Data Point

Cox Automotive Analysis: Honda Quarterly Market Performace

Friday May 14, 2021

Article Highlights

- Honda, Acura sales posted double-digit increases.

- Honda reduced incentives from last year’s highs.

- Honda, Acura average transaction prices.

Honda Motor in Japan reported earnings for its full fiscal year and the quarter that ended March 31, 2021.

In the U.S., one of its most important markets, American Honda, which includes the Honda and Acura brands, significantly improved sales in the quarter, reduced incentives and gained in pricing. Here are data for the quarter from Cox Automotive on American Honda’s performance.

Sales and Market Share

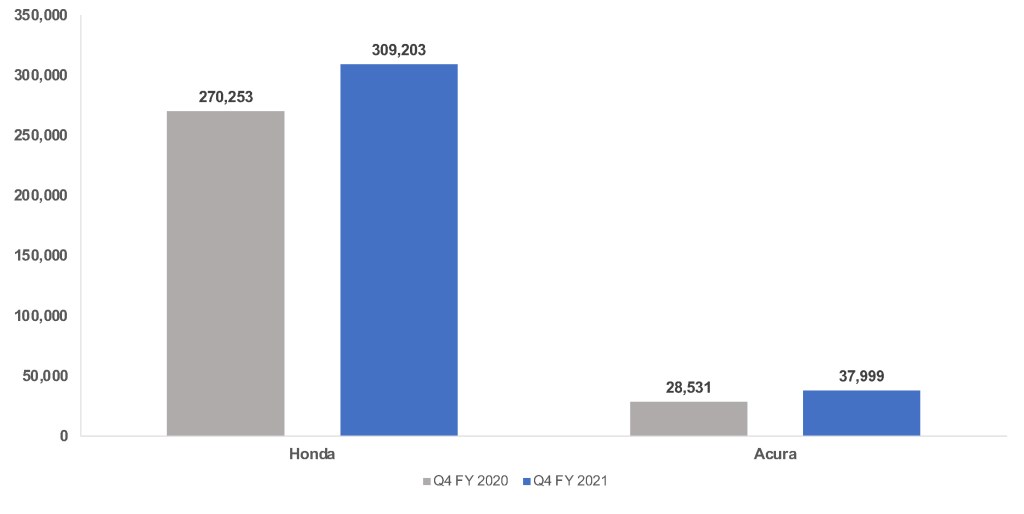

American Honda sold 347,091 vehicles in the quarter, up 16% from the year-ago quarter when the pandemic began. Honda brand vehicle sales rose 14% to 309,203 units. Acura brand vehicle sales were also up 33% to 37,999 units, its highest sales volume for the quarter since 2016.

Sales Volume

The automaker outpaced the overall market, which gained 11% in the quarter. As a result, American Honda garnered 8.9% market share, up .4 of a percentage point. Both brands contributed .2 of a percentage point to the overall gain. Honda’s market share was 7.9%. Acura’s hit 1%, after handily outpacing the luxury market that gained 17% in sales in the quarter.

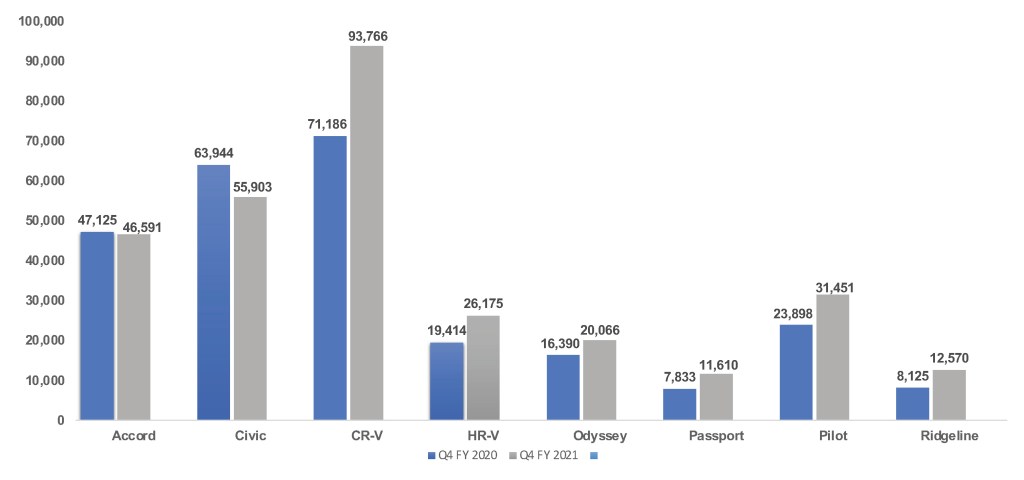

The Honda brand relies largely on three models for the bulk of its vehicle sales. The CR-V, the second best-selling compact crossover in the U.S. behind the Toyota RAV4, had a 32% sales increase. Sales of the Accord, which has been drifting lower due to consumers preferring SUVs over cars, dipped only 1% in the quarter. Civic sales were down 13% as the compact car is being sold down to make way for the new one coming this year.

Model Sales

Other Honda models had double-digit gains, including the: HR-V, up 35%; Odyssey minivan, up 22%; Passport, up 48%; Pilot, up 32%; and the Ridgeline pickup truck, up 55% to its highest level of sales for the quarter since at least 2015.

Acura’s volume leaders pushed the brand’s gain. The new MDX, which hit the market in February, had a 90% sales increase to 16,998 units, its highest for the quarter since at least 2015. Acura’s next highest volume model, the RDX, had a 41% gain to 11,612 units, its second-highest for the quarter since 2015.

Incentives and Prices

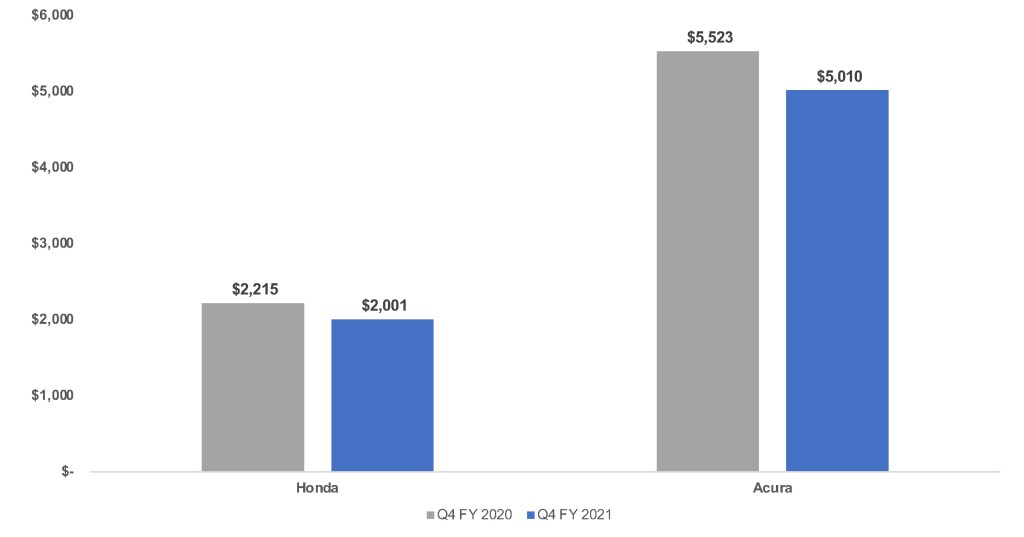

American Honda is always one of the lowest incentive spenders. In the recent quarter, the automaker reduced incentives from a year ago when they were the highest in years.

In total, American Honda spent an average of $2,329 per vehicle, down 8% from last year, according to Cox Automotive calculations. Honda brand incentives averaged $2,001 per vehicle, down 10%. Acura’s spend declined 9% for an average of $5,010.

Incentives

Despite the decrease from a year ago, the per-vehicle incentives were still American Honda’s second-highest for the quarter since at least 2015, though it still spends below the rest of the industry.

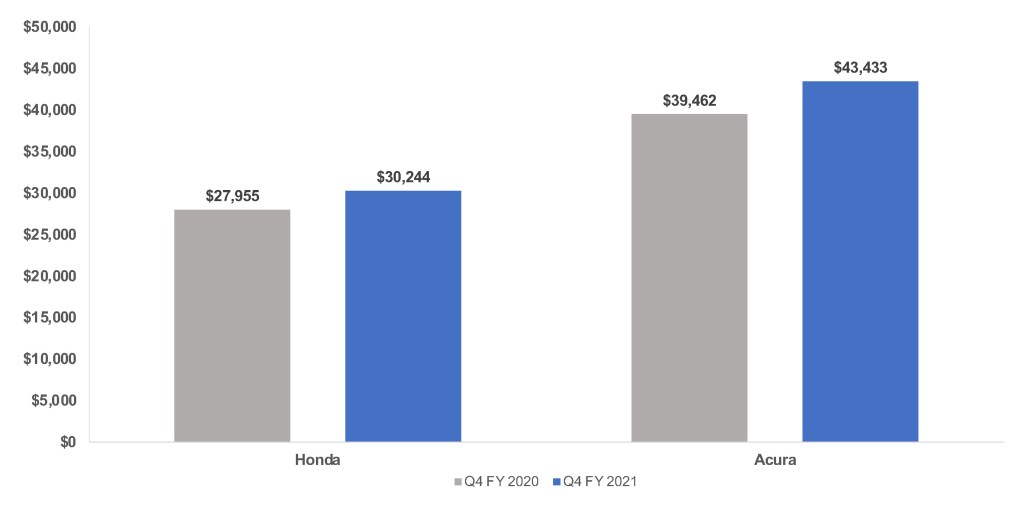

The increase in incentive spending was more than offset by much higher average transaction prices (ATP). American Honda’s overall ATP rose 9% to $31,683, the first time it broke the $30,000 mark in the quarter.

Average Transaction Prices

Acura’s ATP soared 10% to $43,433, setting a record high for the quarter. All Acura models had gains except the RLX, which is being discontinued.

Honda brand’s ATP rose 8% to $30,244. All models posted pricing gains except the Clarity hybrid, which is being discontinued. Much of the brand’s pricing strength came from the Ridgeline with a 12% increase in ATP to $39,090.