Data Point

Cox Automotive Analysis: Honda’s Q2 FY2021 U.S. Market Performance

Thursday November 5, 2020

Article Highlights

- American Honda sales down 10%; Honda down 11%, Acura up 2%.

- American Honda incentives soared 12% to $2,540 per vehicle; Acura’s way up.

- American Honda’s overall ATP climbs 4% to $29,723.

Honda Motor Co. of Japan reports financial results for Q2 FY 2021, the July-to-September quarter, on Friday, Nov. 6, marking the midway point for its fiscal year that ends March 31, 2021.

Honda swung to a loss in the previous quarter but should show signs of recovery in the just-closed quarter.

Here are some data from Cox Automotive on Honda’s market performance in the U.S., one of the Japanese automaker’s most important markets, for the recently closed quarter.

Sales and Market Share

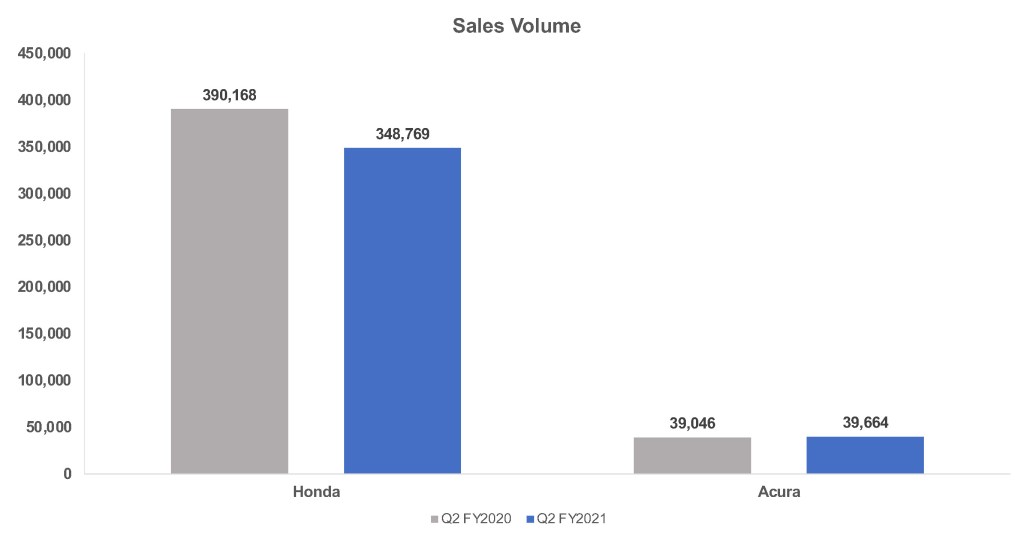

American Honda sales, which include the Honda and Acura brands, dropped nearly 10% to 388,433 vehicles in the quarter, in line with the overall industry’s decline.

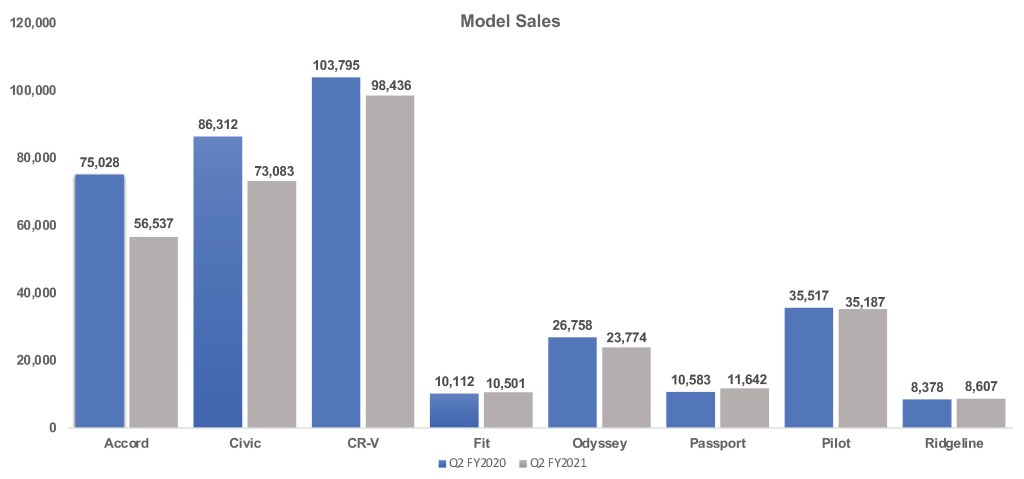

Honda brand fell nearly 11%. It relies heavily for the bulk of its sales on just three models, and all three posted sales declines. The CR-V was down 5%, Civic fell 15% and Accord dropped 25%. Honda models that posted sales increases included the Passport SUV, up 10%, along with the Fit and Ridgeline.

Acura sales rose nearly 2% on the volume leading RDX, which had sales up 2% to 15,038 units. The ILX was up 5%. The MDX SUV, Acura’s second bestseller, and the TLX, its distant third bestseller, had sales roughly flat with last year. The MDX undergoes a major redesign that goes on sale in January. It will be a 2022 model as Acura skipped the 2021 model year for it.

Acura’s sales hike pushed American Honda’s overall market share to 9.97%, up from 9.92%, and its highest Q2 market share in the past five years. Acura’s market share surpassed the 1% mark, up to 1.02%. Honda’s dipped to 8.95% from 9.02% a year ago.

Incentives

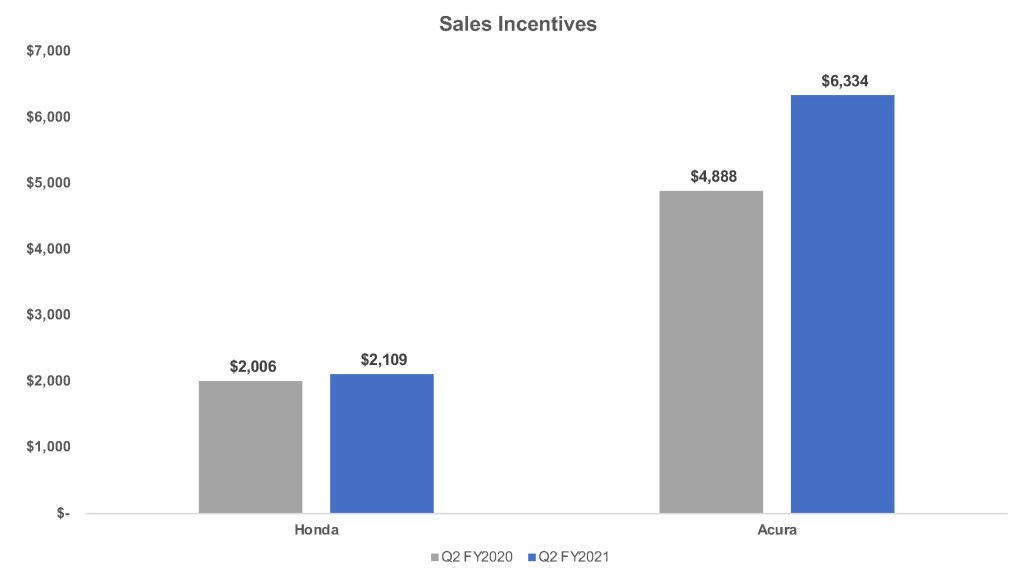

American Honda increased incentives 12% to $2,540 per vehicle, according to Kelley Blue Book calculations. That’s still low compared with the rest of the industry.

The bulk of the increase went to Acura, which boosted incentives a stunning 30% to an average of $6,334 per vehicle, the highest by a huge margin for this quarter in the past five years. The boost in Acura incentives may well have helped bolster sales.

Honda brand incentives were up 5% to an average of $2,109 per vehicle, still low compared to other mainstream brands but its highest for the quarter in the past five years.

Average Transaction Price

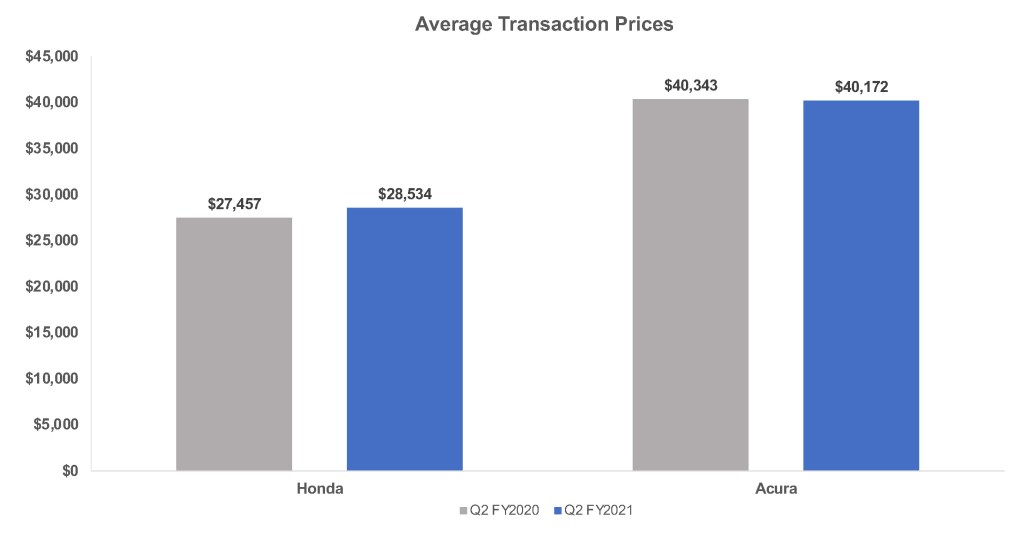

Honda’s average transaction price (ATP) increased 4% to $29,723, according to Kelley Blue Book calculations.

Honda’s ATP rose 4% to $28,534. Despite lower sales of its three volume-leading models, all three had ATP hikes: Accord’s ATP rose 4% to $26,681; CR-V was up 4% to $29,367; and Civic climbed 3% to $22,301. The Ridgeline pickup truck had the biggest rise in ATP, up 8% to $39,356. Pilot was up 3% to $38,280. Acura’s ATP was roughly flat at $40,172.