Data Point

Cox Automotive Analysis: Hyundai’s Quarterly U.S. Market Performance

Friday May 13, 2022

Article Highlights

- Hyundai, Kia and Genesis sales fell only 5%, pushing market share to nearly 10%.

- Hyundai Motor slashed incentives by 59% to an average of $1,058 per vehicle.

- Hyundai Motor’s Average Transaction Price rose 17% to $35,988.

South Korean automaker Hyundai Motor, which includes the Hyundai, Kia and Genesis brands, posted a better-than-expected rise in its first-quarter profit as favorable exchange rates more than made up for higher raw material costs and a drop in vehicles sales caused by the global computer chip shortage.

The U.S. is one of the most important markets for the automaker. Here are some data points from Cox Automotive on its quarterly market performance.

SALES AND MARKET SHARE

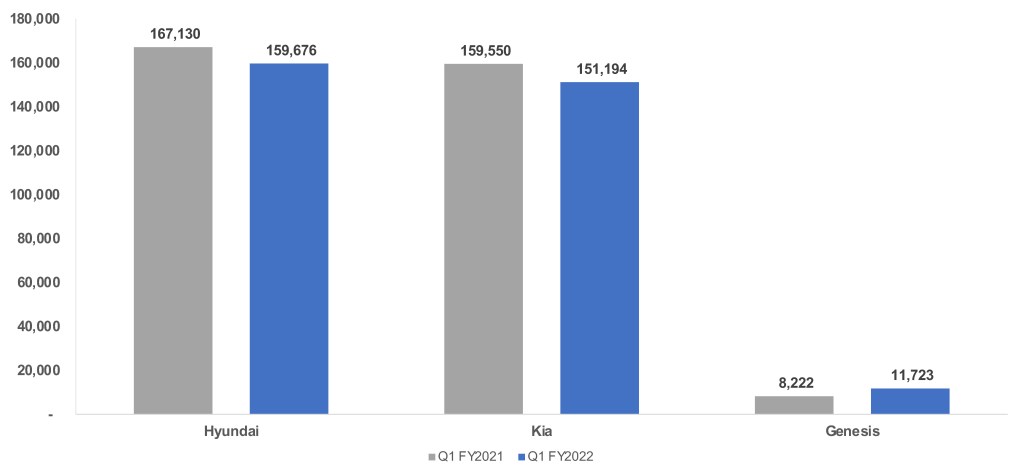

Sales for the Hyundai, Kia and Genesis brands combined were down only 4% to 322,593 units in the quarter, a level second only to the year-ago quarter. The total U.S. industry had sales down 16%. That put Hyundai Motor’s total U.S. market share at 9.7%, an increase of 1.2 percentage points from a year ago.

U.S. Sales Volume

Hyundai brand sales totaled 159,676 vehicles, down 5%. Even with brand sales down, market share rose 0.6% to 4.8% for the quarter, its highest for the first quarter in at least six years. Hyundai’s electric and hybrid vehicles, the Ioniq and the Nexo, each saw sales increase by more than 100% in the quarter, mainly driven by higher gas prices and increased interest in alternate fuel vehicles. Two of Hyundai’s SUVs saw sales increases – the Tucson was up 20%, and the Venue was up 13%. Popular models such as the Elantra and Sante Fe had declines of more than 10%.

Kia sales dropped by 5% to 151,194 units. Its market share saw a slight increase of 0.5% to 4.6%, also its highest for the quarter in at least six years. The new Carnival minivan saw a sales increase of more than 400%. Fuel-efficient vehicles such as the Niro hybrid saw sales increase by 114%, and the mid-size Stinger sport car experienced a 27% bump. Popular models like Rio and Sorento saw declines of 4.6% and 9.1%, respectively.

Unlike its siblings, the Genesis brand saw a 43% sales increase with a total of 11,723 units sold in the quarter versus 2021. That put Genesis’ market share at its highest level of .4%. The G70 luxury car saw a 54% hike. G90 sales were up 3.4% as luxury sales remained strong. The G80 and GV80 both saw sales declines of more than 25%.

INCENTIVES AND PRICES

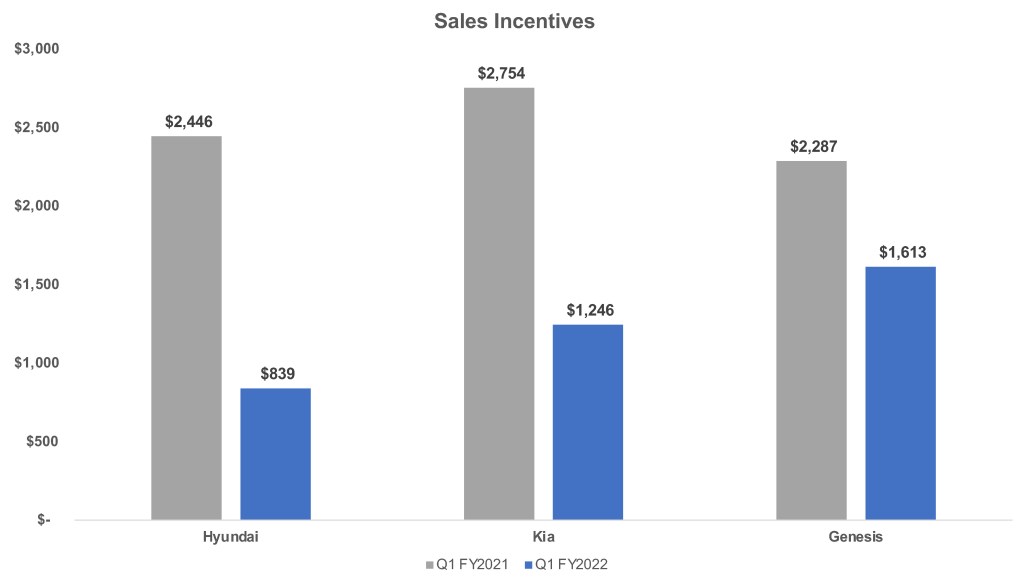

Hyundai slashed incentives as demand was high and inventory remained constrained. In total, Hyundai Motor cut incentives by 59% to an average of $1,058 per vehicle, according to Cox Automotive calculations. It was the first time since 2017 that incentives averaged below $2,500 per vehicle for the quarter.

U.S. Sales Incentives

Hyundai brand incentives were drastically reduced by 66% to an average of $839 per vehicle, the largest drop in incentives in years. From 2017 to 2021, Hyundai brand incentives were above $2,200. Kia incentives dropped by 54% to an average of $1,246 per vehicle, the first time they were below $2,700 for the quarter in at least six years. Genesis incentives were down 30% for the quarter to an average of $1,613 per vehicle versus the 2019 high of $6,825.

AVERAGE TRANSACTION PRICES

Hyundai’s overall average transaction price (ATP) rose 17% to $35,988, according to Cox Automotive calculations. All Hyundai brand vehicles saw ATP increases from 8% for the Palisade to 36% for the Ioniq, except the Nexo, which had a 28% ATP decline to $43,575.

All Kia brand vehicles saw ATP gains, ranging from nearly 7% for the Telluride to 19% for the Niro. Genesis brand vehicles – G70, G90 and GV80 – saw ATP increases of more than 5%, while the G80 saw just a nearly 1% decrease.

Rebecca Rydzewski is a research manager for economic and industry insights for Cox Automotive.