,481 per vehicle.

- Honda’s ATP rose to $28,743; Acura’s slipped to $39,979.

Honda Motor Co. of Japan reports financial results for Q3 FY 2021, the October-to-December 2020 quarter, on Tuesday, February 8, the third quarter for its fiscal year that ends March 31, 2021.

Here are some data for the recently closed quarter from Cox Automotive on Honda’s market performance in the U.S., one of the Japanese automaker’s most important markets.

Sales and Market Share

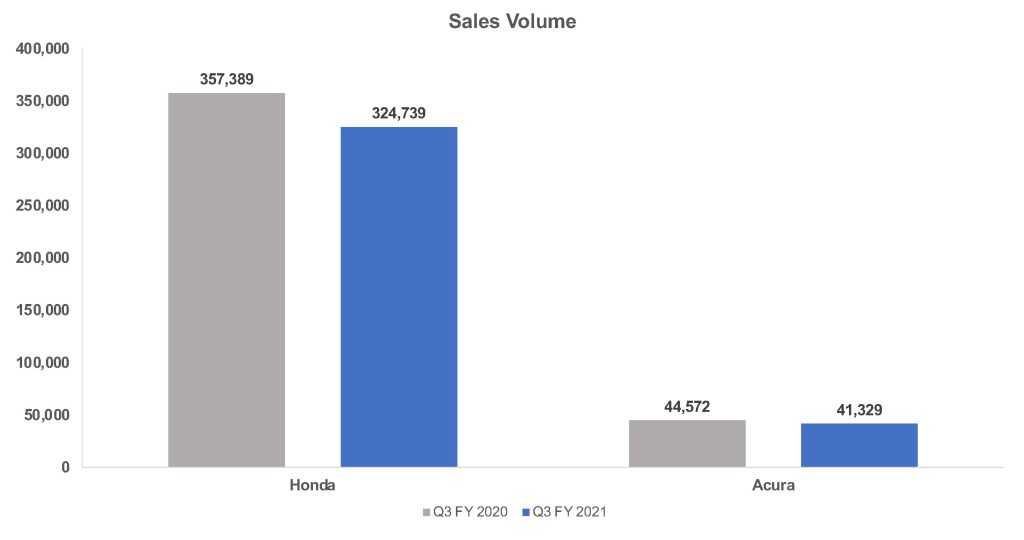

American Honda sales, which include the Honda and Acura brands, fell 9% to 366,068 vehicles in the company’s third quarter, underperforming the U.S. industry, which saw sales dip by 2%. Honda’s market share totaled 8.74%, the first drop below 9% in the last five years.

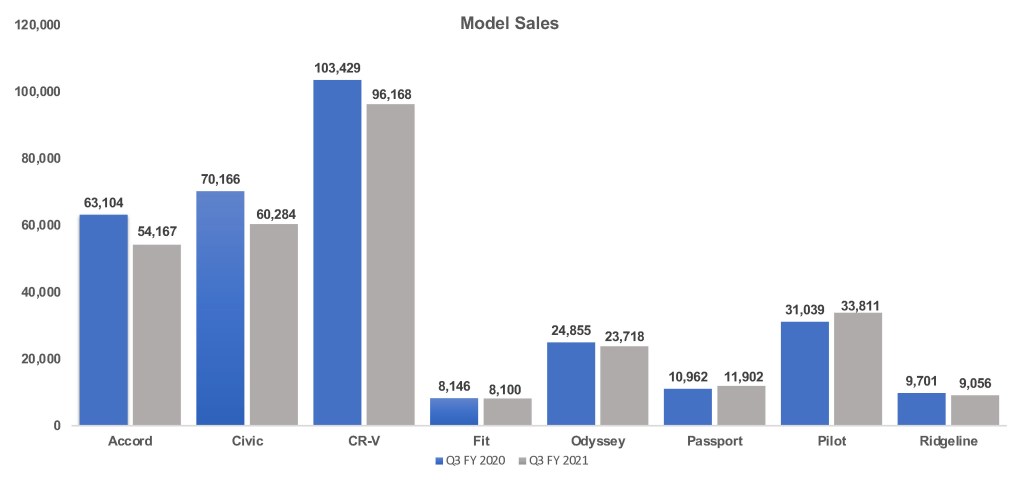

Honda brand sales declined 9% to 324,739 units, the lowest third-quarter sales in five years. That put Honda brand’s market share at 7.75%, marking only the second time since 2015 that it fell below 8%. Among Honda models, only the Pilot and Passport SUVs posted sales gains, each up about 9%. The Pilot was Honda’s fourth best-selling model. Sales of Honda’s best-seller, the CRV crossover, dropped 7% to just under 100,000 units. Volume-leading cars, Civic and Accord, were both down 14%.

Acura sales fell 7% to 41,329 units, the lowest in three years, leaving Acura’s market share at .99%. As for models, only two were in negative territory, the TLX and the RDX. Sales of Acura’s best-selling MDX, which was in sell-down mode to make way for the new version, rose 3% to 15,263 units.

Incentives

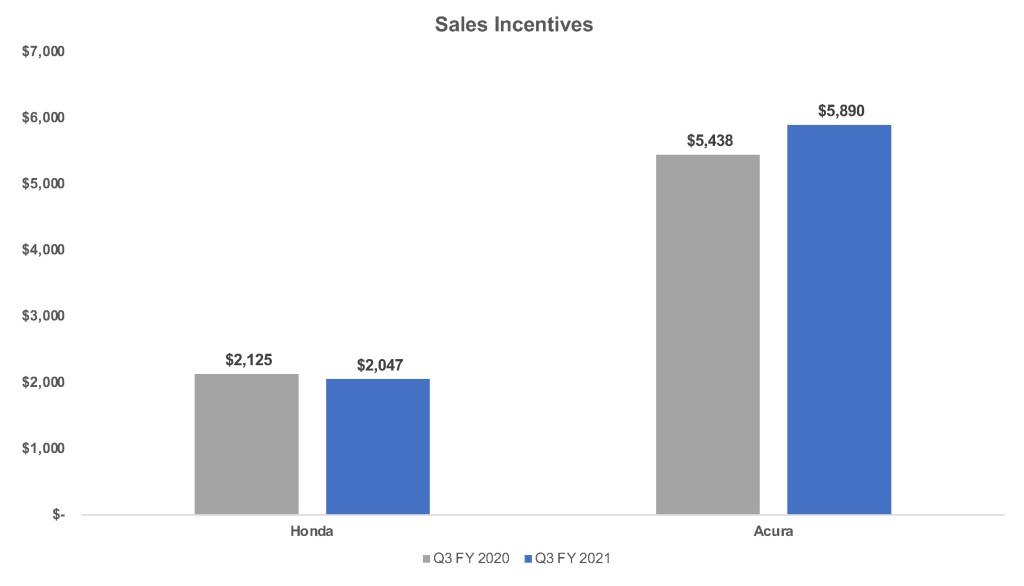

When it comes to incentives, Honda is always one of the lowest spenders. In the quarter, Honda’s overall incentives were roughly flat from a year ago at an average of $2,481 per vehicle and down from the previous quarter, according to Kelley Blue Book calculations.

Honda brand incentives were reduced by 4% to an average of $2,047 per vehicle. Acura incentives were boosted by 8% to an average of $5,890 per vehicle, the highest by several hundred dollars over the past five years and attributable to the sell-down of the previous MDX model.

Average Transaction Prices

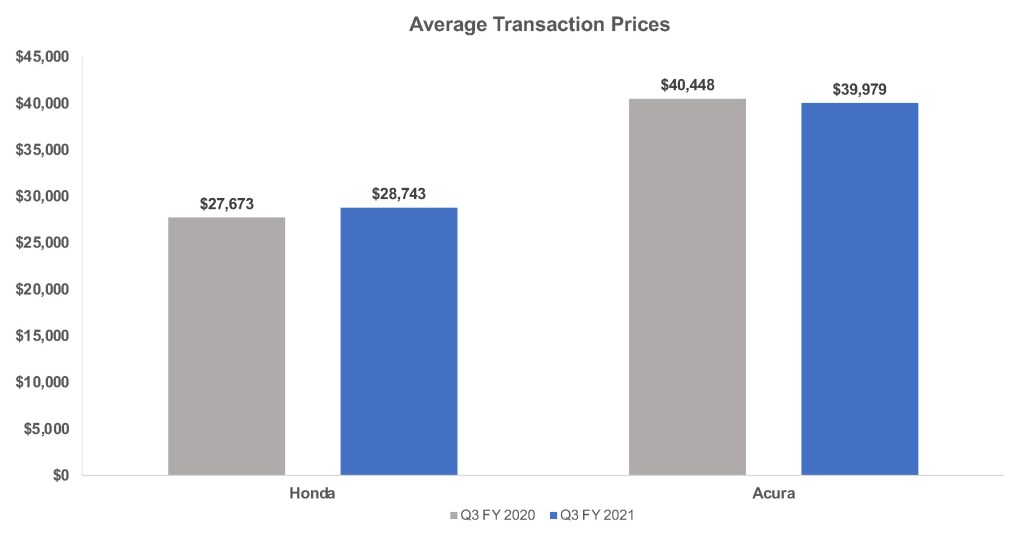

Honda’s average transaction price (ATP) rose 3% to $30,012, according to Kelley Blue Book calculations, surpassing the $30,000 mark in the quarter for the first time in five years.

The overall rise came from the Honda brand. Its ATP reached a record high, rising 4% to $28,743. The Ridgeline pickup truck, despite lower sales, had a 10% gain in its ATP to $37,891, pulling up Honda’s average.

Acura’s ATP slipped 1% to $39,979, the first time it fell below the $40,000 mark since 2015. Only the TLX gained in pricing, up 9% to $38,617.