Data Point

Cox Automotive Analysis: Hyundai Motor’s Q4 2023 U.S. Market Performance

Friday January 26, 2024

Article Highlights

- Hyundai Motor sales in 2023 break records; share above 10%, putting the group ahead of Stellantis as the fourth-largest vehicle seller in the U.S. market.

- Hyundai Motor boosts incentives, but they remain lower than before the pandemic.

- Hyundai Motor’s ATP climbs nearly 4% to $37,700.

Hyundai Motor Company had a record-setting 2023 for U.S. sales as a company and individually for each of its three brands – Hyundai, Kia and Genesis.

The South Korean automaker, which posted fourth-quarter and full-year financial results Jan. 25, closed 2023 as the No. 4 automaker in the U.S. as measured by vehicle sales, surpassing Stellantis, Honda and Nissan. In pre-pandemic 2019, the automaker ranked No. 7.

Hyundai Motor closed the year with strong fourth-quarter sales in the U.S. Like the industry in general, the automaker substantially boosted incentives at year-end. However, the year-over-year comparison to 2022 is exaggerated because incentives one year ago were extremely low due to tight inventories caused by the global computer chip shortage. Nearly all automakers posted large year-over-year gains in incentive spending. Hyundai eked out an increase in average transaction prices (ATP), though, like with the entire industry, price growth has vastly slowed as inventory levels increased through 2023.

Here is the fourth-quarter data from Cox Automotive for Hyundai Motor in the U.S., one of its most important global markets.

Hyundai Motor Sales in 2023 Hit Record High

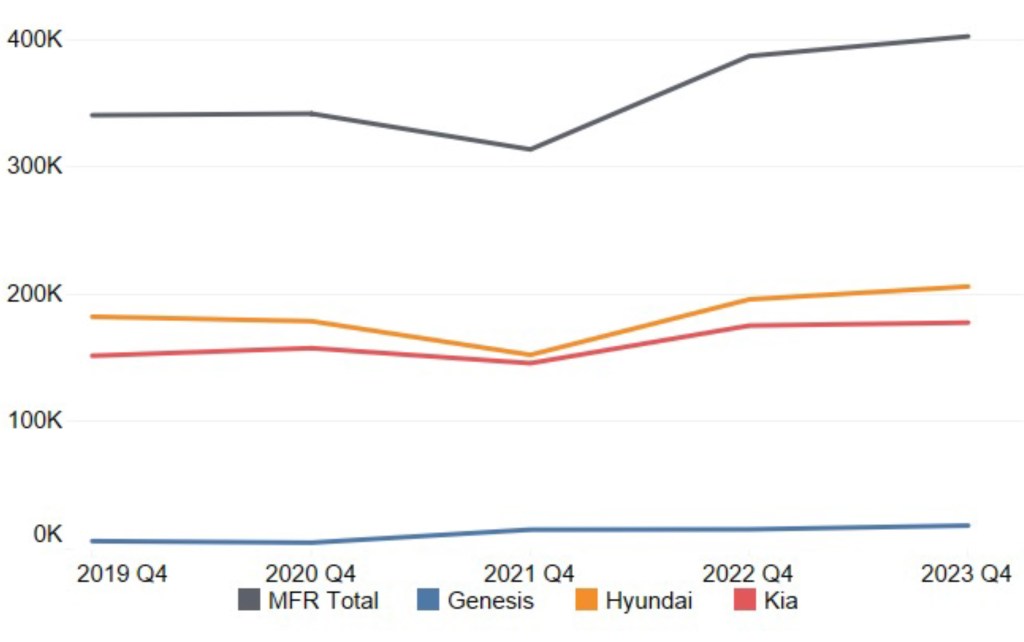

Hyundai Motor sold 402,339 vehicles in the fourth quarter, up 4% from the year earlier. In the second, third and fourth quarters of 2023, the automaker broke the 400,000-mark for the first time ever in those quarters, according to Cox Automotive calculations.

Hyundai Motor Company U.S. Sales Performance for Q4 2023

The Hyundai brand posted fourth-quarter sales of 206,048 units, up 5% from the final quarter of 2022. It was the first time the Hyundai brand had broken the 200,000-unit mark in any fourth quarter.

Sales performance for Hyundai models was mixed in the quarter. However, its volume leaders pulled up the brand. The top-selling Tucson SUV had sales of 56,444 units, up 14% from the previous year and far surpassing sales levels for any previous fourth quarter. The Palisade also had a giant boost, with sales up 62% to a record 30,652 units for the quarter. Sales of the Ioniq5 EV nearly doubled to 8,621 units. Kona sales rose 23%. In contrast, Sonata, Venue, Santa Cruz, and Elantra sales were down by double digits.

For the full year, Hyundai brand sales shot past 800,000 vehicles, topping the previous high of 768,057 in 2016 and up 11% from 2022. Hyundai attributed its performance to the steady increase in retail sales, an expanded EV line, a large portfolio of SUVs, and the addition of the small Santa Cruz pickup truck.

Kia reported sales of 177,777 units in Q4, up only 1% from the year-earlier quarter. The brand had been leading Hyundai in sales but fell back in the quarter.

Except for the K5 and Forte cars, most of Kia’s volume models reported sales drops. However, Carnival’s sales nearly quadrupled to 10,514 units. Sales of Kia’s electric EV6 rose 37% to 4,081 units.

Kia sales totaled 782,451 vehicles for the year, up 13% from 2022 and beating the previous record set in 2021, thanks to EVs and crossovers.

Throughout 2023, Kia had one of the lowest inventory levels in the industry, beaten only by Toyota and Honda. According to Cox Automotive’s analysis of vAuto inventory data, Kia closed the year with an improvement in supply but still below average.

Genesis boasted the biggest percentage sales gain among Hyundai Motor’s brands, with sales up 19% to 18,514 units, putting it ahead of Nissan’s Infiniti sales. Genesis sales were led by the GV70, with sales of 7,218, up 28% from a year ago, and the GV80, up 23% to 6,014.

Genesis sales were up 23% from 2022 to nearly 70,000 units for the year, thanks to a new electrified line and an expanding dedicated dealer network.

Hyundai Motor Market Share Stays Above 10%

Hyundai Motor’s market share slipped slightly from the fourth quarter a year ago but remained above the 10-percent mark at 10.31% (down from 10.71%), according to Cox Automotive calculations.

Genesis was the only brand to have a higher share than a year ago, edging up to 0.47%, its highest for any fourth quarter – from 0.43% a year ago. Hyundai’s market share slipped to 5.28% from 5.43%. Kia’s market share slipped to 4.56% from 4.86%. Still, both brands had their second-highest market share ever for any fourth quarter.

Hyundai Motor Boosts Incentives; Remain Lower Than Before the Pandemic

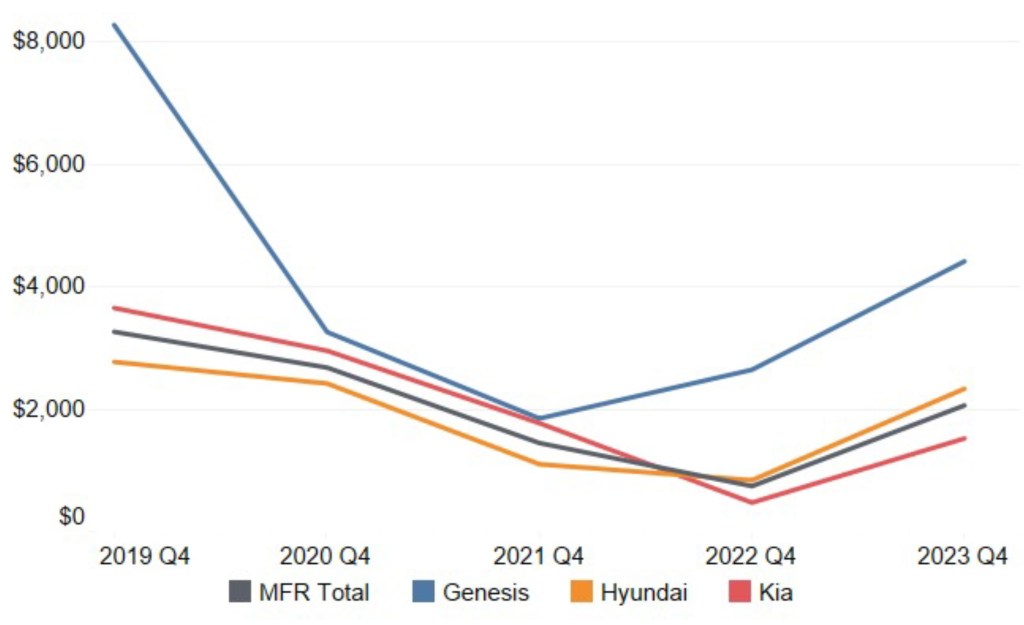

Hyundai Motor vastly increased incentives in the final quarter of 2023 compared with a year ago. However, incentives a year ago were historically low as inventories were mostly decimated due to the chip shortage.

Hyundai Motor Company U.S. Incentive Spending for Q4 2023

Incentives for all three brands were up a combined 178% to an average of $2,017 per vehicle versus a skimpy $746 per vehicle on average a year ago, according to Cox Automotive calculations.

Kia had the biggest hike, up 222% to an average of $1,521 per vehicle. Hyundai had a smaller but still hefty boost – up 178% – and a higher average per vehicle payout of $2,334. Genesis had the highest incentives at $4,416 per vehicle, up 67%.

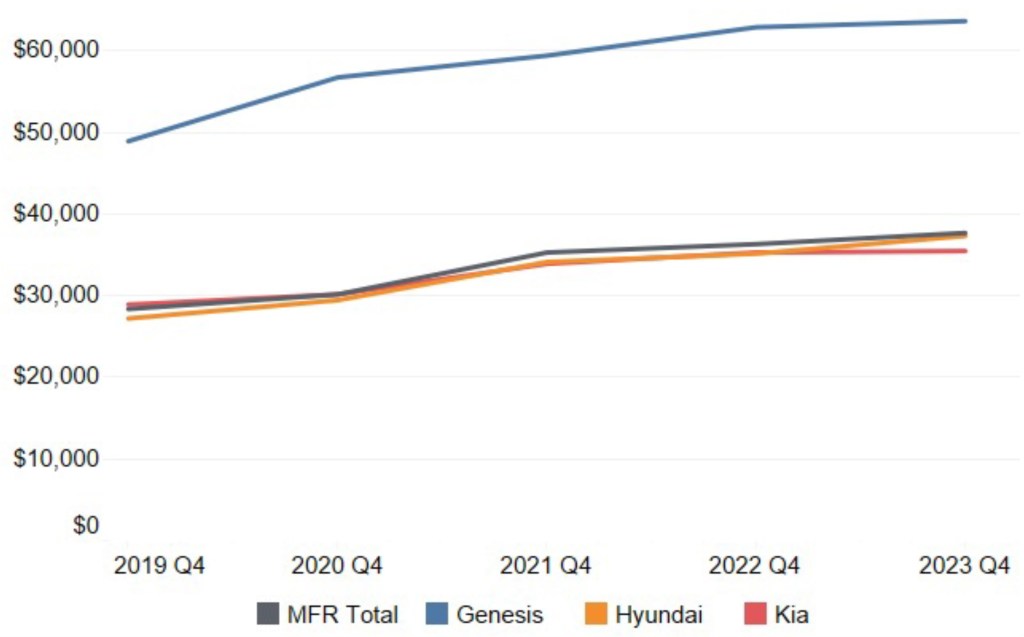

Hyundai Motor ATP Edges Nearly 4% Higher to $37,700

Hyundai Motor’s overall ATP climbed nearly 4% to $37,700, according to Cox Automotive’s calculations. It was the highest ATP for any fourth quarter and higher than any quarter in 2023.

Hyundai Motor Company U.S. Average Transaction Price for Q4 2023

Genesis had the highest ATP, up 1% from a year ago to $63,604. All models except for the G70 had ATPs above $50,000, and the G70 was just shy of it. The G90 had the highest ATP of Genesis models at $98,092, followed by the GV80 at $74,268, up 2% from a year ago. The G80 had the biggest hike, up 4% to $67,637.

Hyundai brand had the biggest gain. Its ATP rose 6% to $37,308, the highest ever for any fourth quarter. Nexo is a low-volume, hydrogen-fuel cell vehicle and had the highest ATP for the brand, up 10% to $61,482. Both EVs – the Ioniq5 and Ioniq6 – had ATPs over $50,000. The Venue and Elantra had the lowest ATPs, both well below $30,000.

Kia’s ATP was about flat with a year ago at $35,456. The new electric SUV, the EV9, is Kia’s priciest model, with an ATP of $71,868. At the other end of the price spectrum, Kia Forte, Soul and Rio all had ATPs under $25,000, among the most affordable products in the industry. Rio is being dropped after the 2023 model year. The Seltos had the biggest gain in ATP, up 5% to $29,591.